Abstract

We describe an agent-based model of a financial market where agents can learn whether to buy costly information on returns, to use noise as if it were information, or to disregard any signals. We show that while learning alone drives all noise traders to extinction in stationary populations, allowing for small rates of replacement of existing agents with new ones suffices to generate substantial levels of persistent noise trading, with the equilibrium share of agents using irrelevant news reaching double digits. Remarkably, the presence of noise traders, when replacement is realistically considered, inflates the share of agents who use costly information relative to the benchmark scenario without replacement.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Black (1986) famously stated that “noise trading is trading on noise as if it were information” and acknowledges that noise traders, and the noise upon which they trade, can affect prices, price volatility, trading volumes, and the incentives for informed traders to trade aggressively. Hence, their presence – or absence – affects market outcomes. For example, Stambaugh (2014) linked the decline in active portfolio management to the decline in the share of noise traders.

However, trading on noise is not rational: early arguments (Fama 1965; Friedman 1953) claimed that irrational investors would hence eventually lose all their wealth and be driven out of the market, and that people who trade on noise would objectively be better off not trading at all (Black 1986). De Long et al. (1990, 1991) pointed out that this is not necessarily true, spurring a stream of literature on the role of noise traders.

This paper describes an agent-based model (ABM) with three kinds of traders (informed, uninformed, and noise traders) where small changes in the learning mechanism produce dramatically different outcomes, contributing to the debate on the survival/extinction of noise traders in financial markets. In line with the intuition of Fama (1965) and Friedman (1953), in a setup with pure learning by imitation we obtain the rapid and definitive extinction of noise traders. However, this equilibrium is fragile: it is sufficient to perturb the pure imitation mechanism with a tiny rate of replacement (entry/exit) to observe a double-digit equilibrium share of noise-traders. Note that a minimal replacement rate, possibly due to experimentation and randomness among incumbent investors with bounded rationality, is a realistic and inevitable feature of any financial market. In this respect, our model also offers a possible explanation – complementary to that of De Long et al. (1991), based on the presence of risk generated by noise traders themselves – for the ubiquitous presence of noise traders. Such a presence, in turn, prompts more agents to become informed in order to “milk” such noise traders.

The rest of the paper is organized as follows. Section 2 provides a concise literature review. Section 3 presents the model. Section 4 shows the results of the simulations. Finally, Sect. 5 concludes.

2 Literature review

De Long et al. (1990) showed that, under certain conditions, noise traders earn a higher expected return than rational investors, because they are rewarded for taking a disproportionate amount of self-generated risk, defined in the literature as “noise trader risk”. This finding contrasts with the idea that irrational investors cannot last long in the market (Fama 1965; Friedman 1953). In a subsequent paper (De Long et al. 1991), the authors also showed that, under plausible conditions, noise traders would not only earn higher returns, but also survive in the financial market and dominate the market – in terms of wealth – in the long run. The role and survival of noise traders was also discussed in Blume and Easley (1992), who further supported the intuition of De Long et al. (1990, 1991), while Sandroni (2000) provided support for the market selection argument (Fama 1965; Friedman 1953).

Our paper may be related also to the evolutionary finance literature and more specifically, with a stream of papers explicitly addressing the evolutionary dynamics in financial markets with heterogeneous investing rules.Footnote 1

Among the others, Bottazzi et al. (2018) proved that traders with very biased beliefs can survive in the long-run; Bottazzi and Dindo (2013) showed that the market may converge to a long-run equilibrium in which not necessarily only the best informed agents survive. Recently, Giachini (2021) argued that agents using non-optimal (heuristic) decision rules may contribute to improve the pricing performance of the economy under biased and heterogeneous beliefs. In Evstigneev et al. (2023), the problem of survival was analyzed assuming that asset payoffs endogenously depend on agents’ strategy. Finally, Hirshleifer et al. (2023) examined a setting in which best performing investors may transfer their investing information to others, showing that heterogeneous investment styles can coexist in the long run, implying a greater diversity than predicted by traditional theory.

As far as rationality is concerned, several models incorporated features of bounded rationality to match stylized facts observed in real financial markets.Footnote 2 For example, Barberis et al. (2015) presented a model with two types of traders: fully rational traders and traders with extrapolative expectations. Their model is consistent with actual returns and prices, as well as with surveys of investors’ expectations. Bordalo et al. (2019) showed diagnostic expectations to explain overreaction to news that leads to excess volatility and mean reversion, a concept first presented in Shiller (1981). More recently, He et al. (2019) proposed a probabilistic approach to determine the optimal share of informed traders in a setup based on Grossman et al. (1980). Böhl and Hommes (2021) presented a model with the presence of both perfectly rational forward-looking and boundedly rational backward-looking agents. Westphal and Sornette (2020) used an ABM of a financial market with three types of traders: fundamentalists, noise traders, and “dragon riders” who are able to diagnose financial bubbles. Westphal and Sornette (2020) replaced the “dragon riders” with a dragon slayer (policymaker) whose objective is to prevent bubbles. More generally, the model is related to the literature on agent-based models in finance. See Axtell and Farmer (2022) for a review and future perspectives.

The present paper is also related to the literature that adopts learning-by-imitation approaches. This literature includes, among others, simulations (Başçı 1999; Fosco and Mengel 2011), experiments (Offerman et al. 2002; Villena and Zecchetto 2011), and theoretical work (Alós-Ferrer and Weidenholzer 2008).

In a paper related to ours, Dai et al. (2023) developed an artificial stock market with three types of agents that are similar to ours in some respects (informed, uninformed, and noise traders). While they find that noise traders cannot survive in the long run, the presence of noise traders increases market volatility, price distortion, noise trader risk, and trading volume. Our work differs substantially from theirs in that we consider costly information, explore the effect of learning, and allow for a small degree of investor replacement (entry/exit) in the market.

3 The model

Our financial market model is based on three components that complement each other to produce an equilibrium of prices and market shares, namely, the relative proportion of traders of different type: (i) a stylized exchange economy inspired by Grossman et al. (1980), where three different populations of investors set their strategies and prices emerge through market clearing; (ii) a learning protocol based on imitation, where investors copy a more profitable strategy; (iii) a mechanism of market entry and exit. We begin by describing the first component.

The financial market

We consider an economy where two assets are traded at time t: a riskless asset with gross return \(R\ge 1\) and a risky asset, traded at price \(p_t\), which at the end of the period yields the payoff

where \(d>R\), \(\theta _t\) and \(\epsilon _t\) are zero-mean independent and normally distributed random variables with variance \(v_\theta \) and \(v_\epsilon \), respectively. Although seemingly symmetric, \(\theta _t\) and \(\epsilon _t\) play very different roles: while \(\theta _t\) is observable and traders can buy this informative signal at a predetermined cost \(c>0\), \(\epsilon _t\) cannot be observed and is therefore a completely idiosyncratic component of the value of the payoff that accounts for all remaining exogenous variability. We allow traders to observe, at no cost, a random signal \(\phi _t\sim \mathcal {N}(0,v_\phi )\) that is actually uncorrelated with \(\theta _t\sim \mathcal {N}(0,v_\theta )\) and \(\epsilon _t\sim \mathcal {N}(0,v_\epsilon )\), and hence with \(D_t\):

Traders have the choice to be “informed” (I), purchasing the true signal \(\theta _t\) (and ignoring \(\phi _t\)), or remain “uninformed” (U), not purchasing the true signal \(\theta _t\) (nor observing the irrelevant \(\phi _t\)). Compared to the original Grossman-Stiglitz setup, we add the option of being “noise traders” (M), who do not purchase the true signal \(\theta _t\) while observing the irrelevant signal \(\phi _t\).Footnote 3 A note on the terminology is in order: noise traders naively believe that \(\phi _t\) is informative and therefore consider it to be a cheap alternative to the true signal \(\theta _t\). Informed and uninformed traders, conversely, choose to ignore \(\phi _t\), believing (correctly) that they cannot extract any useful information from it. Since \(\phi _t\) is uncorrelated with \(D_t\) and has null mean, noise traders do not make systematic errors.

We assume that demand is directly proportional to the return traders expect to gain and inversely proportional to the perceived variance they face. As with CARA-Normal agents, their demand is:

where a is a risk-aversion coefficient and p is the price at which traders can buy/sell the risky asset. Ceteris paribus, uninformed traders end up holding smaller positions in the risky stock than informed and noise traders, because they are indeed aware that they face uncertainty about the current values of both \(\theta \) and \(\epsilon \) (see the denominators in Eq. 3). In contrast, informed traders believe (correctly) that the residual uncertainty is only related to the value of \(\epsilon \) and end up trading large orders on average; the same belief is (incorrectly) shared by noise traders.

Denoting as \(\lambda _{It},\lambda _{Mt},\lambda _{U_t}\ge 0\) the share of informed, noise, and uninformed traders at time t, respectively, the clearing price at t solves the equation in p

From Eq. (3) and Eq. (4), and exploiting the identity \(\lambda _{Ut}=1-\lambda _{It}-\lambda _{Mt}\), it is not difficult to show that the equilibrium price \(p_t\), prevailing at t, can be written as

where \(\rho =v_\theta /v_\epsilon \). The price is linear in \(\theta \) and in \(\phi \), but not linear in \(\lambda _I\) and in \(\lambda _M\). Price p increases more with the true signal \(\theta \) (irrelevant signal \(\phi \)) at high values of \(\rho \) and \(\lambda _I\) (\(\rho \) and \(\lambda _M\)). Note that noise traders affect the price of the risky asset through Eq. 5, but do not affect the value of the future payoff (1). Therefore, our model does not include noise trader risk in the sense introduced by De Long et al. (1990, 1991). Traders’ profits are given by the product of quantities and payoffs, net of costs:

where the demands are computed using \(p_{t-1}\), the last observed price before clearing at time t takes place, and \(W_0\) is the initial wealth, which is assumed to be the same for all traders.

Learning

Agents’ strategies evolve using an explicit and rather basic learning mechanism based on imitation. In short, traders can occasionally copy (imitate) more successful strategies, i.e., strategies that have produced a higher payoff, from peers they encounter.Footnote 4

More formally, trading is organized in rounds of T trading periods. Then, in round k, profits are cumulated for periods \(t=(k-1)T+1,..., kT\), during which the strategy is constant for each trader \(i=1,...,N\). The cumulated profit is therefore obtained as

A fixed number \(h\le N/2\) of randomly selected pairs of traders are formed at the end of each round. If traders i and j are paired at (the end of) the k-th round, they will both begin round \(k+1\) with the strategy that maximized \(\{W_i, W_j\}\).

Finally, at the end of round k, all traders consume their revenues and their wealth is reinitialized to \(W_0\) in round \(k+1\).

Market entry and exit

In each period, some traders exit the market and are replaced by an equal number of new entrants. Each newcomer, who has no prior knowledge about which strategy is preferable, randomly picks one of the three strategies with uniform probability.Footnote 5 We assume that every T periods, \(\mu \) traders uniformly pick a random strategy in \(\{I,M,U\}\). In our experiments, we consider either \(\mu =0\) or \(\mu \ll h\), signaling a market where there is either no or low replacement.

In the next proposition, we derive necessary conditions that the three market shares must satisfy at the equilibrium. These conditions are crucial to understanding the numerical results of our model, when discussing the persistence/absence of noise traders.

Proposition 1

For any i and j \(\in \{I,M,U\}\), \(i\ne j\), denote by

the outperforming probability involving two types of investors employed in a pairwise comparison. Then, at the equilibrium, the average shares of informed, noise, and uninformed traders satisfy the following conditions

The proof is provided in Appendix C. Some remarks are due. First, note that the probabilities are non-linear functions of the market shares, so there are indeed two unknown objects to be determined at the equilibrium, namely, the two market shares (being the third one obtained by summing to one). However, it is not possible to elicit the outperforming probabilities as a function of market shares, so the system is generally not solvable in closed form. To gain some intuition, we first consider the simple case where \(\mu =0\) and one of the three populations disappears at the equilibrium (say \(\lambda _M=0\)). In this case, two of the previous probabilities are meaningless and the remaining one, \(p_{UI}\), satisfies

This corresponds to a kind of median equilibrium where, due to the learning mechanism based on a crisp comparison of wealth, each type of investor has a 0.5 probability of being the winner of any pairwise competition. It is quite intuitive that for a different triplet of average probabilities \(p_{IM},p_{UI},p_{UM}\), there would be a favorable strategy and the system would adjust to compensate for this unbalanced situation. Returning to the general case, it is clear how the median equilibrium is no longer obtained by setting \(p_{ij}=0.5\), which would not take into account the correction imposed by the entry/exit component in the equations. In the next section, we will deepen this analysis by setting up an ABM experiment and comparing different scenarios.

4 An ABM experiment

This section presents the results obtained from the simulation of the model, focusing in particular on the evolution of the relative share of traders using each strategy. The sequence of events within each period t is summarized in Fig. 1. Note that prices, wealth, and other economic variables are also relevant to describe the evolution of the economy. However, once the relative shares of the three populations are established, all other variables can be easily determined by the market clearing condition and the rules described above on the market structure. Therefore, in the following we focus our attention mainly on the equilibrium market shares. To this end, we analyze in detail two different scenarios characterized by the absence (presence) of market entry/exit. This analysis is crucial for understanding the role of such a component in the model.

We anticipate some comments on the two scenarios. First, in the absence of market entry/exit, the simple learning-by-imitation approach is sufficient to force the extinction of noise traders. Moreover, the market reaches an allocation of traders between the two surviving strategies where each has a 50% probability of outperforming the other in terms of profits. In this context, as stated in Proposition 1, we have that \(\lambda _M=0\) and \(p_{UI}=0.5\). On the contrary, if entry/exit is allowed, even at a tiny rate, the steady states of the system change dramatically and we see the emergence of equilibria where the share of noise traders is large (in the order of a double-digit share) and persistent. In a seemingly paradoxical way, the presence of these noise traders leads to a higher – ceteris paribus – share of informed traders. We suggest reasons why a stronger incentive to acquire information may be the consequence of the presence of noise traders, and rule out the possibility that the effect is driven by the purely mechanical effect of random entry and exit, which would lead to equal shares of informed, uninformed, and noise traders. We also show that the above results are robust to changes in the values of the key parameters of the model.

4.1 Scenario 1: Market with no entry/exit

Table 1 shows the values of the model’s parameters under different configurations. The first row represents the baseline configuration, while the remaining rows represent some variants to be explored. We hold constant the number of traders \(N=1,000\), the riskless rate of return \(R=1.01\), the deterministic component of the payoff \(d=1.1\), the risk-aversion coefficient \(a=2\), and the initial capital \(W_0=1\). The initial shares of traders are fixed at \(\lambda _{I0}=\lambda _{U0}=\lambda _{M0}=1/3\). One simulation run lasts for 15,000 periods, of which the first 5,000 are used to warm up the model (this is more conservative than what is prescribed in Vandin et al. (2022) and ensures that a steady state is reached). The following analysis is therefore based on the last 10,000 periods.

The baseline configuration is somewhat representative of a number of reasonable characteristics of equity markets: the idiosyncratic component (\(\epsilon \)) has a standard deviation of 20% and a signal (\(\theta \)) with a standard deviation of 10% can be accessed (e.g., by purchasing shares of a good mutual fund) at a cost of \(c=0.03\). This can be interpreted in terms of annual fees (3%). This situation bears a resemblance with a volatile market, where the future dividend is blurred by robust uncertainties due to the idiosyncratic component, but where good managers can sometimes get valuable signals by using their knowledge (although \(\textsc {E}(\theta )=0\)).

In the other configurations, listed in Table 1 and in bold to emphasize the difference with the baseline, we increase the informativeness of the signal \(\theta \) (I), by increasing the variance \(v_\theta \); we expect to observe an increase in the share of informed traders, since the signal is more valuable. We increase the size of the idiosyncratic component (II); we expect to observe a decrease in the share of informed traders, since the signal is less valuable. We increase the number of pairs h that learn after T periods (III); we have no prior in the direction of the effect. We set \(T=4\) to determine how longer horizons affect the equilibrium; we expect this to increase the share of informed traders, as accumulating earnings for several periods when the information is known is less likely to be affected by adverse sequences of independent random draws of \(\epsilon \). Finally, we reduce the cost of information (V), expecting to observe again an increase in the share of informed traders, since the signal is less costly. For each configuration in Scenario 1, we carried out a minimum of 75 simulation runs; whenever necessary, we increase the number of runs in order to achieve a standard error in the estimate of \(\lambda _I\), \(\lambda _M\) and \(\lambda _U\) not higher than 0.005, following (Vandin et al. 2022).Footnote 6

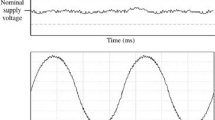

Figure 2 plots, in a representative run, the price and shares of informed, uninformed, and noise traders over 10,000 periods in the pure imitation baseline configuration. The mean price is 1.089, which is exactly the discounted average payoff of the risky asset, d/R. The median share of uninformed traders (black line) of the run is 0.84 (visible as a horizontal black dashed line); the median share of informed traders (green line) is 0.16. Notably, noise traders do not survive after the warm-up period, suggesting that trading based on noise is a dominated strategy in this setup. The Monte-carlo distributions of price, (market) share and wealth, summarizing all simulation runs, are reported in Appendix A.

There is heteroskedasticity in the price, which appears to be more volatile when the share of informed traders is higher. The intuition is that ceteris paribus informed traders trade higher volumes, and these higher volumes put pressure (which could be upward or downward, depending on the sign of \(\theta \)) on the price. Uninformed traders, conversely, are much more conservative, and their prudence is reflected in fewer market swings when they are widespread.

The graph also illustrates that an “equilibrium” in this setup is to be understood as a set of stationary distributions where prices and shares are constantly fluctuating. Even in equilibrium, no single trader is likely to follow the same strategy for long, and everyone instead often chooses another element in \(\{I,U\}\) so that, over time, the net flows between different types are (approximately, in the simulation) equal to zero.

Figure 3 shows the time series of \(p_{UI}=Pr(W_U\ge W_I)\), including also the warm-up period. As already discussed in Sect. 3, this probability tends to 0.5, a value that is reached in about 1,000 periods. Put differently, the median profits of the two surviving strategies are almost the same. The graph shows one of the most interesting outcomes of our model: in this (stationary) equilibrium, the probability that the informed trader earns more than the uninformed trader is basically 50%. The intuition is as follows: information has a cost, which we assume to be constant, and a value, which instead decreases with the share of traders who have the same information. The shares of boundedly rational traders adopting one or the other strategy are mutually adjusted in such a way that the information advantage exactly offsets the information cost, and even an omniscient marginal trader would be indifferent between being informed and being not informed.

The outcomes of the model obviously depend on the specific values of the parameters, and Table 2 shows - for the baseline configuration and the five parametric variants - some representative statistics, averaging the outcomes of the different simulation runs, each with a different seed, with respective standard errors. The number of simulation runs per each configuration is reported in the last row of the table.

The average price, as expected, is equal to \(d/R=1.089\) in all configurations. The median share of noise traders is equal to zero.Footnote 7 The share of informed traders is larger when the signal is more informative, when a longer T is used to aggregate wealth, and when information is less costly (in configurations I, IV, and V, respectively). In the presence of higher (unobserved) return volatility, in II, the share of informed traders decreases.Footnote 8

The median wealth (or “returns”) generated by different strategies is equal to – or reasonably close to – the risk-free rate in all parameter configurations considered.Footnote 9 Even though the median wealth is basically the same across strategies, the mean wealth is consistently larger for informed traders, see the row for \(\textsc {E}(W_I)\) and contrast with \(\textsc {E}(W_U)\): informed traders’ average gains are in the range [1.04, 1.09], while uninformed traders get on average about the riskless rate per period in all configurations considered.Footnote 10

4.2 Scenario 2: market with entry/exit

In this scenario, after imitation, \(\mu \) traders are randomly selected and replaced by newcomers. Each newcomer, who has no prior knowledge about which strategy is preferable, randomly chooses one of the three strategies \(\{U,M,I\}\) with equal probability. This is expected to drive \(\lambda _U\), \(\lambda _I\), and \(\lambda _I\) closer to 1/3 with respect to the values we observed in Table 2.

In the following, we fix \(\mu =1\), which, given that N=1000, implies that the replacement of existing traders occurs at a very low rate (0.1% of the population per period). Hence, in this framework, the number of newcomers is an order of magnitude smaller than the number of traders – 30 in the baseline, up to 60 in Configuration III – who are involved in learning by imitation. Thus, at first glance, market entry and exit are expected to produce a second-order effect.Footnote 11

Conversely, it turns out that market entry and exit have a remarkable effect, and Table 3, analogous to Table 2, shows that the equilibrium share of noise traders reaches a double-digit value once entry and exit are considered. For example, in the baseline configuration of Scenario 1, with learning only, \(Me(\lambda _M)=0\), but allowing for entry and exit, as in Scenario 2, such value is increased to \(Me(\lambda _M)=0.160\) (see Table 3). Therefore, the presence of entry and exit inflates the number of noise traders from zero to one in six. Figure 4 plots, in a representative run, the price and shares of informed, uninformed, and noise traders in the baseline configuration of this scenario.

Similar results are obtained in the other parametrizations of the model. Not coincidentally, the minimum value of \(Me(\lambda _M)\) is obtained in Configuration III, when the number of learning traders is doubled and the “weight” of the newcomers is reduced. Nevertheless, the main point that emerges is the ubiquitous presence of noise traders under all parameter configurations considered: noise would be eliminated by learning, but this is severely impaired by the sole entry and exit of a handful of traders from the market. The remarkable share of noise traders achieved in the equilibrium, as will become clearer in a few lines, is the consequence of the volatility of the market, which often makes them outperform the other strategies.

Another consequence of market entry and exit is that the median returns of the different strategies are no longer equal, leading to a disequilibrium in the market from a learning point of view. In fact, as shown in Fig. 5 for the baseline configuration, the probability that one strategy outperforms another no longer converges to 0.5, as we observed in Scenario 1. There is an “excess” of informed and noise traders and a “shortage” of uninformed traders due to random replacement of existing traders. The probabilities of one strategy outperforming the others hence converge to a value close to (but strictly different from) 0.5, and on average we have \(Pr(W_U\ge W_I)\approx 0.514\), \(Pr(W_U\ge W_M)\approx 0.528\), \(Pr(W_I\ge W_M)\approx 0.496\). Therefore, in each learning round, learning will push, for example, noise traders to become uninformed slightly more frequently than the other way round. This implies that, compared to informed and uninformed agents, noise traders (playing a dominated strategy) still “win” about once every two rounds and have a similar median wealth at the end of the period (see Table 3).

In essence, the flow due to “disequilibrium” in learning offsets the “disequilibrium” induced by entry and exit. For example, consider the third equation in Eq. 8, which refers to uninformed traders:

The first term in the l.h.s. of the equation is the expected flow due to learning, which is different from zero unless \(Pr(W_U\ge W_I)=0.5\) and \(Pr(W_U\ge W_M)=0.5\), that is, unless we reach a median equilibrium in learning. Replacing the parameters with the respective median values (see Table 3), we find that this expected flow is approximately 0.278. The second part, \((1/3-\lambda _U)\mu \), is instead the expected flow due to market entry and exit which pushes the share towards 1/3, and it is approximately \(-0.269\). It is evident how the two terms, computed numerically, compensate to reach the equilibrium condition in the general case of learning and market exit/entry. The same argument applies to the remaining two equations of Eq. 8.

Evolution of the outperforming probabilities, as defined by (7), in Scenario 2

In other words, in the more general scenario that includes market entry and exit, there is a less trivial equilibrium where the small flows from one strategy to another driven by differences in profits are exactly offset by the blind effect of the newcomers choosing a random strategy.

4.2.1 Scenario 3: Does the presence of noise traders affect the incentives to collect reliable information?

Scenario 1, with a stationary population of traders, and Scenario 2, with a tiny rate of market entry and exit, produce different values for the share of informed traders. However, the direct comparison of these two scenarios does not allow us to disentangle the role of the mechanical effect of entry/exit from a possible role of the presence of a relevant share of noise traders on the value of information – and, hence, on the share of informed traders.

To shed light of this issue, we consider a counterfactual setting –Scenario 3– where noise traders are removed and entry/exit is tweaked so that newcomers become either informed or uninformed with probabilities 1/3 and 2/3, respectively.Footnote 12 As the probability that a newcomer becomes informed is equal in both Scenarios 2 and 3, any difference in the equilibrium shares can be attributed only to the absence of noise traders from the market. Specifically, we are interested in determining whether their presence have any effect on the incentives to become informed and in the sign of this possible effect.

The results of this new scenario are reported in Tables 4 and 5 compares the mean and median of \(\lambda _I\) under Scenario 2 (first and third row) and Scenario 3 (second and fourth row).Footnote 13 In the baseline and in all variants, we observe a decrease in both \(Me(\lambda _I)\) and \(\textsc {E}(\lambda _I)\) in the absence of noise traders. This decrease is particularly noticeable in Configuration I (median from 0.456 in Scenario 2 to 0.418 in Scenario 3), Configuration IV (median from 0.609 to 0.583), and Configuration V (median from 0.537 to 0.508). In line with Stambaugh (2014), this finding corroborates the intuition that the presence of noise traders increases the “equilibrium” share of informed traders.

Note that in our setting, traders are unaware of the share of traders following each different strategy. They simply observe \(\theta \) (if informed), \(\phi \) (if noise traders), and the price, and then decide how much of their wealth to invest in the risky asset and how much in the riskless asset. Hence, the presence of noise traders – who should not be in the market in a pure imitation setting – is reflected in the price.

5 Conclusion

In this paper, we have presented the evolutionary dynamics of an agent-based model of a financial market with risk-averse investors allocating their wealth in a riskless and a risky asset. Traders are of three types: uninformed, informed, and noise traders. Uniformed traders know only the deterministic component of returns and the price, and trade small volumes. Informed traders collect (costly) information that is positively correlated with next period’s return; their greater awareness of future returns leads them to trade more aggressively. Noise traders trade on noise, which is actually uncorrelated with return, as if it were information; even though noise does not lead them to make any systematic errors in forecasting future dividends, they trade as aggressively as informed traders, and possibly in the wrong direction.

We compare the results with respect to two alternative scenarios. A first market scenario in which traders never exit the market (nor are newcomers allowed) and decide to change their strategy through a very simple learning-by-imitation scheme: if they learn that a peer had a higher return over a certain time span, they copy their peer’s strategy. In this setting, learning leads the population of traders to understand that it is preferable to be informed or uninformed than to be a noise trader. The latter lose money on average in favor of informed traders. Hence, noise traders are wiped out of the market; furthermore, the market reaches an equilibrium share of informed and uninformed traders such that the value of information – which decreases in the share of informed agents – exactly offsets its cost, and the probability of outperforming the other strategy in any given period is 50%, a result consistent with the theoretical model of Grossman et al. (1980).

In an alternative scenario, a negligible share (0.1%) of traders is replaced by new entrants in each period. Despite the fact that the number of traders entering/exiting the market is one order of magnitude smaller than those involved in learning, this alternative scenario produces a strikingly different result: not only does the entry/exit of traders prevent noise from being wiped out of the market, but the share of noise traders in equilibrium reaches a remarkable double-digit figure. De Long et al. (1990, 1991) have shown that noise traders can persist in financial markets because they bear a self-created “noise trader risk”. Our paper shows that noise can persist in the market even in the absence of “noise trader risk”, provided that the population of traders is not constant and some newcomers take noise into account in their trading strategy. Furthermore, the presence of “noise” traders in turn increases – ceteris paribus – the share of traders using the costly informative signal, a result consistent with Stambaugh (2014) point that the presence of noise traders affects the incentives for active portfolio management, which in our model consists of using costly but precious information to trade relatively large volumes of the risky asset.

Data Availability

No datasets were generated or analysed during the current study.

Notes

See Evstigneev et al. (2016) for a review of the main contributions in such a field.

See Conlisk (1996) for a discussion on the relevance of bounded rationality.

It would be natural to use “N” to denote “noise traders”; however, N is conventionally used in simulations to denote the number of agents involved. Hence, in order to avoid any confusion, we use the letter “M” since noise traders are misinformed (“noise trading is trading on noise as if it were information” Black, 1986).

Our terminology resembles the standard one used in genetic algorithm description, see Mitchell (2009) for an introduction, even though the set of strategies \(\{I,U,M\}\) is particularly simple in our setup.

This is equivalent to what is defined as mutation in genetic algorithms.

For Scenario 2 and Scenario 3, we run a minimum of 60 simulations.

The mean share of noise traders is strictly different from zero because, in some of the simulations, they take slightly longer than the warm-up period to disappear.

By construction, the benchmark model of the paper rules out the possibility that a trader can use a strategy once it has disappeared from the market. This may be the main reason for the zero median value of \(\lambda _M\) and, under some parameter configurations, of \(\lambda _I\). To check for this, in Appendix B we present a slightly different version of the model in which strategies are artificially prevented from disappearing (there will always be at least one trader using each of the three strategies). The share \(\lambda _M\) remains close to zero even in this different setup. Conversely, for example, the mean and median of \(\lambda _I\) increase significantly in Configuration III, reaching levels close to the baseline: being informed is not a dominated strategy.

This is also true for Configuration IV: trading profits are accumulated over a longer period of time as \(T=4\), and the riskless asset would generate a return of about 4%.

This holds even in Configuration IV, as \(1+(1.040-1)/4= 1.01=R\).

Using back-of-the-envelope calculations and considering that, for example, imitation drives \(\lambda _M\) to zero while newcomers drive \(\lambda _M\) to 0.33, one may expect \(\lambda _M\) to be around 1% (\(Me(\lambda _M)=(0*30+0.33*1)/31\simeq 1\%\)).

Conversely, assuming a random choice of newcomers between I and U with equal probability (1/2) would bias the pressure of entry/exit on the share of informed traders with respect to Scenario 2.

Even though 60 simulation runs were enough to obtain standard errors for the mean/median share of informed traders (\(\lambda _I\)) below 0.005, we decided to increase the number of simulation runs in Configuration III to 100 in order to further decrease the s.e. and make sure that the null hypothesis that mean/median of \(\lambda _I\) in Scenario 3 is equal to the one in Scenario 2 is rejected at the 5% level.

References

Alós-Ferrer C, Weidenholzer S (2008) Contagion and efficiency. J Econ Theory 143(1):251–274

Axtell RL, Farmer JD (2022) Agent-based modeling in economics and finance: Past, present, and future. J Econ Lit

Barberis N, Greenwood R, Jin L, Shleifer A (2015) X-capm: An extrapolative capital asset pricing model. J Financ Econ 115(1):1–24

Başçı E (1999) Learning by imitation. Econ. Dyn Control 23(9–10):1569–1585

Black F (1986) Noise. J Financ 41(3):528–543

Blume L, Easley D (1992) Evolution and market behavior. J Econ Theory J Econ Theory J Econ Theory 58(1):9–40

Böhl G, Hommes CH (2021) Rational vs. irrational beliefs in a complex world (IMFS Working Paper Series No. 156). Frankfurt a. M. Retrieved from https://hdl.handle.net/10419/233208

Bordalo P, Gennaioli N, Porta RL, Shleifer A (2019) Diagnostic expectations and stock returns. J Financ 74(6):2839–2874

Bottazzi G, Dindo P (2013) Selection in asset markets: the good, the bad, and the unknown. J Evol Econ 23:641–661

Bottazzi G, Dindo P, Giachini D (2018) Long-run heterogeneity in an exchange economy with fixed-mix traders. Economic Theory 66:407–447

Conlisk J (1996) Why bounded rationality? J Econ Lit 34(2):669–700

Dai X, Zhang J, Chang V (2023) Noise traders in an agent-based artificial stock market. Ann Oper Res pp 1–30

De Long JB, Shleifer A, Summers LH, Waldmann RJ (1990) Noise trader risk in financial markets. J Polit Econ 98(4):703–738

De Long JB, Shleifer A, Summers LH, Waldmann RJ (1991) The survival of noise traders in financial markets. J Bus 64(1):1–19

Evstigneev I, Hens T, Schenk-Hoppé KR (2016) Evolutionary behavioral finance. Springer, The handbook of post crisis financial modeling, pp 214–234

Evstigneev I, Tokaeva A, Vanaei MJ, Zhitlukhin M (2023) Survival strategies in an evolutionary finance model with endogenous asset payoffs. Ann Oper Res pp 1–21

Fama EF (1965) The behavior of stock-market prices. J Bus 38(1):34–105

Fosco C, Mengel F (2011) Cooperation through imitation and exclusion in networks. J Econ Dyn Control 35(5):641–658

Friedman M (1953) The case for flexible exchange rates. Essays in Positive Economics/University of Chicago Press

Giachini D (2021) Rationality and asset prices under belief heterogeneity. J Evol Econ 31(1):207–233

Grossman SJ, Stiglitz JE (1980) On the impossibility of informationally efficient markets. Am Econ Rev 70(3):393–408

He X-Z, Shi L, Tolotti M (2019) The social value of information uncertainty (Tech. Rep.). Available at SSRN: https://ssrn.com/abstract=3332356

Hirshleifer D, Lo AW, Zhang R (2023) Social contagion and the survival of diverse investment styles. J Econ Dyn Control 154:104711

Mitchell M (2009) Complexity: A guided tour. Oxford university press

Offerman T, Potters J, Sonnemans J (2002) Imitation and belief learning in an oligopoly experiment. Rev Econ Stud 69(4):973–997

Sandroni A (2000) Do markets favor agents able to make accurate predictions? Econometrica 68(6):1303–1341

Shiller RJ (1981) Do stock prices move too much to be justified by subsequent changes in dividends? Am Econ Rev 71(3):421–436

Stambaugh RF (2014) Presidential address: Investment noise and trends. J Financ 69(4):1415–1453

Vandin A, Giachini D, Lamperti F, Chiaromonte F (2022) Automated and distributed statistical analysis of economic agent-based models. Journal of Economic Dynamics and Control 143:104458

Villena MG, Zecchetto F (2011) Subject-specific performance information can worsen the tragedy of the commons: Experimental evidence. J Econ Psychol 32(3):330–347

Westphal R, Sornette D (2020) Market impact and performance of arbitrageurs of financial bubbles in an agent-based model. J Econ Behav Organ 171:1–23

Westphal R, Sornette D (2020) Market impact and performance of arbitrageurs of financial bubbles in an agent-based model. J Econ Behav Organ 171:1–23

Acknowledgements

We are grateful for the useful comments and feedback we obtained from David Goldbaum, Tony He, Giulia Iori, and Friederike Wall, the participants of the 47th Eastern Economic Society, the 24th and 25th Workshop on Economics & Heterogeneous Interacting Agents, the 43rd and 47th AMASES Meeting, the 27th International Conference on Computing in Economics and Finance, the 14th International Conference on Computational and Financial Econometrics, the 2nd DISEI Workshop on Heterogeneity, Evolution and Networks in Economics, and the Second Conference on Zero/Minimal Intelligence Agents. We also thank two anonymous reviewers for their constructive feedback, which has greatly helped improve the presentation of this paper. Any remaining errors are our own.

Funding

Open access funding provided by Università Cattolica del Sacro Cuore within the CRUI-CARE Agreement. Paolo Pellizzari received funding from the European Union’s Horizon 2020 research and innovation programme under the Marie Skłodowska-Curie grant agreement No 956107 (EPOC).

Author information

Authors and Affiliations

Contributions

Authors contributed equally to this work.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no Conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

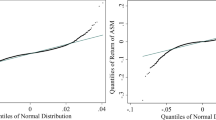

Appendix A: Density functions

Panel A: Kernel density estimation of the probability density function of price; Scenario 1, 2 and 3, baseline configuration. Panel B: Kernel density estimation of the probability density function of the share of informed traders (\(\lambda _I\), green), of the share of uninformed traders (\(\lambda _U\), black), and of the share of noise traders (\(\lambda _M\), red); Scenario 1, 2 and 3, baseline configuration. Panel C: Empirical Cumulative Distribution Function of the wealth of informed traders (\(W_I\), green), of the wealth of uninformed traders (\(W_U\), black), and of the wealth of noise traders (\(W_M\), red); Scenario 1, 2 and 3, baseline configuration

Appendix B: New scenario with “rebirth”

In this Appendix, we show that the extinction of noise traders in the benchmark model is not a mechanical effect of the impossibility for any trader to use a strategy once it has disappeared from the market. We present here a slightly different version of Scenario 1 in which strategies are artificially prevented from disappearing (there will always be at least one trader using each of the three strategies).

In fact, pure imitation only allows traders to adopt a strategy that is still used in the population. Hence, if the share of users of a given strategy \(X\in \{I,M,U\}\) drops to zero at some time \(t'\), then the number of traders using X will be null for all \(t>t'\).

We introduce rebirth as a way to preserve all strategies in the pool of traders at all times, ensuring that a streak of unlucky events does not wipe out one strategy forever. Specifically, under rebirth, for any \(X\in \{I,M,U\}\)

We emphasize that rebirth is activated only if at least one of \(\lambda _I, \lambda _M, \lambda _U\) is null, with the goal of restoring a situation in which any strategy can be selected in the future by imitation.

Given that our simulations include 1,000 traders, rebirth implies that \(\lambda _{Xt}\ge 0.1\%\) in all periods. Table 6 shows the representative statistics with rebirth (and learning by imitation).

Although \(\lambda _M\) is prevented from actually reaching zero, its median is never greater than 1% and its mean is never greater than 3%. This is another indication that being a noise trader is dominated by being either informed or uninformed. Figure 7 also corroborates this intuition: \(\lambda _M\) increases from time to time, but after a few periods it approaches zero again. Hence, the extinction of noise traders under imitation cannot be attributed to bad luck or a sequence of unfortunate realizations of \(\epsilon \) and \(\phi \) as, in all evidence, rebirth does not change this result.

Appendix C: Proof of proposition 1

The proof is based on the idea that the variation of \(\lambda _k\), for \(k\in \{I,M,U\}\) must be zero (on average) at equilibrium. Note that \(\lambda _k\) is a random variable. Therefore, we now elicit the form of \(\Delta \lambda _k\) and compute its average. It turns out that the three equations in Eq. 8 are equivalent to \(\textsc {E}[\Delta \lambda _k ]=0\), for \(k\in \{I,M,U\}\). Let us concentrate on \(\Delta \lambda _U\); a similar argument holds for the other two random variables. First, note that the population of uninformed traders changes over time due to a number of different (independent) events: a matching event with a Type I or Type M investor that results in a change in the strategy of the uninformed investor; the exit of a Type I (or Type M) investor that results in the entry of a Type U investor; the exit of a Type U investor replaced by a newcomer of Type I or M. We now describe all such events, introducing the following random variables:

-

\(\mathbbm {1}_{\{ i \leftrightarrow j\}}\,\) “Type i matches Type j”;

-

\(\mathbbm {1}_{\{ i \mapsto j\}}\,\) “Type i imitates Type j”;

-

\(\mathbbm {1}_{\{ i \, \looparrowright \, j\}}\,\) “Type i exits and is replaced by Type j”.

With these definitions, we have that \(\lambda _U \mapsto \lambda _U+1/N\) in case the following (composite) event is realized:

Similarly, \(\lambda _U \mapsto \lambda _U-1/N\) when the following event is realized:

Summarizing,

Taking the expectation of such a random variable, we have

Generally speaking, \(\textsc {E}[\mathbbm {1}_{\{Event\}}]=Pr(Event)\). Therefore, we need to replace all the probabilities of the single events in the previous formula. To this end, note that

-

\(Pr({\{ i \leftrightarrow j\}})=2h\lambda _i\lambda _j/N\);

-

\(Pr({\{ i \mapsto j\}})=Pr(W_i\ge W_j)=p_{ij}\);

-

\(Pr(\mathbbm {1}_{\{ i \, \looparrowright \, j\}})={\mu \lambda _i}/{(3N)}\).

The latter is due to the fact the probability accounts for the simultaneous and independent exit of Type i (occurring with a probability of \(\mu \lambda _i/N\)) and the entry of Type j (occurring with a probability of 1/3). Substituting all the different probabilities in the previous formula, we obtain

Collecting the common terms, we obtain

By adding and subtracting \(\lambda _U\) from the last term and noting that \(p_{ij}=1-p_{ji}\), we have

which is equivalent to

Since this variation must be zero at the equilibrium, we obtain the equation in Eq. 8. The same rationale is applied to obtain the equations related to \(\lambda _I\) and \(\lambda _M\).\(\square \)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Gerotto, L., Pellizzari, P. & Tolotti, M. Fleeting extinction? Unraveling the persistence of noise traders in financial markets with learning and replacement. J Evol Econ 35, 355–379 (2025). https://doi.org/10.1007/s00191-025-00892-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-025-00892-y