Abstract

In this paper, we use a series of simple examples to illustrate how wealth-driven selection works in a market for Arrow securities. Our analysis delivers both a good and a bad message. The good message is that, when traders invest constant fractions of their wealth in each asset and have equal consumption rates, markets are informationally efficient: the best informed agent is rewarded and asset prices eventually reflect this information. However, and this is the bad message, when asset demands are not constant fractions of wealth but dependent upon prices, markets might behave sub-optimally. In this case, asymptotic prices depend on preferences and beliefs of the whole ecology of traders and do not, in general, reflect the best available information. We show that the key difference between the two cases lies in the local, i.e. price dependent, versus global nature of wealth-driven selection.

Similar content being viewed by others

Notes

Since we are primarily interested in analyzing the selective capability of markets, we assume that agents are myopic and drop the assumption of perfect foresight or rational-expectations. These assumptions would indeed sterilize the effect of the trading-induced wealth reallocation, as all the problems would be reduced to an ex-ante identification of possible equilibria.

As we shall see, the appropriate quantification of the “distance” between probability distributions is provided by the relative entropy.

Portfolio rules are distinct from investment rules when intermediate consumption is considered, in which case the portfolio rule specifies the fraction of wealth to be allocated to each asset whereas the investment rule also specifies the fraction of wealth to be saved and the fraction of wealth to be consumed. See also footnote 4 below.

This is equivalent to assuming a constant and homogeneous consumption rate for all agents, bar a renormalization of price levels. As discussed in Blume and Easley (1992), the introduction of heterogeneous consumption rates weakens markets informational efficiency when better informed traders have a higher propensity to consume. Since the effect is well understood, we have chosen not to consider it in the present analysis.

Were the reader, for any reason, averse to the expected utility framework, he or she is free to consider the constant rules as behavioral rules, that is, as mere descriptions of agents behavior. Our results and the overall analysis remain the same.

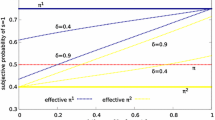

When \(\pi \ne 1/2\), one can use the function I π (α) to rescale the vertical axis in the EMC plot so that the entropic distance can be still inferred by visual inspection.

In some contributions of the Evolutionary Finance literature, the Kelly rule has been replaced by the generalized Kelly rule, that is, investing proportionally to expected assets payoffs. Despite the fact that the two rules coincide in a market with only Arrow securities, they differ under more general asset structures. In particular, the generalized Kelly rule is in general not log-optimal, although it has been shown to dominate among constant rules, see Evstigneev et al. (2009). The relation between the log-optimal Kelly rule and the generalized Kelly rule is the object of ongoing research. See also Section 5.3 of this paper and Section 5.1 in Bottazzi and Dindo (2010).

In other words, we shall first identify all the deterministic fixed points of the random dynamical system, and then perform their local asymptotic stability analysis. The local analysis is made possible by the fact that in single agent markets the equilibrium price is regular, i.e. locally unique, so that the market dynamics is well defined. Thus market dynamics can be linearized around the fixed points and agents can be described as if they were using suitably defined constant rules. As a result, the analysis of asymptotic states can proceed along the lines of Section 4. For sufficiently smooth investment rules, results from the linearized markets carry over to the original market, albeit only locally (see Bottazzi and Dindo 2010, for details).

When performing simulations, we need to ensure that the market equilibrium is unique for all possible wealth distribution, and not only when a single agent has all the wealth. For the rules the wealth dynamics of which is plotted in Fig. 5 the result easily holds because their convex combination is always non-increasing and thus has a unique interception with the EMC.

Also in this example, when performing simulations, we need to ensure that the market equilibrium is unique for all possible wealth distribution and not only for the single survivor case. The result can be established by looking at the first derivative of the convex combination of the two rules, which has limit \(+\infty \) for \(p \to 0\), first decreasing and then increasing, and limit \(+\infty \) for \(p \to 1\). It follows that the convex combination of the two rules cannot have more than one intercept with the EMC.

Even more in danger are risk neutral agents, or risk lovers, who, by investing all their wealth in the asset with the highest expected payoff, would disappear from the market in finite time.

Referring to the discussion in footnote 7, in the case of price dependent rules, it is log-optimality that grants local dominance. In the context of price dependent rule and non-Arrow asset structures, the generalized Kelly rule of Amir, Hens, Evstigneev, and Shenck-Hoppeè, i.e. investing proportionally to expected payoff, is not log-optimal. Regarding both points see Section 5.1 of Bottazzi and Dindo (2010).

It directly follows for the convexity of the log function.

In all the examples of this section, uniqueness of the market equilibrium price can be established by following the same reasoning presented in footnote 10.

References

Amir R, Evstigneev I, Hens T, Schenk-Hoppé K (2005) Market selection and survival of investment strategies. J Math Econ 41:105–122

Anufriev M, Bottazzi G (2010) Market equilibria under procedural rationality. J Math Econ 46:1140–1172

Anufriev M, Dindo P (2010) Wealth-driven selection in a financial market with heterogeneous agents. J Econ Behav Organ 73:327–358

Anufriev M, Bottazzi G, Pancotto F (2006) Equilibria, stability and asymptotic dominance in a speculative market with heterogeneous agents. J Econ Dyn Control 30:1787–1835

Blume L, Easley D (1992) Evolution and market behavior. J Econ Theory 58:9–40

Blume L, Easley D (2006) If you are so smart why aren’t you rich? Belief selection in complete and incomplete markets. Econometrica 74:929–966

Blume L, Easley D (2010) Heterogeneity, selection, and wealth dynamics. Ann Rev Econ 2:425–450

Bottazzi G, Dindo P (2010) Evolution and market behavior with endogenous investment rules. LEM Working Paper 2010-20. Scuola Superiore Sant’Anna, Pisa

Breiman L (1961) Optimal gambling systems for favorable games. Proceedings of the 4th Berkley symposium on mathematical statistics and probability 1:63–68

Evstigneev I, Hens T, Schenk-Hoppé K (2008) Globally evolutionary stable portfolio rules. J Econ Theory 140:197–228

Evstigneev I, Hens T, Schenk-Hoppé K (2009) Evolutionary finance. In: Hens T , Schenk-Hoppé K (eds) Handbook of financial markets: dynamics and evolution. North-Holland (Handbooks in Economics Series)

Hommes C (2006) Heterogeneous agent models in economics and finance. In: Judd K, Tesfatsion L (eds) Handbook of computational economics, vol 2. Agent-based computational economics. North-Holland Handbooks in Economics Series, Amsterdam

Kelly J (1956) A new interpretation of information rates. Bell Syst Tech J 35:917–926

LeBaron B (2006) Agent-based computational finance. In: Judd K, Tesfatsion L (eds) Handbook of computational economics, vol 2. Agent-based computational economics. North-Holland (Handbooks in Economics Series)

Nelson R, Winter S (2002) Evolutionary theorizing in economics. J Econ Perspect 16:23–46

Sandroni A (2000) Do markets favor agents able to make accurate predictions. Econometrica 68(6):1303–1341

Sandroni A (2005) Market selection when markets are incomplete. J Math Econ 41:91–104

Acknowledgments

We acknowledge financial support from the Institute for New Economic Thinking, INET inaugural grant #220 and the European Commission 6th FP Project DIME (Contract CIT3-CT-2005-513396). All usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bottazzi, G., Dindo, P. Selection in asset markets: the good, the bad, and the unknown. J Evol Econ 23, 641–661 (2013). https://doi.org/10.1007/s00191-013-0318-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-013-0318-4