Abstract

This paper presents a simulation exercise undertaken with a newly available regional general equilibrium model for the Spanish region of Andalusia. The exercise is intended to assess the structural adjustment processes and impacts on the Andalusian economy directly induced by the dramatic fall in tourism expenditure which occurred in the year 2020, due to the prevention measures implemented because of the COVID-19 pandemic. We also undertake a preliminary evaluation of the impact on some environmental indicators, such as greenhouse gases emissions and air pollutants. The key insight emerging from our analysis is that the COVID crumbling of tourism demand reduces the environmental pressure but also generates very relevant distributional consequences. We believe that these insights are not peculiar to Andalusia but could be extended to many other regions in the world, especially those similar in terms of magnitude of the shock, economic structure, and labor market. We illustrate the latter point by contrasting Andalusia with a set of South-East Asian countries.

Similar content being viewed by others

1 Introduction and motivation

Tourism is possibly the sector most negatively affected by the COVID-19 lockdown and prevention measures, but it is also the economic backbone for many regions and countries, most notably in Asia. Therefore, those economies which are heavily dependent on tourism are also those which are more exposed to the economic impact of the pandemic.

According to OECD (2021) tourism in Spain in 2018 accounted for more than 12% of the national GDP, a share (rising, at that time) which would substantially be larger for a popular tourism destination, such as Andalusia. According to World Travel and Tourism Council (2021), some Asian countries with similar dimensions are Malaysia (11.7%) and Singapore (11.1%), whereas tourism is much more important in Cambodia (25.9%), Philippines (22.5%) and Thailand (20.1%). Nonetheless, these figures may mask and underestimate the actual importance of the sector within the economic system. This is because there are many other industries that are significantly supported by the indirect tourism demand. For instance: maintenance and cleaning services, local transport, cultural activities, shops, food, energy, water, etc. Many of these other industries may not be classified as belonging to the tourism sector.

In good times, tourism propels the rest of the economy. In bad times, multiplicative effects turn negative, and the engine gets into full reverse. Because of the interlinkages between industries directly and indirectly related to tourism, an assessment of the systemic consequences of a massive drop in tourism demand, such as that experienced in 2020, needs models and methods fully considering the input–output trade interdependences.

However, traditional input–output analysis would fall short, for two main reasons. First, the demand drop would generate excess capacity and supply in the markets for primary resources. This will cause prices to lower and, in the labor market, additional unemployment. The latter aspect is especially relevant in Spain, and the more so in Andalusia, plagued by high unemployment levels even before COVID-19. Second, shrinking factor income (lower returns, lower employment) would feed back to consumption demand, further amplifying the negative shock.

All these aspects call for a modeling approach based on general equilibrium, as this fully traces the circular flow of income inside the economic system. It is indeed the approach we adopt in the exercise illustrated in this paper, where we present and analyze the results of a numerical simulation, undertaken with a regional computable general equilibrium model (Roson 2021). Parameters of the model are calibrated based on a social accounting matrix of Andalusia that we estimated (Roson and Van der Vorst 2020).

The exercise is a classic comparative static one, where an initial (general) equilibrium is perturbed, and a counterfactual equilibrium is generated, in the absence of any explicit time dimension. The perturbation here is the cut in tourism external income inflow, which is exogenous in the model. The results should by no means be interpreted as a realistic measure of impacts, though, but rather as a hypothetical ceteris paribus evaluation. Indeed, we are not considering other impacts related to the pandemic in Andalusia or elsewhere. Also, we are not considering non-market adaptation or policy responses, even when they would be semi-automatic (like in the case, e.g., of higher unemployment benefits). Therefore, our aim is highlighting which structural adjustment processes would have been triggered in the regional economy, only because of the direct effect of lower tourism expenditure.

As we shall better see in the following, results are not trivial, nor all possibly expected. Furthermore, because of the level of detail provided by the model and its general equilibrium nature, it is possible to identify potential “winners and losers” into the economic system, even though the exogenous shock we are imposing is clearly a negative one, at least at the aggregate level.

We complement our analysis with an assessment of environmental impacts on some indicators, namely greenhouse gas emissions and air pollutants. Our primary aim here is appraising the intuition that a slowdown of economic activities is beneficial to the environment. Although this is broadly confirmed by our results, we nonetheless found some other unanticipated findings.

The rest of the paper is organized as follows. After a review of the relevant literature, a section briefly illustrates our main data sources, the model structure, its key characteristics, as well as the way we implemented the simulation exercise. We then turn on section three, to a presentation of the most relevant economic impact results, along with some decomposition and interpretation analysis. Estimated changes in emissions of greenhouse gases and air pollutants are presented and commented in section four. Before offering some concluding remarks, we discuss the applicability of our results to some regions in Asia, considering the similarity in the shock magnitude, and the economic structure.

2 Related literature

The COVID-19 pandemic is a relatively recent phenomenon. Because of its huge economic impact, it has attracted the interest of many scholars, willing to provide an assessment of some of its economic consequences (for some early reviews see, e.g., Brodeur et al. 2020; Nicola et al. 2020). Within the broad range of contributions, using different approaches and perspectives, a predominant role is given to studies based on general equilibrium. This should not come as a surprise, given the systemic nature of the crisis, not confined to a specific sector or region.

However, the analysis is especially complex, because the COVID-19 pandemic is causing multiple and interrelated shocks to the economic systems: disruption of international trade and travel, excess capacity and productivity effects related to lockdown measures, radical changes in consumption patterns, modifications in the level and composition of public expenditure, massive income transfers, boom of on-line services, etc. It would be utopian to conceive a single model, simultaneously encompassing all these dimensions. Therefore, most or all studies available to date are focusing on specific channels of impact, often through adaptation of tested methodologies.

We can identify different “phases” of COVID-19 CGE modelling, depending on when the study was conducted during the pandemic. During the first half of 2020 there was a demand for fast, “instant” analyses that could quickly provide some insight into the possible effects of the health crisis. The studies became more sophisticated as more data became available and there was a better understanding of the impact channels of COVID-19. By 2021, the literature had become more mature, and studies benefitted from the additional data as well as scientific debate among economic researchers (Roson and Van der Vorst 2022). This study was conducted at a time when it had become clear that tourism demand is one of the prime impact channels of COVID-19. Moreover, detailed tourism data were available to conduct a high-quality experiment of the isolated shock, caused by the fall in tourism on the Andalusian economy.

Some papers focus on one or a few countries. Nechifor et al. (2020a, b, 2021) identify five impact channels in their analysis for Kenya (labor productivity, demand for exports and tourism, internal trade costs, domestic demand, and remittances). Roson and Costa (2020) analyze the shock related to lockdown measures in Italy and France, which is interpreted as a reduction of productivity. Similarly, Lahcen et al. (2020) simulate a decrease in working time, due to the temporary shutdown of certain industries or work-from-home policies in Belgium. This study also considers a shock on the demand side, distinguishing between essential sectors and other sectors. Aydin and Ari (2020) combine demand and supply shocks, to see whether falling oil prices could partly compensate some of the pandemic effects in Turkey.

Other studies focus a wider regional or global level (Bekkers et al. 2020; Park et al. 2020; Maliszewska et al. 2020). For instance, Maliszewska et al. and the European Commission DG TRADE (2020) analyze the effects on global GDP and trade. A report by OECD (2020) considers value chains, finding that globally integrated economies appear to have proved to be more resilient during the crisis.

A few more studies (Lahcen et al. ibid.; Malliet et al. 2020) broaden the scope of analysis to consider, like we do in this paper, some (direct or indirect) environmental consequences of the pandemic. For instance, Lahcen investigate whether post-COVID recovery plans could stimulate economic activity while also improving the environmental performance.

CGE models have been used to examine policies and impacts in some fields, which are directly related to the COVID-19 pandemic. Some notable examples can be found in the health economics literature, where CGE models are sometimes employed to assess the systemic impact of a health crisis on the economy, usually by introducing a shock to labor efficiency or supply. Keogh-Brown et al. (2020) and McKibbin and Fernando (2020) provided early economic assessments of COVID-19 for different regions of the world, considering regional contagion and fatality rates. These papers simulate the health crisis via reduced labor supply, increased production costs and changes in consumption patterns. Similar CGE-based studies have been conducted for other diseases such as HIV/AIDS, H1N1, SARS and Ebola (Arndt and Lewis 2001; Dixon et al. 2010; Lee and McKibbin 2012; World Bank 2014).

CGE-based studies considering the pandemic impact on tourism are, up to know, quite rare. Leroy de Morel et al. (2020) provide one of the few impact assessments of this kind, focusing on tourism in New Zealand. Other examples are the global analyses of tourism by UNCTAD (2020, 2021). In the past, CGE models have been extensively used to gauge the economic impact of tourism related activities, which in some cases also includes an evaluation of their environmental footprint. For instance, Roson and Sartori (2014) use a CGE model to assess the trade-off between tourism development in the Mediterranean and sustainable water management. Bigano et al. (2008) analyze the climate change impact on sea level rise and tourism.

Recently, Cardenete et al. (2021) analyze the effect of the drop in tourism demand, for the same Spanish region we are considering in this study, Andalusia. However, their analysis substantially differs from the one we are presenting here, in several aspects. First, they rely on a rather mechanical, totally demand driven, input–output model, where changes in consumption patterns are ruled out, by construction. Since input–output is not general equilibrium, relevant effects in the markets for primary resources (e.g., unemployment in the labor market, unused capacity of installed capital) are disregarded. They employ a data source, where tourism does not appear as a single industry. Consequently, when simulating the demand shock, they reduced exogenous final demand in a number of tourism-related activities, however employing subjectively determined (guessed) shares. Finally, they do not consider any impact on the environment, as we do in this work.

Several regions in East and South-East Asia have had previous experiences with economic shocks, caused by viruses such as SARS and MERS. Tanaka (2022) gives a comprehensive overview of the literature that measures the economic impact of SARS and MERS in Asia. For both these crises, the crash of the demand for tourism was one of the main impact channels (Tanaka 2022). This indicates the need for more CGE studies on the specific effects of COVID-19 and tourism. Our study addresses this need and provides insight that can help to understand how countries in South-East Asia will be affected by a similar drop in tourism caused by the COVID-19 pandemic.

The tourism impact channel is so salient that a country can experience a negative economic shock caused by a fall in tourism demand even when the country itself is not directly impacted by a disease. Hor and Thaiprasert (2015) find that SARS pushed down tourist arrivals to Cambodia in 2003, even when Cambodia itself did not have any confirmed cases of SARS. Chou et al. (2004) use a CGE model to analyze the impact of SARS on Taiwan and identify the tourism sector as one of the main affected sectors. Still, their simulation includes some other shocks, such as to FDI, and therefore the results cannot be used to extract the isolated impact of the tourism shock. The studies by UNCTAD (2020, 2021) about tourism and COVID-19 find that South-East Asia, and Thailand in particular, are some of the regions that are most at risk to experience a large drop in GDP due to the fall in tourist spending. These studies provide valuable insight into the tourism impact channel of COVID-19. However, the simulations are based on a SAM which does not distinguish between different types of households and, consequently, it is more difficult to disentangle spending by tourists from the data. Our study includes two types of households–residents and tourists—and consequently we can isolate the demand shock to tourists from outside Andalusia.

3 Data and modeling strategy

The main data source for the modeling exercise presented in this paper is a Social Accounting Matrix (SAM) for the Spanish region of Andalusia (Roson and Van der Vorst 2020). Structural parameters of the general equilibrium model have been calibrated on the SAM data, therefore the design of the CGE model has been influenced by the available information.

A Social Accounting Matrix is an accounting framework, formulated as a matrix, depicting the circulation of income flows among various agents inside an economic system (Pyatt and Round 1985). It usually takes the form of a square matrix, where each entity is associated with a row (identifying sources of income) and a column (showing expenditure outlets), such that the two vectors correspond to a double-entry bookkeeping balance.

The Andalusian SAM considers three regions (Andalusia, Rest of Spain, Rest of the World), 87 produced goods and services and 84 industries (an industry can produce multiple goods, whereas a good may be produced by different industries), two household categories (residents, non-residents), a public sector and an investment sector. It also considers eight classes of primary factors, where four of them denote categories of labor. The structure of the SAM, which refers to the year 2016, is shown in Fig. 1.

Especially important here is the level and pattern of final consumption for non-residents households, as these broadly correspond to tourists coming from outside Andalusia. The expenditure of tourists is financed by income generated abroad, which enters the regional economy as a kind of transfer.

The general equilibrium model, based on the SAM, takes the form of a large non-linear system of equations, including market balances, budget constraints and accounting identities. The whole list of equation is presented in the Appendix, whereas a more detailed description of the model is available in Roson (2021).

Parameters are estimated through calibration, meaning that, without changes in exogenous variables and parameters, the model generates an equilibrium where all endogenous variables (e.g., activity levels, trade patterns, income, etc.) correspond to the baseline SAM data. As it is customary in CGE models, functional forms adopted in the model to express the behavioral response of economic agents (to changing relative prices) are based on combinations of Constant Elasticity of Substitution (CES) functions and their variants, like Constant Elasticity of Transformation (CET) and Linear Expenditure System (LES). Since elasticities of substitution or transformation cannot be calibrated, their values were taken from the literature, or from assumptions adopted in similar models, or just plain educated guesses.

Like in all Walrasian general equilibrium models, money does not play any role and the system can only determine relative prices, from where all remaining endogenous variables are derived. To this end, a numeraire price is chosen, which in this case is the fixed level of external prices. This allows interpreting the domestic price index as a virtual regional exchange rate. Please notice that, unlike in most country-level CGE models, where the (real) exchange rate is endogenous and the trade balance is required to be in equilibrium (usually net of the baseline surplus or deficit), the numeraire choice permits here foreign (non-Andalusian) net savings to vary. We believe that this kind of model closure is better suited for a sub-national model like the one at hand.

There are other assumptions that depart from the typical CGE setting. All primary factors, for instance, are not perfectly mobile. A CET function is used to allocate the factors among the various productive activities, in such a way that more (but not all) factors get employed where their returns are relatively higher. The elasticity of transformation in each CET function could be interpreted as an index of inter-industry factor mobility: the higher the elasticity the higher the mobility and the smaller the compensation gap (or vice versa). Equivalently, when the elasticity is small it means that it is quite difficult to “convert” a factor employed in an industry into a factor employable in another industry. As a limit case, a zero elasticity indicates an industry-specific input. Table 1 shows the elasticity values adopted for the primary resources CET functions.

The framework accounts for the fact that Andalusian factors may be employed outside the region, whereas not all factors employed in Andalusian industries are owned by regional citizens. However, there is no interregional migration of factors.

Another peculiar assumption is that average salaries for labor factors are endogenously determined through a wage curve, meaning that the model computes variations in employment (or unemployment) by worker category (equation A37 in the Appendix). This model feature is of fundamental importance in a region where unemployment rates are very high. A wage curve is an empirical relationship, justifiable because of the existence of trade unions or efficiency wages, linking wages to unemployment rates. It therefore plays the role of a labor supply curve. The key elasticity parameter (− 0.06) has been estimated for Andalusia by Bande et al. (2012) and it is adopted here for all labor categories.

Normally exogenous variables in the model include: regional exports, public sector demand, foreign prices, income transfers to/from the public sector and to/from households (comprising non-residents), and endowments of non-labor primary resources. Any of these variables can be shocked and varied from its initial level as set through the calibration SAM.

For the specific exercise presented in this paper, the logical candidate to shock is the money inflow spent in the region by non-residents, distinguished by origin (rest of Spain, rest of the world). The magnitude of the shock, which is of course a reduction, can be estimated by considering some information on touristic flows in the year 2020. The year includes very different sub-periods: when the region was totally open (first two months), totally closed, open for national travelers, partially open to international travelers with movement limitations (fewer flights, more controls and mobility constraints).

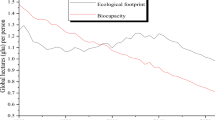

The Spanish National Institute for Statistics provides detailed data on tourism expenditure in Andalusia by tourists from different destinations. Expenditure by tourists coming to Andalusia from the rest of Spain fell by 25% in the first quarter of 2020, compared to the previous year. The year-on-year differences for the second and third quarter of 2020 are − 85% and − 21% (INE 2021a). The relatively better performance in the summer reflects the easing of mobility restrictions over that season. Tourist expenditure from the EU and the rest of the world decreased even more in year-on-year terms, by 20%, 99% and 79% respectively in the first, second and third quarter of 2020 (INE 2021b). Figure 2 displays monthly data on expenditure by international tourists in Andalusia, highlighting how year-on-year differences in expenditure were rather stable until 2020, when tourism expenditure collapsed with only a short revival during the summer (INE 2021b). Based on these data, we find that expenditure by international tourists fell by 75% and we correspondingly reduced the incoming revenue by the same amount in the simulation. Expenditure by tourists from the rest of Spain falls slightly less, thus we applied a shock to consumption expenditure from the rest of Spain of − 70%.

4 Economic impact

The fall in tourists’ expenditure has generated far-reaching effects in the Andalusian economy, and some of them are captured by our general equilibrium model, where sectoral interdependences are considered.

The tourism shock leads to an excess supply for Andalusian products and resources, bringing about lower prices in equilibrium and an overall − 3.74% fall in regional GDP. This finding is of course contingent on the underlying assumptions of our simulation exercise, where other direct and indirect effects of the COVID-19 are not considered, whereas regional exports and interregional income transfers are kept constant.

Not surprisingly, we found that the most impacted sectors are those heavily reliant on tourism. From our SAM data we find that, on average, non-resident tourists spend 33% of their total consumption budget on food and drinks services, 21% on accommodation and 13% on real estate services. On the other hand, there are sectors where expenditure by non-residents makes up half or more of all sales, e.g.: accommodation and rental services, maritime, air and land transport, creative and cultural services.

The fall in demand yields a contraction in prices and output, which is especially relevant in tourism-exposed industries. However, it would also shift resources towards those industries, which are relatively less affected by the shock, where we could ultimately notice some expansion. This kind of outcome is typical of general equilibrium analyses, driven by relative prices and competitiveness: even in the presence of a negative macroeconomic shock some sectors may turn out to gain.

This result can be noticed in Fig. 3, displaying the largest price variations for goods and services produced in Andalusia. Whereas the overall price level lowers by − 1.28%, accommodation services (where almost 90% of output was initially directed to tourists) experience a drop of around 25%. Something similar, albeit less pronounced, occurs for rental services, drinks production and real estate. On the other hand, we see rising prices for R&D and construction, by 10% and 5%, respectively.

Of course, price changes are related to changes in output, as can be noticed in Fig. 4, which illustrates the largest relative changes in output by industry. Most industries with large prices drop in Fig. 3 are also present in Fig. 4, because of their large output variation. As in Fig. 3, accommodation services account for the widest change, with output falling by more than 30%. A different response can be observed in the real estate industry. There, prices fall by around 10%, yet the change in output is relatively small (− 2.5%). This is because the missing demand by tourists is partially made up by a 2.3% increase in consumption from residents, taking advantage of the lower prices.

The general picture of structural adjustment in the Andalusian economic system is characterized by market shares shifting away from many service industries towards the primary and secondary sectors. For instance, gross production in architecture and engineering, construction and information services increase between + 6% and + 12%.

This structural adjustment process leads to changing demand for specific types of workers, whereas the overall unemployment rate rises by + 1.84%. Employment and unemployment levels are endogenous in the model because the average wage (by worker category) is determined by a wage curve function, where wages are quite rigid and only minimally adjust to the excess supply of labor.

There are, however, large differences in employment rates and changes across the different categories of workers. We found that service and shop workers suffer the largest decline in employment (− 5.34%), as this type of labor is largely employed in tourism industries such as restaurants, hotels, or tour guides. Somewhat less severe is the decline in employment for clerks and technically skilled labor, falling by − 2.5% and − 1.6%, respectively. On the other hand, it turns out that the demand for labor increases (+ 4.1%) for agricultural and low-skilled labor (Fig. 5). This latter finding can be explained through the combined effect of expanding sectors (e.g., agriculture, construction), and relatively high inter-sectoral mobility of workers (see Table 1). Notice, for instance, that production in the domestic construction industry increases by + 12%, where almost 30% of non-skilled workers are employed.

Factor income is of course affected by varying levels of employment and wages, but also by drops in the returns on non-labor primary factors, such as capital (Fig. 6). We found that factor income for service and shop workers falls the most (− 5.34%), whereas revenue for agricultural and low-skilled labor increases (+ 4%). Returns on capital plunge by − 4.1%. Total factor income, which is composed of the different sources, is found to shrink by − 2.57%.

In our model, resident households receive income associated with their ownership shares of primary factors, but they also get transfers and factor income generated abroad. These two latter components are kept fixed in our simulation, so that total household income for residents declines by only − 1.7%. The parameter of the marginal propensity to consume (that is, the share of income devoted to consumption) is also exogenously given and fixed.

An aggregate index of market prices, which considers endogenous substitution of imported goods (whose price is constant) with cheaper Andalusian products, goes down by − 1.28%. However, not all price changes are equally relevant for residents. For example, falling prices for hotels are not going to substantially increase residents’ welfare, but prices for real estate and food and drinks services (− 8.14% and − 9.28%) do. Indeed, expenditure on real estate makes up 25% of their pre-shock consumption basket, whereas food and drink services accounts for 14%. It is important to note here that, according to the international national accounting rules, the share for real estate consists of both normal rental payments as well as in-kind virtual rent paid by owners to themselves.

As prices lower more in our experiment where the tourism expenditure shares get larger, the price impact on residents’ welfare can be assessed by looking at the correlation between resident and non-resident consumption patterns, as well as that between price changes and resident consumption patterns. Figure 7 presents a correlogram, where relationships are shown between resident and non-resident expenditure shares, changes in industrial production output levels and prices.

Not surprisingly, changes in prices and output volumes are strongly correlated (+ 0.84), where the typical association is between lower price and lower production. On the other hand, both prices and output are characterized by a negative correlation with the consumption shares of non-residents (− 0.61 and − 0.65, respectively). This is because the demand shock will be more severe where tourist consumption is larger. Most importantly, a high positive correlation is found between resident and non-resident consumption patterns (+ 0.62). This means that the two patterns are quite similar, but it also means that large impacts on prices and output are occurring in those industries which are also important consumption items for resident households.

One monetary measure of welfare that is often employed in this kind of analyses is the Equivalent Variation (EV). The EV is obtained from data on real consumption, by calculating what change in expenditure or available income could have generated the same variation of utility, at unchanged baseline prices. We computed the EV for resident households in our model and we found that it is mildly positive, amounting to 1967.55 millions of Euros (2016).

This result is counterintuitive, as we are considering a negative macroeconomic shock which, in the end, turns out to slightly benefit the resident households. We postpone at a later stage in this paper a discussion of this outcome, where we shall also provide a possible interpretation. In terms of model mechanics, however, the finding can be readily explained. There are two counteracting forces, determining the level of real purchasing power of resident households: (1) diminished nominal income: (2) lower prices. However, the first effect is dumped by the existence of some constant income sources, whereas the second effect is amplified by the concentration of price reductions in key consumption goods and services. Therefore, our result simply demonstrates that the positive price effect is stronger than the negative income effect.

5 Environmental impact

A frequent comment about the COVID-19 crisis is that, while being bad for humans, it generated positive consequences for the planet, in terms of reduced pollution and environmental impact. We tried to verify if this claim is confirmed in our analysis.

To this end, data for GHG emissions (CO2 and non-CO2) and air pollutants were retrieved from the auxiliary data sets of the GTAP global SAM, version 10 (Aguiar et al. 2019). More specifically, we considered those related to domestic production and private consumption, disregarding those from intermediate demand, to avoid double counting. Since data are provided at the national level, we calculated a set of pollution intensity coefficients (akin to input–output coefficients) for Spain, applying them to some endogenous variables in our MEGA model.

We found that CO2 emissions associated to production in Andalusia would decrease by around 3%, corresponding to 0.23 million metric tons of CO2. Figure 8 illustrates the largest absolute changes in CO2 emissions by industry. Transport services are the largest contributors to the decline of CO2 emissions. This is because transport industries are emission-intensive, and consequently even a small reduction in output levels could significantly reduce CO2 emissions.

In our simulation, private consumption by residents increases slightly, but there is an overall drop in private consumption, caused by the reduced consumption of non-resident tourists. This fall in private consumption leads to a 6.7% reduction in CO2 emissions, or 0.26 Mt.

The non-CO2 data include emissions from methane (CH4), nitrous oxide (N2O) and fluorinated gases (F-gases), for both domestic production and private consumption. Overall, non-CO2 emissions from Andalusian production decrease by only 0.4%. There are, however, quite different results per type of non-CO2 gas. CH4 emissions are reduced by 0.02 CO2-equivalent million tons (mil tCO2-eq.), N2O emissions by 0.002 mil tCO2-eq. On the other hand, F-gases emissions increase slightly, by 0.004 mil tCO2-eq. This information is visualized in Fig. 9.

There are only six sectors in Andalusia emitting F-gases during the production phases (see Fig. 10). Panel A of Fig. 10 shows our estimated percentage change in output level for these industries, which are all positive. They are heavy industries, not closely related to tourism, whose production increases, because of factors shifting away from sectors more directly affected by the plunging demand.

There are no emissions of F-gases associated with final consumption. However, emissions of CH4 and N2O would decline slightly, by − 0.0024 and − 0.0041 mil tCO2-eq., respectively.

Air pollution data are also available for pollutants resulting from domestic production and private consumption. A wide range of air pollutants is included: carbon monoxide (CO), ammonia (NH3), nitrogen oxides (NOx), non-methane volatile organic compounds (NMVOC), sulfur dioxide (SO2), organic carbon (OC), particulate matter (PM10 and PM2.5), black carbon (BC).

As for the non-CO2 emissions associated with production activities, we detected decreases in some air pollutants, as well as increases in others. Overall, we got a total increase of 0.23 Gigagrams (Gg) for the whole set of air pollutants. This total increase is, to a large extent, due to rising levels of CO. The key drivers are the iron, steel, and minerals industries, where CO pollution rises between 0.05Gg to 0.1Gg.

Indeed, most of air pollution in Andalusia is caused by a few heavy industries, while little pollution is generated by the typical tourism services sectors. Consequently, the shift away from tourism to some heavy industries explains much of the rise in air pollution. One exception is the drinks industry. Since this sector depends on tourism, the supply of drinks products declines by almost 10%, bringing about in a notable reduction in air pollution. On the other hand, air pollution generated by land transportation declines significantly, especially for PM10 and PM2.5, where there is a − 0.04Gg and − 0.02Gg variation, respectively.

However, the increase in air pollution from domestic production is more than offset by the reduction coming from private consumption, amounting to − 8.8Gg. As can be seen in Fig. 11, this reduction is mostly driven by the − 6Gg decrease in CO pollution. Other notable reductions are those of NMVOC (− 1.5Gg) and NOx (− 0.8Gg).

The pollution impact can be usefully decomposed in two parts. Indeed, total emissions vary because of the general activity slowdown, as well because of the different sectoral mix in the economy. To gauge the relevance of this second factor, we conducted an estimation of the hypothetical volume of production-related emissions, under the hypothesis that total gross output would remain unchanged, but industry shares would be those emerging after applying the shock. In this way, we aim to detect how much the structural change, induced by the lower tourism expenditure, contributes to the overall variation in pollution emissions, net of the general decrease in economic activity.

Results are summarized in Table 2, displaying the variation, in absolute physical volume and in relative percentage, for all greenhouse gases and air pollutants emissions generated by production activities in the region.

Total variation can be decomposed as the algebraic sum of two factors: scale change and structure change. As expected, the scale effect is always negative, which simply means that the decrease in economic activity reduces emissions. When expressed in percentage terms, variations are quite similar; this is a direct consequence of assuming proportionality between emissions and industrial output volumes.

Interestingly, the structural change component is generally positive, the only exception being CO2. This means that the different sectoral mix generated by the tourism demand shock would push the regional economy towards more polluting industries. Therefore, structure and scale go to opposite directions. Ordinarily, the scale effect is stronger and total emissions are lower, but this is not the case for fluorinated gases, black carbon, and ammonia.

6 Can we draw some lessons for South-East Asian regions?

We could summarize the results obtained for Andalusia as follows. The sudden drop in income inflow from tourists causes all industries related to tourism to shrink, but also (because of the diffusion of the initial shock throughout the economic system) triggers a process of structural change, with a reallocation of resources, mainly benefitting the primary and secondary sectors. Unemployment increases, but not for all workers’ categories. Analogously, pollutant emissions get lower, but not uniformly, and increasing in a few cases.

We leave for the following section a critical appraisal and an evaluation of these insights. Here, we rather focus on the question of the applicability of the results, of course from a qualitative perspective, for a set of selected South-East Asian countries: Brunei, Cambodia, Indonesia, Lao PDR, Malaysia, Philippines, Singapore, Thailand, and Vietnam. These countries were chosen because of data availability and geographical contiguity. Unfortunately, we were unable to collect sufficient information at the level of sub-national regions.

The general idea is that, although the key insights are applicable in general, they would better fit to those economies somewhat “similar” to the Andalusian one. Since “similarity” is a multidimensional concept, we focus here on a few indicators, which we consider to be especially relevant in this context.

We already commented about the share of tourism activities in the GDP. In this respect, Malaysia and Singapore stand out as the most akin to Andalusia. On the other hand, even if the share of tourism in GDP for Indonesia is only 5.9% (WTTC 2021), a completely different picture would emerge if we could consider a highly touristic region within the country like, for instance, Bali-Lombok.

One interesting and quite surprising result we found in Andalusia is the lack of evidence of welfare losses for local inhabitants, at least in the aggregate. Would this hold for South-East Asian countries as well?

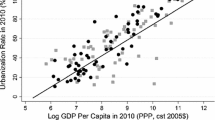

Remember that this finding was due to two main drivers: (1) the relative similitude in consumption patterns between locals and tourists; (2) the existence of income transfers, assumed as constant in the model. Consumption patterns, on the other hand, are mainly driven by the individual purchasing power, or real income per capita. Citizens of developing countries are significantly poorer than the average incoming tourist, therefore local consumers cannot generally replace tourists. According to the World Bank (2021) only Singapore and Brunei had (in 2019) a GDP per capita (expressed in Purchasing Power Parity) higher than the Spanish one, whereas the proportion was just 70% in Malaysia, 46% in Thailand, 22% in the Philippines, 20% in Vietnam, 19% in Lao PDR, and only 11% in Cambodia.

Income transfers are many and diverse, but generally smaller in magnitude, therefore less relevant, in developing countries. One interesting case is that of unemployment benefits, which would require a sufficiently developed welfare system, and of course apply only to permanent, formal jobs. Both conditions are unlikely to be met, in many circumstances, in relatively poor countries.

All in all, we can conclude that the “local household welfare puzzle” we noticed in Andalusia should not materialize in any of the countries we considered, the only possible exceptions being Singapore and Brunei.

Was the tourism demand fall similar in magnitude in the Asian countries? We estimated, for the whole year 2020, a drop in tourism expenditure of − 72.5%. According to the World Travel and Tourism Council Annual Research (2021), the corresponding figures are − 44.90% for Brunei, − 77.80% for Cambodia, − 78.40% for Indonesia, − 71.90% for Lao PDR, − 84.00% for Malaysia, − 78.80% for Philippines, − 74.40% for Singapore, − 76.50% for Thailand, − 68.50% for Vietnam. Therefore, except for Brunei, the decrease in demand is of a comparable order of magnitude.

If we combine this data with information about the size of tourism activities in the economy, where we noticed that Malaysia and Singapore are comparable to Andalusia, we can conclude that the exogenous demand shock in these two countries appears to be quite analogous, at the macroeconomic level.

We analyzed some environmental impacts, in terms of pollutant emissions. As we assumed proportionality of emissions to gross production or demand volumes, the aggregate effects we measured are due to (a) the slowing down of the economy and (b) the varying industry mix in the economic structure. Based on the arguments discussed above, we should expect relative changes in emissions of air pollutants to be somewhat comparable in the South-East Asia.

Nonetheless, what really matters in this context is often the absolute, not the relative, variation. For instance, human-induced climate change depends on total emissions, therefore concentrations, of greenhouse gases in the atmosphere. To this end, it may be worthwhile to consider the pollution intensity of the various economies.

For instance, emissions of carbon dioxide in Andalusia are estimated to be 1.39 tons per capita. For Brunei, that figure is as large as 16.33 tons. Even Malaysia and Singapore are relatively more polluting, with 4.23 and 4.75 tons, respectively (calculations based on Aguiar et al. 2019). We found in our simulations that CO2 emissions associated to production in Andalusia would decrease by around 3%, and by 6.7% those associated to consumption. Even if the corresponding variations in Brunei would be roughly similar, the absolute change in per capita emissions would turn out to be much more significant, because of the different initial point.

7 Discussion and concluding remarks

We have used in this study a general equilibrium model to assess the consequences on the Andalusian economy of the drop in consumption demand, generated by the mobility restrictions imposed during the COVID-19 pandemic in the year 2020. We also tried to see if the insights we got are applicable to a set of countries in South Asia. The numerical exercise is a comparative static one and, as such, it is not intended to realistically replicate what has occurred. Like in a hypothetical laboratory, we are “isolating” what we believe is the most important impact of COVID-19 in Andalusia, disregarding all the other concurring effects, taking place in Andalusia or elsewhere. Furthermore, since we are contrasting two general equilibrium states, in a setting without explicit time dimension, we cannot capture differences in rigidity and adjustment speed among markets. All these are well known limitations, intrinsic to the methodology we have adopted.

On the other hand, our disaggregated, internally consistent general equilibrium framework allows us to highlight the systemic, higher-order propagation effects of exogenous shocks, like the sudden drop in tourism demand. Overall, the key insight emerging from our analysis is that the COVID crumbling of tourism demand generates very relevant distributional consequences. In other words, not everybody is equally affected by the macroeconomic shock, whereas somebody turns out to gain.

We can see this in many ways. Even if gross production declines in most industries, we found that output volumes notably increase for Cement production (+ 2.12%), Construction (+ 3.60%), Engineering technical services (+ 3.18%), Research and development (+ 3.90%) and, surprisingly, Travel agencies (+ 3.65%).

Unemployment gets worse. Still, more agricultural and non-skilled workers get employed (+ 4.1%), because industries performing better are relatively intensive in non-skilled labor, and workers in this category are quite mobile.

We did not find evidence of welfare reduction for resident households, in the aggregate. We noticed that this is due to a consumption price index falling more than nominal income, such that the purchasing power improves. This rather unexpected finding is of course a direct consequence of some assumptions we adopted, most notably the constancy of income transfers. It is also a consequence of a welfare measure which only considers consumption levels, and no other elements of “happiness”, including the health status. However, we do not believe that this result should be dismissed as totally unrealistic.

There is some (limited) evidence that income and wealth have not deteriorated for many households during the pandemic. At the same time, saving rates have significantly increased, partly because of precautionary reasons and partly because of the impossibility to spend in some non-basic items, including tourism. This has produced an unprecedented amount of hoarded liquidity (Smith 2020).

Of course, aggregate data mask very substantial differences among households and individuals, which cannot be captured in our model, where only two representative households (resident and non-resident) are present. Wages for some workers have been protected by contractual norms and some jobs have swiftly moved into tele-working, without significant variations in productivity and sometimes even grabbing side-benefits (like savings on office space rents). Irregular, immigrant, seasonal workers, etc., have not benefitted from such degree of resilience, although some emergency relief programs have been directed to them by many governments. An analysis of the distributional effects of the pandemic is one very promising field of research, but currently still at its infancy (for an early, seminal contribution, see Glover et al. 2020).

We found the same, more complex picture, when focusing on the environmental consequences of the exogenous shock in tourism expenditure. Saying that the environmental impact of the pandemic is generally positive is far too simplistic. Looking at the results about greenhouse gases and air pollutants, we noticed that emissions for most pollutant categories would decrease but could also increase in some other cases. Furthermore, the structural change, induced by the exogenous demand shock, would imply an expansion of some polluting industries.

References

Aguiar A, Chepeliev M, Corong E, McDougall R, van der Mensbrugghe D (2019) The GTAP data base: Version 10. J Global Econ Anal 4(1):1–27. Retrieved from: https://www.jgea.org/resources/jgea/ojs/index.php/jgea/article/view/77

Arndt C, Lewis JD (2001) The HIV/AIDS pandemic in South Africa: sectoral impacts and unemployment. J Int Dev 13(4):427–449. https://doi.org/10.1002/jid.796

Aydın L, Ari I (2020) The impact of Covid-19 on Turkey’s non-recoverable economic sectors compensating with falling crude oil prices: a computable general equilibrium analysis. Energy Explor Exploit 38(5):1810–1830. https://doi.org/10.1177/0144598720934007

Bande R, Fernández M, Montuenga V (2012) Wage flexibility and local labour markets: a test on the homogeneity of the wage curve in Spain. J Region Res 24:175–198

Bekkers E, Keck A, Koopman R, Nee C (2020) Methodology for the WTO Trade Forecast of April 8 2020. Economic Research and Statistics Division. World Trade Organization, French

Bigano A, Bosello F, Roson R, Tol RSJ (2008) Economy-wide impacts of climate change: a joint analysis for sea level rise and tourism. Mitig Adapt Strat Glob Change 13(8):765–791. https://doi.org/10.1007/s11027-007-9139-9

Brodeur A, Gray DM, Islam A, Bhuiyan S (2020) A literature review of the economics of COVID-19. IZA discussion paper no 13411

Cardenete MA, del Carmen Delgado M, Villegas P (2021) Impact assessment of Covid-19 on the tourism sector in Andalusia: an economic approach. Curr Issue Tour. https://doi.org/10.1080/13683500.2021.1937073

Chou Ji, Kuo N-F, Peng S-L (2004) Potential impacts of the SARS outbreak on Taiwan’s Economy*. Asian Econ Pap 3(1):84–99. https://doi.org/10.1162/1535351041747969

Dixon P, Lee B, Muehlenbeck T, Rimmer M, Rose A, Verikios G (2010) Effects on the U.S. of an H1N1 Epidemic: analysis with a quarterly CGE model. Centre of Policy Studies, Monash University. General paper no G-202

European Commission, Directorate General Trade (2020) The Impact of the Covid-19 Pandemic on Global and EU Trade—May 2020

Glover A, Heathcote J, Krueger D, Ríos-Rull JV (2020) Health versus wealth: on the distributional effects of controlling a pandemic. National Bureau of Economic Research No. w27046

Hor C, Thaiprasert N (2015) Analysis of international tourism demand for Cambodia. In: Huynh V-N, Kreinovich V, Sriboonchitta S, Suriya K (eds) Econometrics of Risk. Springer, Cham, pp 415–425. https://doi.org/10.1007/978-3-319-13449-9_28

Instituto Nacional de Estadística (2021a) Resultados nacionales: Destino principal de los viajes (extranjero/comunidad autónoma) Viajes, pernoctaciones, duración media y gasto por destino principal. Retrieved from: https://www.ine.es/jaxiT3/Datos.htm?t=12434

Instituto Nacional de Estadística (2021b) Gasto Turístico: Resultados por comunidades autónomas—Gasto de los turistas internacionales según comunidad autónoma de destino principal. Retrieved from: https://www.ine.es/jaxiT3/Datos.htm?t=10839

Keogh-Brown MR, Jensen HT, Edmunds WJ, Smith RD (2020) The impact of Covid-19, associated behaviours and policies on the UK Economy: a computable general equilibrium model. SSM Popul. Health. https://doi.org/10.1016/j.ssmph.2020.100651

Lahcen B, Brusselaers J, Vrancken K, Dams Y, Da Silva Paes C, Eyckmans J, Rousseau S (2020) Green recovery policies for the COVID-19 crisis: modelling the impact on the economy and greenhouse gas emissions. Environ Resource Econ 76(4):731–750. https://doi.org/10.1007/s10640-020-00454-9

Lee J-W, McKibbin WJ (2012) The impact of SARS. In: Garnaut R, Song L (eds) China: new engine of world growth. ANU Press, pp 19–33. https://www.jstor.org/stable/j.ctt24h9qh.10

Leroy de Morel L, Glen W, Christina L, Dion G (2020) The potential local and regional impacts of COVID-19 in New Zealand: with a focus on tourism. NZIER working paper. NZIER working paper. New Zealand Institute of Economic Research. https://ideas.repec.org/p/ris/nzierw/2020_003.html

Maliszewska M, Mattoo A, Mensbrugghe D (2020) The potential impact of COVID-19 on GDP and trade: a preliminary assessment. Policy research working paper. World Bank Group. https://doi.org/10.1596/1813-9450-9211.

Malliet P, Reynès F, Landa G, Hamdi-Cherif M, Saussay A (2020) Assessing short-term and long-term economic and environmental effects of the COVID-19 Crisis in France. Environ Resource Econ 76(4):867–883. https://doi.org/10.1007/s10640-020-00488-z

McKibbin W, Fernando R (2020) The Economic Impact of COVID-19. In: di Mauro BW (ed) Economics in the time of COVID-19 Baldwin R. CEPR Press: A VoxEU.org Book, London

OECD (2020) Shocks, risks and global value chains: insights from the OECD METRO model. Retrieved from: https://issuu.com/oecd.publishing/docs/metro-gvc-final

OECD (2021) Tourism GDP (indicator). https://doi.org/10.1787/b472589a-en. Accessed on 25 Feb 2021

Park C-Y, Villafuerte J, Abiad A, Narayanan B, Banzon E, Samson JNG, Aftab A, Tayag MC (2020) An updated assessment of the economic impact of COVID-19. Asian Development Bank, Philippines

Pyatt G, Round JI (1985) Social accounting matrices: a basis for planning (No. 9950, p. 1). The World Bank

Nechifor V, Boysen O, Ferrari E, Hailu K, Beshir M (2020a) COVID-19: socioeconomic impacts and recovery in Ethiopia. JRC technical report. European Commission. Retrieved from: https://op.europa.eu/en/publication-detail/-/publication/49de6690-3dbc-11eb-b27b-01aa75ed71a1/language-en

Nechifor V, Ferrari E, Kihiu E, Laichena J, Omanyo D, Musamali R, Kiriga B (2020b) COVID-19 impacts and short-term economic recovery in Kenya. JRC technical report, European Commission. https://doi.org/10.2760/767447

Nechifor V, Ramos MP, Ferrari E, Laichena J, Kihiu E, Omanyo D, Musamali R, Kiriga B (2021) Food Security and Welfare changes under COVID-19 in Sub-Saharan Africa: impacts and responses in Kenya. Glob Food Sec 28:100514. https://doi.org/10.1016/j.gfs.2021.100514

Nicola M, Alsafi Z, Sohrabi C, Kerwan A, Al-Jabir A, Iosifidis C, Agha M, Agha R (2020) The socio-economic implications of the coronavirus and COVID-19 pandemic: a review. Int J Surg 78:185–193

Roson R, Sartori M (2014) Climate change, tourism and water resources in the Mediterranean—a general equilibrium analysis. Int J Clim Change Strateg Manag 6:212–228. https://doi.org/10.1108/IJCCSM-01-2013-0001

Roson R, Costa P (2020) Gli effetti del lockdown contro il COVID-19 sulla struttura delle economie europee. Scenari per l’Italia e la Francia. ASTRID RASSEGNA, no 6

Roson R, Van der Vorst C (2020) A social accounting matrix for Andalusia. University Ca'Foscari Venice, Dept. of Economics Research paper series no 22

Roson R, Van der Vorst C (2022) General equilibrium analyses of Covid-19 impacts and policies: an historical perspective. In: Baltagi BH, Moscone F, Tosetti E (eds) The economics of COVID-19, contributions to economic analysis, vol 296. Emerald Publishing, Bingley, pp 55–70

Roson R (2021) The MEGA regional general equilibrium model. University Ca'Foscari Venice, Dept. of Economics Research paper series no 6

Smith AL (2020) Why Are Americans Saving So Much of Their Income? kcFED Economic Bulletin Dec 4th, 2020, pp 1–4

Tanaka S (2022) Economic impacts of SARS/MERS/COVID-19 in Asian Countries. Asian Econ Policy Rev 17(1):41–61. https://doi.org/10.1111/aepr.12363

UNCTAD (2020) COVID-19 and tourism: assessing the economic consequences. United Nations Conference on Trade and Development, Geneva

UNCTAD (2021) COVID-19 and Tourism—an update: assessing the economic consequences. United Nations Conference on Trade and Development, Geneva

World Bank (2014) The Economic Impact of the 2014 Ebola Epidemic: short and medium term estimates for West Africa. The World Bank Group. Retrieved from: http://documents1.worldbank.org/curated/en/524521468141287875/pdf/912190WP0see0a00070385314B00PUBLIC0.pdf

World Bank (2021) GDP per capita, PPP (current international $). https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD?year_high_desc=true. Accessed 22 Oct 2021

World Travel and Tourism Council (WTTC) (2021) Economic impact reports. https://wttc.org/Research/Economic-Impact. Accessed 15 Oct 2021

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Structure of the MEGA general equilibrium model

Sets

Name | Description |

|---|---|

a | Activities |

f | Factors |

lab ∈ f | Labor factors |

g, gg | Goods |

h | Households |

k | Investments |

l | Locations |

p | Public sector |

e ∈ l | Exterior |

Parameters

Name | Domains | Description |

|---|---|---|

shva | a | Share of value added in activity a |

shf | a, f | Share of factor f in value added a |

shfa | a, f | Share of factor f employed in activity a |

shn | a, g | Share of intermediate factor g in intermediate bundle of a |

shga | a, g | Share of good g produced by a |

shfh | f, h | Share of factor income f going to household h |

shofi | e, f | Share of outgoing factor income |

shpk | p, k | Share of investment type k by public sector (normally one) |

shhk | h, k | Share of investment type k by household h (normally one) |

shek | e, k | Share of investment type k by foreign agent (normally one) |

shgk | g, k | Share of good g in investment demand k |

impc | h | Internal marginal propensity to consume by household h |

empc | h | External marginal propensity to consume by household h |

sheh | e, h | Share of external consumption e in external consumption demand h |

sharm | g, l | Total Armington shares |

ini_nx | Initial level of trade balance | |

ini_emp | Initial employment level | |

un% | Baseline unemployment rate | |

ao | a | Output productivity shifter in activity a |

ava | a | Value added productivity shifter in activity a |

ain | a | Intermediate productivity shifter in activity a |

af | a, f | Productivity shifter of factor f in activity a |

an | a, g | Productivity shifter of intermediate factor g in activity a |

aarm | g, l | Productivity shifter for Armigton demand |

to | a, p | Output tax rate |

tf | f, p | Factor income tax rate |

tc | h, p | Consumption tax rate |

c0 | g, h | Committed consumption |

c1 | g, h | Marginal consumption parameter |

lct | a, f | Activity production losses |

sigmap | a | CES elasticity of substitution in upper level nest production activity a |

sigmav | a | CES elasticity of substitution in value added a |

sigman | a | CES elasticity of substitution in intermediate bundle a |

omegas | a | CET elasticity of transformation for activity a |

sigmaa | g | CES elasticity of Armington nest for good g |

omegaf | f | CET elasticity of transformation for factor f |

beta | lab | Wage curve elasticity |

Variables

Name | Domains | Description |

|---|---|---|

qgl | g, l | Total supply of good g by source l |

pgl | g, l | Market price of good g by source l |

pg | g | Market price of good g |

qa | a | Total supply of activity a |

qga | a, g | Supply of good g by activity a |

qan | a | Same as above, but net of compensation transfers |

pa | a | Price index of activity a |

qva | a | Value added bundle in activity a |

pva | a | Price index value added bundle in activity a |

qfa | a, f | Demand of primary factor f in activity a |

qnd | a | Intermediate bundle in activity a |

pnd | a | Price index intermediate bundle in activity a |

qf | f | Total supply of primary factor f |

qna | a, g | Demand of intermediate factor g in activity a |

pf | f | Market price of primary factor f (index) |

pfa | a, f | Market price of primary factor f in activity a |

ih | h | Household income |

ip | p | Public sector income |

ik | k | Investment expenditure |

ie | e | RoW and RoS income |

tif | f | Total factor income |

evash | a, f | Endogenous factor share of value added |

armDem | g | Total Armington demand |

qgh | g, h | Consumption demand of good g by household h |

veh | e, h | Consumption abroad in e by household h (value) |

qgp | g, p | Demand of good g by the public sector |

qgk | g, k | Investment demand of good g |

qge | g, e | Export of good g to e |

esharm | g, l | Endogeous Armington shares |

tra | a, p | Production tax revenue by activity |

trh | p | Consumption tax revenue |

trf | p | Factor tax revenue |

trep | e, p | Transfers to public sector from outside |

trhp | h, p | Transfer to households from public |

treh | e, h | Transfer to households from outside |

ifi | e, f | Incoming factor income |

ofi | e, f | Outgoing factor income |

hsav | h, k | Households savings |

psav | k, p | Public savings |

esav | e, k | External savings |

defl | Regional GDP deflator | |

unemp | Unemployment rate |

1.2 Equations

-

(A1) Demand for the value added bundle

$${\text{qva}}_{a} = {\text{shva}}_{a} \cdot {\text{qa}}_{a} \cdot \frac{{{\text{pa}}_{a} }}{{{\text{pva}}_{a} }}^{{{\text{sigmap}}_{a} }} \cdot ({\text{ao}}_{a} \cdot {\text{ava}}_{a} )^{{({\text{sigmap}}_{a} - 1)}} \quad\quad \forall a$$ -

(A2) Demand for the intermediate bundle

$${\text{qnd}}_{a} = (1 - {\text{shva}}_{a} ) \cdot {\text{qa}}_{a} \cdot \frac{{{\text{pa}}_{a} }}{{{\text{pnd}}_{a} }}^{{{\text{sigmap}}_{a} }} \cdot ({\text{ao}}_{a} \cdot {\text{ain}}_{a} )^{{({\text{sigmap}}_{a} - 1)}} \quad\quad \forall a$$ -

(A3) Unit cost of production in activity a

$${\text{pa}}_{a} = \frac{1}{{{\text{ao}}_{a} }} \cdot \left( {{\text{shva}}_{a} \cdot \frac{{{\text{pva}}_{a} }}{{{\text{ava}}_{a} }}^{{(1 - {\text{sigmap}}_{a} )}} + (1 - {\text{shva}}_{a} ) \cdot \frac{{{\text{pnd}}_{a} }}{{{\text{ain}}_{a} }}^{{(1 - {\text{sigmap}}_{a} )}} } \right)^{{\frac{1}{{1 - {\text{sigmap}}_{a} }}}} \quad\quad \forall a$$ -

(A4) Demand for primary factor f in activity a

$${\text{qfa}}_{a,f} = {\text{shf}}_{a,f} \cdot {\text{qva}}_{a} \cdot \frac{{{\text{pva}}_{a} }}{{{\text{pfa}}_{a,f} }}^{{{\text{sigmav}}_{a} }} \cdot {\text{af}}_{a,f}^{{({\text{sigmav}}_{a} - 1)}} \quad\quad \forall a,f$$ -

(A5) Price of value added bundle in a

$${\text{pva}}_{a} = \sum\limits_{f} {\left( {{\text{shf}}_{a,f} \cdot \frac{{{\text{pfa}}_{a,f} }}{{{\text{af}}_{a,f} }}^{{(1 - {\text{sigmav}}_{a} )}} } \right)}^{{\frac{1}{{1 - {\text{sigmav}}_{a} }}}} \quad\quad \forall a$$ -

(A6) Demand for intermediate factor g in activity a

$${\text{qna}}_{a,g} = {\text{shn}}_{a,g} \cdot {\text{qnd}}_{a} \cdot \frac{{{\text{pnd}}_{a} }}{{{\text{pg}}_{g} }}^{{{\text{sigman}}_{a} }} \cdot {\text{an}}_{a,g}^{{({\text{sigman}}_{a} - 1)}} \quad\quad \forall a,g$$ -

(A7) Price of intermediate bundle in a

$${\text{pnd}}_{a} = \sum\limits_{g} {\left( {{\text{shn}}_{a,g} \cdot \frac{{{\text{pg}}_{g} }}{{{\text{an}}_{a,g} }}^{{(1 - {\text{sigman}}_{a} )}} } \right)}^{{\frac{1}{{1 - {\text{sigman}}_{a} }}}} \quad\quad \forall a$$ -

(A8) Define activity level net of compensating transfers

$${\text{qan}}_{a} = {\text{qa}}_{a} - \sum\limits_{f} {{\text{lct}}_{a,f} } \quad\quad \forall a$$ -

(A9) Supply of good g by activity a

$${\text{qga}}_{a,g} = {\text{shga}}_{a,g} \cdot {\text{qan}}_{a} \cdot \frac{{{\text{pgl}}_{{g,{\text{A}}}} }}{{{\text{pa}}_{a} }}^{{{\text{omegas}}_{a} }} \quad\quad \forall a,g$$ -

(A10) Price index for a

$${\text{pa}}_{a} = \sum\limits_{g} {\left( {{\text{shga}}_{a,g} \cdot {\text{pgl}}_{{g,{\text{A}}}}^{{(1 + {\text{omegas}}_{a} )}} } \right)}^{{\frac{1}{{1 + {\text{omegas}}_{a} }}}} \quad\quad \forall a$$ -

(A11) Total domestic supply of good g

$${\text{qgl}}_{{g,{\text{A}}}} = \sum\limits_{a} {{\text{qga}}_{a,g} } \quad\quad \forall g$$ -

(A12) Definition of the tax revenue on income, by activity

$${\text{tra}}_{a,p} = {\text{pa}}_{a} \cdot {\text{qa}}_{a} \cdot {\text{to}}_{a,p} \quad\quad \forall a,p$$ -

(A13) Definition of the tax revenue on consumption

$${\text{trh}}_{p} = \sum\limits_{g,h,l} {\left( {{\text{qgh}}_{g,h} \cdot {\text{esharm}}_{g,l} \cdot {\text{pgl}}_{g,l} \cdot {\text{tc}}_{h,p} } \right)} \quad\quad \forall p$$ -

(A14) Definition of the tax revenue on factors income

$${\text{trf}}_{p} = \sum\limits_{f} {({\text{tif}}_{f} \cdot {\text{tf}}_{f,p} )} \quad\quad \forall p$$ -

(A15) Public sector income

$${\text{ip}}_{p} = \sum\limits_{a} {{\text{tra}}_{a,p} } + {\text{trh}}_{p} + {\text{trf}}_{p} + \sum\limits_{e} {{\text{trep}}_{e,p} } \quad\quad \forall p$$ -

(A16) Public sector surplus or deficit (by investment type)

$${\text{psav}}_{k,p} = {\text{shpk}}_{p,k} \cdot \left( {{\text{ip}}_{p} - \sum\limits_{g,l} {({\text{qgp}}_{g,p} \cdot {\text{esharm}}_{g,l} \cdot {\text{pgl}}_{g,l} )} - \sum\limits_{h} {{\text{trhp}}_{h,p} } } \right)\quad\quad \forall k,p$$ -

(A17) Endogenous factor share of value added

$${\text{evash}}_{a,f} = \frac{{{\text{pfa}}_{a,f} \cdot {\text{qfa}}_{a,f} }}{{{\text{qva}}_{a} \cdot {\text{pva}}_{a} }}\quad\quad \forall a,f$$ -

(A18) Total regional factor income

$${\text{tif}}_{f} \cdot \left( {1 + \sum\limits_{p} {{\text{tf}}_{f,p} } } \right) = {\text{pf}}_{f} \cdot \left( {{\text{qf}}_{f} - \sum\limits_{a} {{\text{lct}}_{a,f} } } \right) + \sum\limits_{e} {{\text{ifi}}_{e,f} } - \sum\limits_{e} {{\text{ofi}}_{e,f} } - \sum\limits_{a,p} {({\text{tra}}_{a,p} \cdot {\text{evash}}_{a,f} )} \quad\quad \forall f$$ -

(A19) Definition of outgoing factor income

$${\text{ofi}}_{e,f} = {\text{shofi}}_{e,f} \cdot \left( {{\text{pf}}_{f} \cdot \left( {{\text{qf}}_{f} - \sum\limits_{a} {{\text{lct}}_{a,f} } } \right) - \sum\limits_{a,p} {\left( {{\text{tra}}_{a,p} \cdot {\text{evash}}_{a,f} } \right)} } \right)\quad\quad \forall e,f$$ -

(A20) Private sector income

$${\text{ih}}_{h} = \sum\limits_{f} {\left( {{\text{shfh}}_{f,h} \cdot {\text{tif}}_{f} } \right)} + \sum\limits_{p} {{\text{trhp}}_{h,p} } + \sum\limits_{e} {{\text{treh}}_{e,h} } \quad\quad \forall h$$ -

(A21) Demand for internal hh consumption

$$\left( {{\text{qgh}}_{g,h} - {\text{c0}}_{g,h} } \right) \cdot {\text{pg}}_{g} \cdot \left( {1 + \sum\limits_{p} {{\text{tc}}_{h,p} } } \right) = {\text{c1}}_{g,h} \cdot \left( {{\text{impc}}_{h} \cdot {\text{ih}}_{h} - \sum\limits_{gg} {\left( {{\text{c0}}_{gg,h} \cdot {\text{pg}}_{gg} \cdot \left( {1 + \sum\limits_{p} {{\text{tc}}_{h,p} } } \right)} \right)} } \right)\quad\quad \forall g,h$$ -

(A22) Demand for external hh consumption (total value)

$${\text{veh}}_{e,h} = {\text{sheh}}_{e,h} \cdot {\text{empc}}_{h} \cdot {\text{ih}}_{h} \quad\quad \forall e,h$$ -

(A23) Private saving

$${\text{hsav}}_{h,k} = {\text{shhk}}_{h,k} \cdot (1 - {\text{impc}}_{h} - {\text{empc}}_{h} ) \cdot {\text{ih}}_{h} \quad\quad \forall h,k$$ -

(A24) Income available for investments

$${\text{ik}}_{k} = \sum\limits_{{h|{\text{hsav}}{\text{.L}}_{h,k} }} {{\text{hsav}}_{h,k} } + \sum\limits_{p} {{\text{psav}}_{k,p} } + \sum\limits_{e} {{\text{esav}}_{e,k} } \quad\quad \forall k$$ -

(A1) Demand of investment goods by type k

$${\text{qgk}}_{g,k} = \frac{{{\text{shgk}}_{g,k} \cdot {\text{ik}}_{k} }}{{{\text{pg}}_{g} }}\quad\quad \forall g,k$$ -

(A25) Income to RoS or RoW

$${\text{ie}}_{e} = \sum\limits_{g} {({\text{pgl}}_{g,e} \cdot {\text{qgl}}_{g,e} )} + \sum\limits_{f} {{\text{ofi}}_{e,f} } + \sum\limits_{h} {{\text{veh}}_{e,h} } \quad\quad \forall e$$ -

(A26) Foreign savings

$${\text{esav}}_{e,k} = {\text{shek}}_{e,k} \cdot \left( {{\text{ie}}_{e} - \sum\limits_{g} {({\text{qge}}_{g,e} \cdot {\text{pgl}}_{{g,{\text{A}}}} )} - \sum\limits_{f} {{\text{ifi}}_{e,f} } - \sum\limits_{h} {{\text{treh}}_{e,h} } - \sum\limits_{p} {{\text{trep}}_{e,p} } } \right)\quad\quad \forall e,k$$ -

(A27) Endogenous Armington shares

$${\text{esharm}}_{g,l} = {\text{sharm}}_{g,l} \cdot \frac{{{\text{pg}}_{g} }}{{{\text{pgl}}_{g,l} }}^{{{\text{sigmaa}}_{g} }} \cdot {\text{aarm}}_{g,l}^{{({\text{sigmaa}}_{g} - 1)}} \quad\quad \forall g,l$$ -

(A28) Armington price index

$${\text{pg}}_{g} = \sum\limits_{l} {\left( {{\text{sharm}}_{g,l} \cdot \frac{{{\text{pgl}}_{g,l} }}{{{\text{aarm}}_{g,l} }}^{{(1 - {\text{sigmaa}}_{g} )}} } \right)}^{{\frac{1}{{1 - {\text{sigmaa}}_{g} }}}} \quad\quad \forall g$$ -

(A29) Total Armington demand

$${\text{armDem}}_{g} = \sum\limits_{a} {{\text{qna}}_{a,g} } + \sum\limits_{h} {{\text{qgh}}_{g,h} } + \sum\limits_{p} {{\text{qgp}}_{g,p} } + \sum\limits_{k} {{\text{qgk}}_{g,k} } \quad\quad \forall g$$ -

(A30) Armington demand split for good g non-domestic

$${\text{qgl}}_{g,e} = {\text{esharm}}_{g,e} \cdot {\text{armDem}}_{g} \quad\quad \forall g,e$$ -

(A31) Armington demand split for good g domestic

$${\text{qgl}}_{{g,{\text{A}}}} = {\text{esharm}}_{{g,{\text{A}}}} \cdot {\text{armDem}}_{g} + \sum\limits_{e} {{\text{qge}}_{g,e} } \quad\quad \forall g$$ -

(A32) Market equilibrium for factors (CET)

$${\text{qfa}}_{a,f} = {\text{shfa}}_{a,f} \cdot {\text{qf}}_{f} \cdot \frac{{{\text{pfa}}_{a,f} }}{{{\text{pf}}_{f} }}^{{{\text{omegaf}}_{f} }} \quad\quad \forall a,f$$ -

(A33) Factor price index

$${\text{pf}}_{f} = \sum\limits_{a} {\left( {{\text{shfa}}_{a,f} \cdot {\text{pfa}}_{a,f}^{{(1 + {\text{omegaf}}_{f} )}} } \right)}^{{\frac{1}{{1 + {\text{omegaf}}_{f} }}}} \quad\quad \forall f$$ -

(A34) Regional GDP deflator

$${\text{defl}} \cdot \sum\limits_{a} {{\text{qva}}_{a} } = \sum\limits_{a} {({\text{pva}}_{a} \cdot {\text{qva}}_{a} )}$$ -

(A35) External trade closure (fixes foreign savings)

$${\text{ini}}\_{\text{nx}} = \sum\limits_{g,e} {({\text{qge}}_{g,e} \cdot {\text{pgl}}_{{g,{\text{A}}}} )} - \sum\limits_{g,e} {({\text{pgl}}_{g,e} \cdot {\text{qgl}}_{g,e} )}$$ -

(A36) Unemployment rate

$${\text{unemp}} = {\text{un}}\% - \left( {1 - {\text{un}}\% } \right)\left( {\frac{{\mathop \sum \nolimits_{{{\text{lab}}}} {\text{qf}}_{{{\text{lab}}}} }}{{{\text{ini}}\_{\text{emp}}}} - 1} \right)$$ -

(A37) Wage curves

$${\text{pf}}_{{{\text{lab}}}} = 1 - {\text{beta}}_{{{\text{lab}}}} \left( {\frac{{{\text{unemp}}}}{{{\text{un}}\% }} - 1} \right)\quad\quad \forall {\text{lab}}$$

Rights and permissions

About this article

Cite this article

Roson, R., van der Vorst, C. Assessing the economic and environmental consequences of the COVID-19 tourism collapse in Andalusia: what lessons can we draw for South-East Asian regions?. Ann Reg Sci 71, 269–297 (2023). https://doi.org/10.1007/s00168-022-01162-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-022-01162-6