Abstract

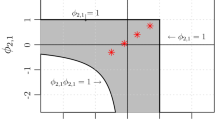

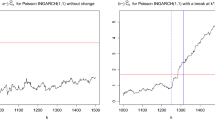

In this work we propose an estimation procedure of a specific TAR model in which the actual regime changes depending on both the past value and the specific past regime of the series. In particular we consider a system that switches between two regimes, each of which is a linear autoregressive of order p. The switching rule, which drives the process from one regime to another one, depends on the value assumed by a delayed variable compared with only one threshold, with the peculiarity that even the thresholds change according to the regime in which the system lies at time t − d. This allows the model to take into account the possible asymmetric behaviour typical of some financial time series. The identification procedure is based on the Particle Swarm Optimization technique.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Battaglia, F., Protopapas, M.K.: Multi-regime models for nonlinear nonstationary time series. Computational Statistics 47, 277–295 (2011)

Chan, K.S., Tong, H.: On Likelihood Ratio Tests for Threshold Autoregression. Journal of the Royal Statistical Society B(52) (Methodological), 469–476 (1990)

Hansen, B.E.: Sample Splitting and Threshold Estimation. Econometrica 68, 575–603 (2000)

Gonzalo, J., Wolf, M.: Subsampling inference in threshold autoregressive models. Journal of Econometrics 127, 201–224 (2005)

Kennedy, J., Eberhart, R.C.: Subsampling inference in threshold autoregressive models. In: In Proceedings of IEEE International Conference on Neural Networks, pp. 1942–1948 (1995)

Li, W.K., Lam, K.: Modelling Asymmetry in Stock Returns by a Threshold Autoregressive Conditional Heteroscedastic Model. The Statistician 44, 333–341 (1995)

Pedersen, M.E.H.: Good Parameters for Particle Swarm Optimization. Hvass Laboratories. Technical Report HL1001 (2010)

Petruccelli, J.D., Davies, N.: A Portmanteau Test for Self-Exciting Threshold Autoregressive-Type Nonlinearity in Time Series. Biometrika 73, 687–694 (1986)

Pizzi, C.: The asymmetric threshold model AsyTAR(2;1,1). In: Sco2007 (2007)

Pizzi, C.; Parpinel, F.: Evolutionary computational approach in TAR model estimation. In: University of Venice “Ca’ Foscari” (edc.) Working Papers, vol. 26/2011. Department of Economics, Venezia (2011)

Shi, Y., Eberthart, R.: A modified particle swarm optimizer. In: Proceedings of the IEEE International Conference on Evolutionary Computation, pp. 69–73 (1998)

Tong, H., Yeung, I.: Threshold Autoregressive Modelling in Continuous Time. Statistica Sinica 1, 411–430 (1991)

Tong, H., Lim, K.S.: Threshold Autoregression, Limit Cycles and Cyclical Data. Journal of the Royal Statistical Society B42 (Methodological), 245–292 (1980)

Tsay, R.S.: Testing and Modeling Multivariate Threshold Models, Journal of the American Statistical Association 93, 1188–1202 (1998)

Wang, H., Zhao, W.: ARIMA Model Estimated by Particle Swarm Optimization Algorithm for Consumer Price Index Forecasting. In: Deng, H., Wang, L., Wang, F.H., Lei, J. (eds.) Artificial Intelligence and Computational Intelligence. Lecture Notes in Computer Science 5855, pp. 48–58. Springer (2009)

Wu, B., Chang, C.L.: Using genetic algorithm to parameters (d,r) estimation for threshold autoregressive models. Comput. Stat. Data Anal. 17, 241–264 (2002)

Zakoian, J.M.: Threshold Heteroskedastic Models. Journal of Economic Dynamics and Control 18, 931–955 (1994)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Pizzi, C., Parpinel, F. (2014). Modelling Asymmetric Behaviour in Time Series: Identification Through PSO. In: Corazza, M., Pizzi, C. (eds) Mathematical and Statistical Methods for Actuarial Sciences and Finance. Springer, Cham. https://doi.org/10.1007/978-3-319-02499-8_24

Download citation

DOI: https://doi.org/10.1007/978-3-319-02499-8_24

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-02498-1

Online ISBN: 978-3-319-02499-8

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)