Abstract

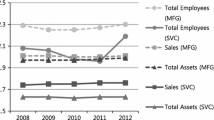

In this paper we model the firm size distribution (FSD) of Italian manufacturing firms of SCI, the GDP survey of ISTAT, by a continuous and a discrete distribution: the Pareto IV distribution on total assets and the Yule distribution on Number of Employees. The Pareto IV distribution is characterized by four parameters and shows a better fit than both the Lognormal and Pareto I, which are the distributions more frequently applied to model firm size. The Pareto IV is inconsistent with Gibrat’s Law according to which the different segments of an Industry are characterized by proportionate growth and the distribution of size is Lognormal. A truncation of the Yule distribution has been necessary because the dataset is characterized by firms with at least 20 employees. The truncated Yule distribution shows a good fit for medium–large firms (firms with more than 50 employees). The partition of the dataset in innovative and non-innovative firms – both of which are well described by the Pareto IV – reveals a beneficial effect of scale on innovation. Finally, the good fit of both distributions holds not only for the composite industry, but for the single sectors too.

Similar content being viewed by others

References

Arnold B (1983) Pareto Distributions. International Co-operative Publishing House, Fairland

Axtell R (2001) Zipf distribution of U.S. firm sizes. Science 293:1818–1820

Barca F (1985) Tendenze nella struttura dimensionale dell’industria italiana: una verifica empirica del ‘Modello di specializzazione flessibile. Politica Economica 1:71–109

Bartoloni E, Baussola M (2004) The persistence of profits, sectoral heterogeneity and innovation. Working papers of the Department of Economic and Social Sciences, Università Cattolica del Sacro Cuore of Piacenza, N. 16, Serie Rossa, Economia

Bell C, Klonner S (2005) Output, prices and the distribution of consumption in rural India. Agric Econ 33(1): 29–40

Bottazzi, G, Cefis E, Dosi G, Secchi A (2003) Invariances and diversities in the evolution of manufacturing industries. Koopmans Research Institute, Discussion Paper Series n.3 03–17, Utrecht University

Cabral LMB, Mata J (2003) On the evolution of the firm size distribution: facts and theory. Am Econ Rev 93(4):1075–1090

Chernoff H, Lehmann EL (1954) The use of maximum-likelihood estimates in χ 2 test for goodness-of-fit. Ann Math Statist 25:579–586

Clementi F, Gallegati M (2004) Pareto’s law of income distribution: evidence for Germany, the United Kingdom, and the United States, http://arxiv.org/PS_cache/cond-mat/pdf/0408/0408067.pdf

D’Agostino RB, Stephens MA (1986) Goodness-of-fit techniques. Marcel Dekker, New York

Dagum C (1977) A new model of personal income distribution: Specification and estimation. Economie Appliquée 30: 413–437

Dunne P, Hughes A (1994) Age, size, growth and Survival: U.K. Companies in the 1980’s. Ind Econ XLII:115–140

Evans DS (1987) Tests of alternative theories of firm growth. J Polit Econ 95(4):657–674

Fisher RA (1924) The conditions under which χ 2 measures the discrepancy between observation and hypothesis. J R Statist Soc 86:442–450

Ganugi P, Grossi L, Crosato L (2004) Firm size distribution and stochastic growth models: a comparison between ICT and mechanical Italian companies. Stat Methods Appl 12:391–414

Ganugi P, Grossi L, Gozzi G (2005) Testing Gibrat’s law in Italian macro-regions: analysis on a panel of mechanical companies statistical methods and applications 14(1):101–126

Gibrat R (1931) Les Inégalités Économiques. Librairie du Recueil Survey, Paris

Hall BH (1987) The Relationship between firm size and growth in the U.S. manufacturing sector. J Ind Econ 35(4):583–606

Hart PE, Prais SJ (1956) The analysis of business concentration: a statistical approach. J R Stat Soc Ser A. 119:150–191

Hart PE, Oulton N (1997) Zipf and the size distribution of firms. Applied Econ Lett 4(4):205–206

Hart PE, Oulton N (1999) Gibrat, Galton and job generation. Int J Econ Bus 6.2:149–164

Ijiri Y, Simon HA (1964) Interpretations of departures from the Pareto curve firm-size distributions. J Polit Econ 82:315–331

Ijiri Y, Simon HA (1977) Skew distributions and the sizes of business firms. North Holland, Amsterdam

Jovanovic B (1982) Selection and evolution of industry. Econometrica 50:649–670

Kalecki M (1945) On the Gibrat distribution. Econometrica 13:161–170

Kleiber C, Kotz S (2003) Statistical size distributions in economics and actuarial sciences. Wiley, New York

Mansfield E (1962) Entry, Gibrat’s Law, innovation, and the growth of firms. Am Econ Rev 52(5):1023–1051

Marsili O (2001) Stability and turbulence of the size distribution of firms: evidence from dutch manufacturing. Paper presented at the CAED’01 Conference, October 2001, Aarhus, Denmark

Marsili O, Salter A (2002) Is innovation democratic? Skewed distributions and the return to innovation in Dutch manufacturing. CEREM publications, Netherlands

Mood AM, Graybill FA, Boes DC (1974) Introduction to the theory of statistics, 3rd edn. McGraw-Hill, New York

Moore DS, Spruill MC (1975) Unified large-sample theory of general Chi-squared statistics for tests of fit. Ann Statist 3:599–616

Okuyama K, Takayasu M, Takayasu H (1999) Zipf’s law in income distribution of companies. Physica A269:125–131

Pareto V (1897), Cours d’Économie Politique. Rouge, Lausanne

Quandt RE (1966) On the size distribution of firms. Am Econ Rev 3:416–432

Reichstein T, Jensen MB (2003) Analysing the distributions of the stochastic firm approach, DRUID Working Paper, n 3.12

Santarelli E, Klomp L, Thurik R (2006) Gibrat’s Law: an overview of the empirical literature, in entrepreneurship, growth, and innovation: the dynamics of firms and industries. International studies in entrepreneurship. Santarelli (ed), Springer, Berlin Heidelberg New York, pp 41–73

Schmalensee R (1992) Inter-industry studies of structure and performance. In: Schmalensee R (ed) Handbook of industrial organization vol II. North Holland, Amsterdam, pp 951–100

Simon HA (1955) On a class of skew distribution functions. Biometrika 52:425–440

Simon HA, Bonini CP (1958) The size distribution of business firms. Am Econ Rev 48:607–617

Simon HA (1960) Some further notes on a class of skew distribution functions. Inform Control 3:80–88

Singh SK, Maddala GS (1975) A function for size distribution of incomes. Econometrica 44:963–970

Stanley MHR, Buldyrev SV, Havlin S, Mantegna RN, Salinger MA, Stanley HE (1995) Zipf Plot and the size distribution of firms. Econ Lett 49:453–457

Steindl J (1965) Random processes and the growth of firms. Griffin, London

Stoppa G (1990). A new model for income size distributions. In: Dagum C, Zenga M (eds). Income and wealth distribution, inequality and poverty: proceedings of the 2nd international conference on income distribution by size: generation, distribution, measurement and applications. Springer, Berlin Heidelberg New York, pp. 33–41

Sutton J (1997) Gibrat’s legacy. J Econ Lit 35:40–59

Voit J (2001) The growth dynamics of German business firms. Adv Complex Syst 4(1):149–162

Author information

Authors and Affiliations

Corresponding author

Additional information

The present work is part of a more general research project: “Industry evolution: innovation, profitability and firm’s growth”, conducted within the Department of Economic and Social Sciences of the Università Cattolica del Sacro Cuore (UCSC), Piacenza, coordinated by Professor Maurizio Baussola in cooperation with ISTAT (Italian Statistical Office, regional office for Lombardy). Part of this research was done when Lisa Crosato was a visiting research student at the LSE Statistics Department, during her Ph.D program in “Quantitative Models for Policy Analysis” at the UCSC of Piacenza.

Rights and permissions

About this article

Cite this article

Crosato, L., Ganugi, P. Statistical regularity of firm size distribution: the Pareto IV and truncated Yule for Italian SCI manufacturing. Stat. Meth. & Appl. 16, 85–115 (2007). https://doi.org/10.1007/s10260-006-0023-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10260-006-0023-7