Abstract

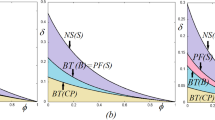

The new economic geography (NEG) aims to explain long-term patterns in the spatial allocation of industrial activities. It stresses that endogenous economic processes may enlarge small historic differences leading to quite different regional patterns—history matters for the long-term geographical distribution of economic activities. A pivotal element is that productive factors move to another region whenever the anticipated remuneration is higher in that region. Given the long-term nature of NEG analyses and the crucial role of expectations, it is astonishing that most of the existing models assume only naïve or myopic expectations. However, a recent stream of the literature in behavioral and experimental economics shows that agents often use expectational heuristics, such as trend extrapolating and trend reverting rules. We introduce such expectations formation hypotheses into a NEG model formulated in discrete time. This modification leads to a system of two nonlinear difference equations (corresponding, in the language of dynamical systems theory, to a 2-dimensional piecewise smooth map) and thus enriches the possible dynamic patterns: with trend extrapolating (reverting) the symmetric equilibrium is less (more) stable; and it may lose stability only via a flip bifurcation (or also via a Neimark–Sacker bifurcation) giving rise to a period-doubling cascade (or also to quasi-periodic orbits). In both cases, complex behavior is possible; multistability, that is, the coexistence of locally stable equilibria, is pervasive; and border-collision bifurcations are also allowed. In this sense, our analysis corroborates some of the basic insights of the NEG.

Similar content being viewed by others

Notes

Specifically, Ottaviano (2001) considers the original Krugman’s (1991a) CP model in which the mobile factor, labor, enters in the representative firm’s cost function both as a fixed and as a variable component; Baldwin’s (2001) footloose entrepreneurs (FE) model is an analytically solvable version of the CP model in which the mobile factor, entrepreneurs or human capital, enters in the cost function only as a fixed component. Oyama (2009a, b) extends Baldwin’s analysis to the case of an economy with two or more asymmetric regions (i.e. with different market sizes or degrees of trade openness).

In the case of two asymmetric regions, self-fulfilling prophecies may also re-direct the economy from one CP equilibrium to the other (see Oyama 2009a).

Compared to the standard CP model or to the FE model, the FC model is analytically much simpler. The mobile factor, physical capital, enters only as a fixed component in the cost function as in the FE model; moreover, shifting capital units from one region to the other does not alter the relative market size of the two regions as it occurs for the other two kinds of NEG models after workers or entrepreneurs migration.

Let us note that, strictly speaking, the equilibria \(P^{0}\) and \(P^{1}\) are one-side saddles whose stable sets are reached by some trajectories.

References

Agliari, A., Commendatore, P., Foroni, I., Kubin, I.: Border collision bifurcations in a footloose capital model with first nature firms. Comput. Econ. 38, 349–366 (2011)

Anufriev, M., Hommes, C.: Evolution of market heuristics. Knowl. Eng. Rev. 27(02), 255–271 (2012)

Anufriev, M., Hommes, C.: Evolutionary selection of individual expectations and aggregate outcomes in asset pricing experiments. Am. Econ. J. Microecon. 4(4), 35–64 (2012)

Baldwin, R.E.: Core-periphery model with forward-looking expectations. Reg. Sci. Urban Econ. 31, 21–49 (2001)

Baldwin, R.E., Forslid, R., Martin, P., Ottaviano, G.I.P., Robert-Nicoud, F.: Economic Geography and Public Policy. Princeton University Press, Princeton (2003)

Bao, T., Hommes, C., Sonnemans, J., Tuinstra, J.: Individual expectations, limited rationality and aggregate outcomes. J. Econ. Dyn. Control 36, 1101–1120 (2012)

Commendatore, P., Currie, M., Kubin, I.: Chaotic footloose capital. Nonlinear Dyn. Psychol. Life Sci. 11(2), 267–289 (2007)

Commendatore, P., Currie, M., Kubin, I.: Footloose entrepreneurs, taxes and subsidies. Spatial Econ. Anal. 3(1), 115–141 (2008)

Currie, M., Kubin, I.: Chaos in the core-periphery model. J. Econ. Behav. Organ. 60, 252–275 (2006)

Di Bernardo, M., Budd, C.J., Champneys, A.R., Kowalczyk, P.: Piecewise-Smooth Dynamical Systems. Theory and Applications. Springer, London (2008)

Foroni, I., Agliari, A.: Complex dynamics associated with the appearance/disappearance of invariant closed curves. Math. Comput. Simul. 81, 1640–1655 (2011)

Frankel, J.A., Froot, K.A.: Using survey data to test standard propositions regarding exchange rate expectations. Am. Econ. Rev. 77, 133–153 (1987a)

Frankel, J.A., Froot, K.A.: Short-term and long-term expectations of the Yen/Dollar exchange rate: evidence from survey data. J. Jpn. Int. Econ. 1, 249–274 (1987b) (also published as NBER working paper 2216, April 1987)

Frankel, J.A., Froot, K.A.: Chartists, Fundamentalists and the Demand for Dollars. In: Courakis, A.S., Taylor, M.P. (eds.) Private behaviour and government policy in interdependent economies, pp. 73–126. Oxford University Press, New York (1990a)

Frankel, J.A., Froot, K.A.: The rationality of the foreign exchange rate. AEA Papers and Proceedings, Chartists, Fundamentalists and Trading in the Foreign Exchange Market. American Economic Review, 80(2):181–185 (1990b)

Fujita, M., Krugman, P.R., Venables, A.: The Spatial Economy: Cities, Regions and International trade. The MIT Press, Cambridge (1999)

Fukao, J., Benabou, R.: History versus expectations: a comment. Q. J. Econ. 108(2), 535–542 (1993)

Gao, Y., Li, H.: A consolidated model of self-fulfilling expectations and self-destroying expectations in financial markets. J. Econ. Behav. Organ. 77(3), 368–381 (2011)

Heemeijer, P., Hommes, C.H., Sonnemans, J., Tuinstra, J.: Price stability and volatility in markets with positive and negative expectations feedback. J. Econ. Dyn. Control 33(5), 1052–1072 (2009)

Hommes, C.: Heterogeneous agent models in economics and finance, In: Tesfatsion, L., Judd, K.L. (eds.) Hand-Book of Computational Economics, Volume 2: Agent-Based Computational Economics. Elsevier Science B.V., pp. 1109–1186 (2006)

Hommes, C.: Bounded rationality and learning in complex markets. In: Barkley Rosser, Jr. J. (ed.) Handbook of Research on Complexity, pp. 87–123. Edward Elgar, Cheltenham (2009)

Hommes, C.: The heterogeneous expectations hypothesis: some evidence from the lab. J. Econ. Dyn. Control 35, 1–24 (2011)

Hommes, C.H., Sonnemans, J., Tuinstra, J., van de Velden, H.: Coordination of expectations in asset pricing experiments. Rev. Financial Stud. 18, 955–980 (2005)

Krugman, P.R.: Increasing returns and economic geography. J. Polit. Econ. 99(3), 483–499 (1991a)

Krugman, P.R.: History versus expectations. Q. J. Econ. 106(2), 651–667 (1991b)

Martin, P., Rogers, C.A.: Industrial location and public infrastructure. J. Int. Econ. 39, 335–351 (1995)

Matsuyama, K.: Increasing returns, industrialization and indeterminacy of equilibrium. Q. J. Econ. 106(2), 617–650 (1991)

Mira, C., Gardini, L., Barugola, A., Cathala, J.C.: Chaotic Dynamics in Two-Dimensional Noninvertible Maps. World Scientific, Singapore (1998)

Nusse, H.E., Yorke, J.A.: Border-collision bifurcations for piecewise smooth one dimensional maps. Int. J. Bifurcation Chaos 5(1), 189–207 (1995)

Nusse, H.E., Ott, E., Yorke, J.A.: Border-collision bifurcations: an explanation for observed bifurcation phenomena. Phys. Rev. E 49, 1073–1076 (1994)

Oyama, D.: History versus expectations in economic geography reconsidered. J. Econ. Dyn. Control 33, 394–408 (2009a)

Oyama, D.: Agglomeration under forward-looking expectations: potentials and global stability. Reg. Sci. Urban Econ. 39(6), 696–713 (2009b)

Ottaviano, G.I.P.: Monopolistic competition, trade, and endogenous spatial fluctuations. Reg. Sci. Urban Econ. 31, 51–77 (2001)

Sushko, I., Agliari, A., Gardini, L.: Bifurcation structure of parameter plane for a family of unimodal piecewise smooth maps: border-collision bifurcation curves. Chaos Soliton Fract. 29, 756–770 (2006)

Weibull, J.: Evolutionary Game Theory. The MIT Press, Cambridge (1995)

Zhusubaliyev, Z.T., Mosekilde, E.: Bifurcations and Chaos in Piecewise-Smooth Dynamical Systems. World Scientific, Singapore (2003)

Acknowledgments

The authors are grateful to the anonymous referees for their useful comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Agliari, A., Commendatore, P., Foroni, I. et al. Expectations and industry location: a discrete time dynamical analysis. Decisions Econ Finan 37, 3–26 (2014). https://doi.org/10.1007/s10203-012-0139-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-012-0139-1

Keywords

- New economic geography

- Expectations formation

- Footloose capital

- Piecewise smooth maps

- Border-collision bifurcations