Abstract

This paper studies the effects that connectivity and centralisation have on the response of interbank networks to external shocks that generate phenomena of default contagion. We run numerical simulations of contagion processes on randomly generated networks, characterised by different degrees of density and centralisation. Our main findings show that the degree of robustness-yet-fragility of a network grows progressively with both its degree of density or centralisation, although at different paces. We also find that sparse and decentralised interbank networks are generally resilient to small shocks, contrary to what so far believed. The degree of robustness-yet-fragility of an interbank network determines its propensity to generate a too-many-to-fail problem. We argue that medium levels of density and high levels of centralisation prevent the emergence of a too-many-to-fail issue for small and medium shocks whilst drastically creating the problem in the case of large shocks. Finally, our results shed some light on the actual robustness-yet-fragility of the observed core-periphery national interbank networks, highlighting the existing risk of systemic crises.

Similar content being viewed by others

1 Introduction and motivation

In this paper, we investigate the relation between the degrees of density and centralisation of interbank networksFootnote 1 and the scope of counterparty default contagion induced in these networks by exogenous shocks of different magnitude. Networks of interbank obligations arise in several contexts—such as payment systems, trading in risk-sharing assets (e.g. CDS, CDO, etc.), cross-holding of liquid positions meant to provide liquidity coinsurance, etc. While, on the one hand, these interbank claims stem from lucrative trading opportunities and risk-sharing activities, on the other hand, they become channels of direct balance-sheet contagion in case of bankruptcy of one or more banks.Footnote 2 The scale of the default cascade, if any, occurring in an interbank network following an insolvency shock depends on both the topology of the network and the magnitude of the shock. No network topology is the most resilient to all possible shocks. Densely connected interbank networks, and highly centralised ones, appear robust-yet-fragile to shocks. They are capable of absorbing small shocks, inducing no contagion at all, while they cause exhaustive systemic crises (complete default contagion) if hit by large enough shocks. Conversely, the decentralised and minimally connected ring networks display the opposite feature; they are vulnerable-yet-resilient to shocks.Footnote 3 Ring networks are exposed to episodes of contagion of limited scope if hit by small shocks, while they appear resilient to systemic crises, even in case of large shocks. These properties have been established, with analytical methods, for the stylised complete,Footnote 4 star and ring interbank networks.Footnote 5 The rationale of these results is that, in both the complete and the star networks, the losses that defaulting banks transmit to their creditors are evenly spread among all banks in the network. In this way, the capacity of each bank to absorb losses is fully exploited; hence either all banks survive, or they all default together in the wake of a shock. The opposite occurs in ring networks, in which the losses coming from the default of a bank are borne directly by its sole creditor neighbour.

The robustness-yet-fragility of complete and star networks, and the vulnerability-yet-resiliency of ring networks, are formally revealed by their contagions thresholds. The contagion threshold associated with an episode of contagion is the magnitude of the smallest exogenous shock that causes that contagion.Footnote 6 The first contagion threshold of an interbank network, for instance, is equal to the value of the smallest external shock capable of generating a secondary default, i.e. the bankruptcy of a bank that is not hit by the exogenous shock directly and defaults because of the losses received by its defaulting neighbours. The second contagion threshold is the smallest shock capable of inducing two secondary defaults, and so on up to the final threshold of contagion. The latter is the value of the smallest shock capable of causing the default of all banks in the network. Both complete networks and star networks (when the centre bank is in default) have a unique contagion threshold, i.e. their first and last contagion thresholds coincide. Conversely, ring networks display a large gap between the first and the last contagion threshold.

The responses to shocks of complete and star networks suggest that the effects that connectivity and centralisation have on such stylised networks are also present in more generic interbank networks. We run numerical simulations to investigate the extent to which the robust-yet-fragile behaviour of an interbank network emerges and grows as we progressively increase its degree of connectivity or centralisation. We test the effects of connectivity by simulating contagion processes on a set of randomly generated regular networks, with null centralisation, obtained starting from a ring network and progressively adding links to it up to a complete network configuration. To look at the effects of centralisation, we similarly build another set of networks; starting again from a ring network, we progressively transform it into a star network, keeping its connectivity at the minimum. We then perturb each of these network configurations with the entire range of possible exogenous shocks, starting from the smallest possible one (the value of a single asset held by a bank) to the largest one, i.e. the entire external assetsFootnote 7 of the network as a whole. In so doing, we record the values taken on by the sequence of contagion thresholds, that is, the values of the progressively larger shocks that cause progressively larger clusters of secondary defaults in the networks at hand. Finally, we evaluate the degree of robustness-yet-fragility of the networks using two measures of the obtained distributions of their contagion thresholds: the gap between the first and the last thresholds and the dispersion of the distribution of the thresholds. The smaller the gap between first and last contagion thresholds and the more concentrated the distribution of the thresholds, the more the network is robust-yet-fragile to shocks. The results we obtain show that the robustness-yet-fragility of interbank networks grows in a markedly progressive fashion both with density and with centralisation, but at rather different paces.

The contextual occurrence of clusters of banks’ defaults can create the known ‘too-many-to-fail’ problem. When the number of jointly failing banks is significant, authorities cannot allow liquidations or arrange bail-ins, and costly public bail-out’s become unavoidable and foreseeable. The predisposition of an interbank network to cause a ‘too-many-to-fail’ problem through direct contagion, under different shock scenarios, depends on its degree of robustness-yet-fragility. The latter determines the amplification of the defaults, if any, due to contagion following a shock. If the scope of contagion—i.e., the number of secondary defaults—is sufficiently large with respect to the ‘seeds’ of contagion—the primary defaults—then the authorities face a ‘too-many-to-fail’ problem. The amplification in the number of defaulting banks forces the authorities to prevent contagion, bailing out the banks directly hit by the exogenous shock (primary defaults). We use the ratio between the secondary and primary defaults obtained in our simulations to measure the increase in bankruptcies due to contagion in different network configurations and shocks. Looking at this ratio, we shed some light on the conditions under which direct contagion in interbank networks can generate a ‘too-many-to-fail’ situation depending on their degrees of connectivity and centralisation.

Finally, our results shed some light on the actual degree of robustness-yet-fragility of the cores of the observed core-periphery interbank networks formed by national banking systems. According to several empirical estimates, the latter resemble regular networks with medium/high density. Our simulations show that such a density is sufficient to render the observed cores highly robust-yet-fragile. We discuss the policy implications that stem from this finding.

Our contribution presents some novelties with respect to the existing literature on financial contagion in interbank networks. We are the first to evaluate the degree of robustness-yet-fragility of interbank networks and, in so doing, we are the first to run simulations of contagion processes that control for all possible magnitudes of an exogenous shock. Second, we are among the first who investigate the effects that different degrees of centralisation of interbank networks have on their exposure to contagion. Third, our results shed some light on the vulnerable-yet-resilient response to shocks of bilateral ring networks and of sparse regular networks, an issue so far neglected in the literature.Footnote 8 Moreover, we are among the first to look at the too-many-to-fail issue from the viewpoint of counterparty contagion, whereas most of the literature focused so far on the strategic choice of portfolio similarities, on the part of banks, that can increase the likelihood of public bail-outs.

The paper is organised as follows. In the next section, we review of the literature related to the present work. In Sect. 3, we introduce the network model used in this paper and describe the analytic results concerning the contagion thresholds of complete, star and ring financial networks. In Sect. 4 we present the methodology and the results of the numerical simulations that we run to investigate the relation between the degree of connectivity and centralization of interbank networks and their degree of robustness-yet-fragility. Section 5 discusses the ‘too-many-to-fail’ issue arising from interbank financial obligations and its relation with the robustness-yet-fragility property of interbank networks. In Sect. 6, we consider the robustness-yet-fragility of the national core-periphery banking networks and discuss some policy implications. Conclusions are drawn in Sect. 7.

2 Related literature

The present paper is related to the many works on systemic risk in financial networks that consider the effects that the density of a network has on the dynamics of contagion. The early literature on financial contagion achieved contrasting results on this issue. Allen and Gale (2000) argue that a complete interbank network is more robust than an incomplete network, i.e., a network in which not all banks are directly connected. Similarly, Freixas et al. (2000) show that diversified lending in the interbank market (that generates a densely connected network) renders the system more resilient to shocks and less exposed to ‘market discipline’, which is the failure of a bank that would be insolvent without interbank lending. Giesecke and Weber (2006) also find that the higher the density of a network, the smaller the risk of contagion. Conversely, Brusco and Castiglionesi (2007) achieve opposite results. These authors argue that the complete network structure bears the largest risk of contagion, while an incomplete cycle-shaped structure increases the banking system’s stability. Nier et al. (2007) run numerical simulations of contagion scenarios varying the connectivity of a network and find a non-monotonic effect of density on contagion. They obtain an ‘M-shaped’ curve of bankruptcies: for low levels of connectivity, contagion increases as density increases, then contagion decreases for high levels of connectivity. Lorenz et al. (2009) obtain the opposite result; they show that the scope of contagion is minimal when the level of density is intermediate.

The main limitation of these early contributions lies in the fact that they did not control for the possibility that the response of a network to a shock can depend on the size of the shock. Andrew Haldane was the first to raise this issue, with his known conjecture: “[...] interconnected networks exhibit a knife-edge, or tipping point, property. Within a certain range, connections serve as a shock-absorber. The system acts as a mutual insurance device with disturbances dispersed and dissipated. Connectivity engenders robustness. Risk-sharing—diversification—prevails. But beyond a certain range, the system can flip the wrong side of the knife-edge. Interconnections serve as shock-amplifiers, not dampeners, as losses cascade. The system acts not as a mutual insurance device but as a mutual incendiary device. Risk-spreading—fragility—prevails.” [Haldane (2009), page 5]. Ladley (2013) is the first to embed this view in a numerical investigation of contagion in interbank networks. The author finds that the ‘optimal’ degree of connectivity, i.e. the one that minimises contagion, varies with shock size. As the author says: “For small shocks a more highly connected market reduces bankruptcies, limiting the spread of contagion by spreading the impact of failures. In contrast for larger shocks the pattern is reversed, more sparsely connected markets are less susceptible to contagion. For intermediate shock sizes, moderately connected markets may be the most vulnerable.” [Ladley (2013), page 1398]. This author evaluates the contagious effects of a limited range of exogenous shocks, i.e. from 0.01 to 0.17 probability of failure of each project (asset) funded by the banks in the network. In this respect, our work is different; our simulations take into account all possible values that an exogenous solvency shock can take on. Nonetheless, our results resonate with the ones obtained by Ladley (2013).Footnote 9

Haldane’s conjecture about the robust-yet-fragile nature of highly dense networks has been proved by Acemoglu et al. (2013, 2015a, b) and Eboli (2019) with analytical methods. These authors show that a complete network has a phase-transition point: for shocks of magnitude up to a certain threshold, this type of network is capable to absorb the shock inducing no default contagion at all while, for shocks larger that such a threshold, all the banks in this network go bankrupt together. These authors also show that ring networks behave in the opposite way. They are vulnerable with respect to episodes of local contagion, caused by relatively small shocks, while they are less exposed than complete networks to the risk of a complete system melt down. Similar results are obtained by Cabrales et al. (2017), who compare the stability of network structures composed of completely connected components or, alternatively, ring components.

While the effects of connectivity on contagion have been largely studied, the same cannot be said about the effects of the degree of centralisation of a financial network on its exposure to systemic risk. Eboli (2019) and Castiglionesi and Eboli (2018) show that star networks also display robust-yet-fragile behaviour in response to exogenous shocks.

The present paper is the first to study the contagiousness of interbank networks with varying degrees of centralisation, investigating the effects of the transition from the vulnerable-yet-resilient ring networks to the robust-yet-fragile star networks. The only other paper that uses numerical simulations to evaluate the stability of networks with different degrees of centralisation is Gofman (2017). This author studies efficiency and stability of core-periphery interbank networks with (seven) different degrees of the centrality of the core banks, i.e. with caps to the number of peripheral banks that can be connected to a single core bank.Footnote 10 The author finds that as the core-periphery connections of core banks are progressively limited, a core-periphery network becomes more stable at first and then rapidly less stable.

3 The interbank network and its contagion thresholds

This section presents the interbank network model that we use in our experiments and the analytic results concerning the contagion thresholds of complete, star and ring networks.

3.1 The interbank network and the contagion process

As is customary, we model an interbank network as a connected, directed and weighted graph \(N:=(\Omega ,\Lambda ),\) where the node \(\omega _{i}(i=1,2,...,n)\) in \(\Omega \) represents a bank and the links in \(\Lambda \subseteq \Omega ^{2}\) represent the interbank deposits that connect the members of \(\Omega \) among themselves. The liabilities of a bank \(\omega _{i} \) in \(\Omega \) comprise customers (households) deposits, \(h_{i,}\) interbank deposits, \(d_{i}=\sum \nolimits _{j}d_{ij},\) where \(d_{ij}\) is the sum that bank \(\omega _{i}\) owes to bank \(\omega _{j}\), and its own equity \( e_{i}\). On the asset side, a bank \(\omega _{i}\) holds long-term assets, \( a_{i}\), which are liabilities of agents that do not belong to \(\Omega \), and interbank deposits \(c_{i}=\sum \nolimits _{j}c_{ij}\). The budget identity of a bank is: \(a_{i}+c_{i}=h_{i}+d_{i}+e_{i}\). A link \(l_{ij}\in \Lambda \) represents the interbank obligations, and its direction goes from the debtor bank \(\omega _{i}\) to the creditor bank \(\omega _{j}\). The weight of the link \(l_{ij}\) is equal to the amount of money \(c_{ji}\) that bank \(\omega _{j} \) has deposited in bank \(\omega _{i}.\)

To model the process of financial contagion in an interbank network, we perturb the network with an exogenous shock that consists of a loss of value of some of the external exposures \(a_{i}.\) Let \(\delta _{i}\in [0,1]\) be a parameter that measures the fraction of the value of the asset \(a_{i}\) which is lost upon the occurrence of shock. If \(\delta _{i}>0,\) then the bank \(\omega _{i}\) suffers a loss equal to \(\delta _{i}a_{i}\). An exogenous shock is a vector of scalars \([\delta _{i}a_{i}],i\in \Omega \), where at least one \(\delta _{i}>0\), and its magnitude is \(\sigma =\sum \nolimits _{\Omega }\delta _{i}a_{i}\).

The propagation across N of the losses caused by an exogenous shock is governed by the rules of limited liability, debt priority and pro-rata reimbursement of creditors. When a bank suffers a loss, this loss is first absorbed by its net worth \(e_{i}\). Only the residual loss, if any, is passed over to its creditors. The losses that are offset by the equity of the banks in \(\Omega \) are born by households, in their capacity as shareholders. This property is represented by an absorption function

associated to each bank in \(\Omega ,\)where \(\lambda _{i}\) is the total loss born by the i-th bank, received from source nodes and/or from other banks in \(\Omega \). The variable \(\beta _{i}\in \left( 0,1\right) \) measures the share of net worth lost by a bank. If a bank \(\omega _{i}\) receives a positive flow of losses, it absorbs an amount of losses equal to \(\beta _{i}e_{i}\).

If the loss \(\lambda _{i}\) suffered by \(\omega _{i}\) is larger than its net worth, i.e. larger than its absorption capacity, then this bank is insolvent and sends the residual loss, \(\lambda _{i}-e_{i}\), to its creditors. For each bank in \(\Omega \), let

be its loss-given-default function. The variable \(b_{i}\in [0,1]\) measures the fraction of the i-th bank’s debt that is not recovered through liquidation, i.e., the loss-given-default ratio. It is equal to zero if the i-th bank is solvent, while it assumes a strictly positive value if the bank defaults. In this case, the assets of the insolvent bank are liquidated and its creditors get a pro-rata refund. When the i-th bank defaults, households receive a loss equal to \( b_{i}h_{i}\), while a bank \(\omega _{j}\) which is a creditor of bank \(\omega _{i}\) receives from the latter a loss equal to \(b_{i}d_{ij}.\) The loss \( \lambda _{i}\) born by a bank in \(\Omega \) is the sum of the losses, if any, received through its external and internal exposures:

Upon the occurrence of a shock, a flow of losses enters into the system. The above-defined absorption and loss-given-default functions map the propagation of these losses across the network by assigning a positive amount of losses to each link in N. In so doing, they define the contagion function in N, i.e. the mapping that associates to an external shock \(\sigma \) the consequent propagation of losses and defaults across N. Formally, a contagion in a network N is a map \( f:(L^{\Omega },L^{A},L^{T},L^{H})\rightarrow \mathbb {R} ^{+}\) such that: \(f(l_{i}^{k})=b^{k}a_{i}^{k},\) \(f(l_{ij})=b_{i}d_{ij},\) \( f(l_{H}^{i})=b_{i}h_{i},\) \(f(l_{T}^{i})=\beta _{i}e_{i}\).

In our numerical simulations, we compute f with the following algorithm. Let us add a superscript \(t=1,2,3,...\) to the variables involved in the computation—namely \(\lambda _{i}^{t},b_{i}^{t},\beta _{i}^{t}\)—to indicate the value taken on by these variables at each iteration of the algorithm. Let

be the vector of the losses born by the banks in \(\Omega \) and let \(\Omega ^{-}=\left\{ \omega _{i}|\lambda _{i}-e_{i}>0\right\} \) be the set of defaulting banks, if any. Then:

-

1.

For a given value assignment of the vector \([\delta _{i}]\), compute \( [\lambda _{i}^{t}]=\left[ \delta _{i}a_{i}\right] +\left[ b_{j}^{t-1}\right] \left[ d_{ji}\right] \), starting with \(t=1\) and setting \(b_{j}^{0}=0;\)

-

2.

compute \([\beta _{i}^{t}]=[\beta _{i}(\lambda _{i}^{t})]\) and \( [b_{i}^{t}]=[b_{i}(\lambda _{i}^{t})]\) according to (1) and (2);

-

3.

if \(\sum _{\Omega }\beta _{i}^{t}e_{i}+\sum _{\Omega }b_{i}^{t}h_{i}<\sum _{\Omega }\delta _{i}a_{i}\) , then start again from point 1; if \(\sum _{\Omega }\beta _{i}^{t}e_{i}+\sum _{\Omega }b_{i}^{t}h_{i}=\sum _{\Omega }\delta _{i}a_{i}\), then compute \(|\Omega ^{-}|\) and stop.

The algorithm stops when the amount of losses endured (absorbed) by shareholders and debtholders of defaulting banks equals the value of the initial shock. It is so because we have neither bankruptcy costs nor fire sales of assets in our model, i.e. no further injections of losses into the network beyond the exogenous shock. Consequently, the circulation of losses among the banks in N stops when the shock \(\sigma \) is absorbed entirely by the portfolios of debtholders and final claimants of the banks in N.

For our purposes, we distinguish the defaulting banks in \(\Omega ^{-}\) in two groups. We call primary defaults the banks that default because of the exogenous loss of value of their assets \(a_{i}\), i.e. the banks in the set \(\Omega _{p}^{-}=\left\{ \omega _{i}|\delta a_{i}-e_{i}>0\right\} .\) We call secondary defaults the banks that default because of the endogenous loss of value of their intra-network assets \(c_{i}\), i.e. the banks in the set \(\Omega _{s}^{-}=\Omega ^{-}\backslash \Omega _{p}^{-}\).

Formally, given an interbank network N and an episode of contagion in N, defined as a non empty set of secondary defaults \(\Omega _{s}^{-}\), the corresponding contagion threshold is the smallest exogenous shock \( \sigma \) that is capable of causing this set of secondary defaults.

3.2 First and final contagion thresholds of complete, star and ring networks

We now briefly present a set of analytic results that establish the robust-yet-fragile nature of complete and star networks and the vulnerable-yet-resilient nature of circular networks.Footnote 11

In a complete interbank network, each bank places a deposit in every other bank: \(\Lambda ^{c}=\left\{ l_{ij}|i\ne j;i,j=1,...,n\right\} .\) Let \(N^{c}=\left\{ \Omega ,\Lambda ^{c}\right\} \) be a complete interbank network where all the links in \(\Lambda ^{c}\) have the same weight \(d_{ij}\). In other words, each bank in \(N^{c}\) receives interbank deposits equal to \( d_{ij}\) form each other bank in the network, and evenly allocates its own interbank deposits among all other banks in the network. We have that in a complete network \(N^{c}\) the first threshold and the final threshold of contagion coincide and are equal to

where \(E=\sum \nolimits _{i=1}^{n}e_{i}\) is the total equity of the banks in \( \Omega ,\) and \(\phi =d_{i}/h_{i}\) is the ratio between the interbank debt and the external debt of a bank. This result shows that the complete network, on one hand, is entirely resilient to relatively small shocks, i.e. faces no defaults for shocks smaller than \(\tau ^{c}\). On the other hand, for large enough shocks—larger than or equal to \(\tau ^{c}\)—this network induces a complete system melt down. The same principle applies to the star network, as we now show.

A star interbank network consists of a centre bank, \(\omega _{c},\) that places a deposit in each of the \(n-1\) peripheral banks which, in turn, place their deposits in \(\omega _{c}\) and exchange no deposits among themselves. Let \(N^{s}=\left\{ \Omega ,\Lambda ^{s}\right\} \) be a star interbank network, i.e. \(\Lambda ^{s}=\left\{ l_{ic},l_{ci}|i\in \Omega \backslash \omega _{c}\right\} \), in which all links in \(\Lambda ^{s}\) have the same weight, i.e., \(d_{cp}=d_{pc}=d_{p}\). Let \(e_{c}\) and \(e_{p}\) be the amount of equity, and \(h_{c}\) and \(h_{p}\) be the amount of customer deposits, held by the centre bank and a peripheral bank, respectively. In this network, the contagion thresholds depend on how the exogenous shock is allocated between the centre and the periphery of the network. We have three possible cases:

-

(1)

the shock is idiosyncratic and hits only the centre bank \(\omega _{c}\). In this case, the first and the final thresholds of a star network \(N^{s}\) coincide and are equal to:

$$\begin{aligned} \tau ^{s}=(n-1)e_{p}+e_{c}+e_{p}\frac{h_{c}}{d_{p}}=E+e_{p}\frac{h_{c}}{d_{p} }\text {.} \end{aligned}$$(4) -

(2)

the shock \(\sigma \) is borne by \(\omega _{c},\) for an amount \(\sigma _{c}< \) \(\tau ^{s},\) and by some peripheral nodes. Also in this case the first and the final thresholds of the network at hand coincide and are equal to:

$$\begin{aligned} \widetilde{\tau }^{s}&=\left[ (n-1)e_{p}+e_{c}+e_{p}\frac{h_{c}}{d_{p}}\right] \left( 1+\frac{h_{p}}{d_{p}}\right) -\sigma _{c}\frac{h_{p}}{d_{p}}\nonumber \\&=\tau ^{s}+(\tau ^{s}-\sigma _{c})\frac{h_{p}}{d_{p}}=\tau ^{s}\left( 1+\frac{1}{ \phi }\right) -\sigma _{c}\frac{1}{\phi }\text {.} \end{aligned}$$(5) -

(3)

the shock is borne by peripheral nodes only. In this case, the first and the final thresholds of contagion in a star network \(N^{s}\) are, respectively, equal to

$$\begin{aligned} \tau _{1}^{s}=me_{p}+e_{c}\left( 1+\frac{1}{\phi }\right) \end{aligned}$$(6)where m is the minimum number of peripheral defaults capable of inducing the default of the centre bank,Footnote 12 and

$$\begin{aligned} \tau _{2}^{s}=\tau _{f}^{s}=\left[ (n-1)e_{p}+e_{c}+e_{p}\frac{h_{c}}{d_{p}} \right] \left( 1+\frac{h_{p}}{d_{p}}\right) =\tau ^{s}\left( 1+\frac{1}{\phi }\right) \text {.} \end{aligned}$$(7)Note that, in this case, the second contagion threshold (i.e. the smallest shock, larger than \(\tau _{1}^{s},\) that can cause further defaults) is equal to the final threshold. Thus, in this network, the first and final contagion thresholds coincide, if the centre bank is in the set of primary defaults. In the opposite case, the second and the final thresholds coincide. Of course, this implies that all other intermediate contagion thresholds are equal to the final one.

The first contagion threshold shows that a small shock, \(\sigma \ge \tau _{1}^{s},\) is sufficient to induce the default of the centre bank, \(\omega _{c}\). Thus, a star network is exposed to a limited default contagion for relatively small shocks borne by the peripheral banks. On the other hand, \( N^{s}\) has a robust-yet-fragile response to large shocks. During a contagion process, the centre bank in \(N^{s}\) acts as a hub and distributes losses among the peripheral banks in an even fashion. Hence, either all the peripheral banks default together—if \(\sigma \) is larger than or equal to \( \tau ^{s}\), \(\widetilde{\tau }^{s}\) or \(\tau _{2}^{s}\)—or all the peripheral banks, that are not in the set of primary defaults, remain solvent.

The response to external shocks of a ring network is rather different from the ones displayed by complete and star networks. In a ring network (also known as a unilateral circle or wheel), each bank is linked to one creditor and one debtor bank. A ring network is formed by a chain of obligations that forms a closed path in which the start node and the final node are the same. Formally, a ring network \(N^{o}=\left\{ \Omega ,\Lambda ^{o}\right\} \) is such that \(L^{\Omega }=\left\{ l_{ij}|i=1,2,...,n;\ j=i+1\right. \ \) for \( i=1,...,n-1\), and \(j=1\) for \(\left. i=n\right\} .\) The ring network has an entire range of final thresholds of contagion because the latter depend on the allocation of external shocks among the banks in the network. Due to problems of tractability, only the smallest and the largest possible final thresholds of this network can be characterised, besides its first threshold of contagion. We have that, in a ring network \(N^{o},\) (i) the first threshold of contagion is equal to

whereas (ii) the smallest possible final threshold is equal to

and (iii) the largest possible final threshold is equal to

The integer k is the largest number of defaults that an idiosyncratic shock hitting a bank \(\omega _{i}\) in \(N^{o}\), i.e. \(\sigma =a_{i}\), generates in this network.Footnote 13 The worst case scenario, i.e. the smallest possible final contagion threshold in \(N^{o},\) is achieved when the primary defaults—the seeds of contagion—are disposed along the ring at regular intervals of length k. This disposition maximises the scope of contagion of each single primary default. If this most contagious disposition of primary defaults occurs, n/k primary defaults are sufficient to induce the default of all other banks in the network.Footnote 14

The integer \(\widehat{k}-1\), in turn, is the largest number of secondary defaults induced in \(N^{o}\) by a chain (of any length) of primary defaults.Footnote 15 This best case scenario, i.e. the largest possible final contagion threshold in \(N^{o}\), occurs when the primary defaults form an uninterrupted sequence (a chain) along the ring network. \(\widehat{k}-1\) is the largest possible number of secondary defaults induced by this type of shock, independently of the length of the chain of primary defaults. In this scenario, the cardinality of the set of primary defaults must be \(n-\widehat{ k}+1\) to induce the default of the remaining \(\widehat{k}-1\) banks.Footnote 16

Concerning large shocks, the ring is the most resilient network among the three considered here. We have the following ranking in terms of final thresholds: \(\tau ^{s}\le \tau ^{c}\approx \widetilde{\tau }^{s}<\tau _{f}^{s}<\tau _{f}^{o}<\widehat{\tau }_{f}^{o}\). That is, both the smallest and the largest final contagion threshold of \(N^{o}\) are larger than the final thresholds of the complete and the star networks. Therefore, a ring network is vulnerable-yet-resilient in as much as it is exposed to episodes of local contagion if hit by relatively small shocks while being less exposed than the star and the complete networks to the risk of a complete system meltdown. Finally, it is worth remarking that the gap between the minimum and the maximum possible final threshold of a ring network is far from negligible and is growing in n. In other words, the analytic results do not help much in predicting the average magnitude of the final threshold of a ring network. Moreover, these results refer to the ring network only, i.e. the unilateral circle in which each bank is connected to its neighbours by one incoming link and one outgoing link. No analytic results are available for the bilateral circle, in which each bank cross-holds liquid positions with both its neighbours. Thus, the numerical simulations on ring networks that we present shed light on the expected response of these networks to a randomly allocated exogenous shock and their exposure to the risk of a systemic crisis.Footnote 17

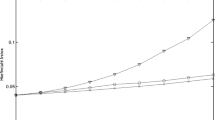

4 The numerical simulations

The analytic results presented in the previous section lead us to conjecture that the robust-yet-fragile feature arises in an interbank network to the extent that it depends on its degrees of density and centralisation. To characterise the scope of a network’s robust-yet-fragile response to shocks, we look at its contagion thresholds. Indeed, the degree of robustness-yet-fragility of a network depends on the distribution of its contagion thresholds. As discussed in Sects. 4.1 and 4.2—and shown in 2, 5 and 8—the more the distribution of the contagion thresholds is concentrated around a mean, the more robust-yet-fragile the network. Equally, the more dispersed such distribution, the more vulnerable-yet-resilient the network is. In our numerical experiments, we run a set of Monte Carlo simulations \(\mathcal {M}\) for each network configuration and record all the contagion thresholds obtained with progressively increasing shocks, from first to last. Then, we consider two measures of the dispersion of the thresholds’ distribution for our purposes. First, we measure the mean gap between the first and the last contagion thresholds as follows:

The cardinality of the simulation set \(|\mathcal {M}|\) indicates the numbers of simulation runs per network configuration, while \((\tau _{f})_{i}-(\tau _{1})_{i}\) is the threshold gap for the i-th simulation run. Second, we survey the (weighted) standard deviation of the dispersion of the distributions. The smaller the gap \(gap_{\tau }\) and the smaller the standard deviation of thresholds obtained with a network configuration, the more the network is robust-yet-fragile with respect to shocks.

To investigate these properties of financial networks in a neat fashion, we isolate the effects of connectivity from the effects of centralisation and run two separate experiments. In the first experiment, we simulate processes of default contagion in networks with different degrees of connectivity, keeping the centralisation of these networks at its minimum, i.e. zero. That is, we explore the response to shocks of the class of regular networks, starting from the least dense one, the ring, and progressively moving towards the densest member of this class, the complete network. In the second set of experiments, we simulate default contagion in networks with different degrees of centralisation, keeping the density of these network at its minimum. In this case, we record the behaviour of the contagion thresholds as we progressively transform a ring network into a star network while keeping constant (and minimal) the number of links in the networks.

We use a simulation engine specifically developed for the experiments at hand.Footnote 18 The engine performs two distinct tasks. First, it randomly generates interbank networks according to a set of parameters that define: (i) the balance-sheet values of the banks in the network, in particular, the capitalisation ratio, \(\varepsilon \) \( =e_{i}/(a_{i}+c_{i})\); and the ratio between the intra-network and the external liabilities of a bank, i.e. \(\phi =d_{i}/h_{i}\); and (ii) the set of weighted links that connect the banks, i.e. the topology of the networks. Second, the engine perturbs the randomly generated networks with an increasing exogenous shock and records the defaults induced in each network by each magnitude of the shock. We run the experiments with networks composed of 64 banks. In all experiments we set the capitalisation ratio \( \varepsilon \) equal to 0, 1, while we run simulations with four different values of the ratio \(\phi \)-namely 0.2; 0.4; 0.6 and 0.8.Footnote 19

4.1 The connectivity experiment

In this experiment, we test the effects of different degrees of density of a network on its response to solvency shocks. To model increasing density, we start from a ring network \(N^{o}\) and progressively transform it into a complete network \(N^{c}\). The former has the lowest degree of connectivity in the class of regular and connected networks—n links connecting n nodes—while the latter is the densest network, with \(n(n-1)\) links for n nodes. This transformation is done in 63 steps. At each step, the simulation engine increases of one unit the in-degree and the out-degree of each bank in the network, adding n links to it and keeping it regular.Footnote 20 In so doing, we ensured that the centralisation of the randomly generated networks is kept null.Footnote 21 Then the simulation engine proceeds with the random allocation, among the sixty-four banks, of a progressively increasing number of solvency shocks. This is done by randomly setting to zero the value of the external assets held by a bank, two banks, three banks and so forth up to the entire stock of external assets held by the network as a whole. In other words, in each simulation, the engine randomly selects a set of primary defaults and progressively increases the cardinality of this set of one unit, from 1 to 64. To obtain a sufficiently large sample, the engine produces 1000 different seeds of random shocks for each pair (network configuration, shock magnitude). The results shown here and in the rest of this section are obtained setting \(\phi =0.4\). Figure 1a depicts the distribution, yielded by this procedure, of the first and final contagion thresholds of the 64 network configurations.Footnote 22

The vertical axe of Fig. 1a measures the magnitude of the shock in terms of percentage of the total external assets A. The horizontal axe reports the 63 steps of the transformation from ring (first column) to complete networks (last column). The first column shows that the range of final contagion thresholds of the ring network lies well above the unique contagion threshold of the complete network (where the latter corresponds to 30 primary defaults). In the case at hand, with \( \varepsilon =0.1\) and \(\phi =0.4\), we have \(k=2\) and \(\tau _{f}^{o}=a_{i}\cdot n/2\), which means that the smallest final threshold of the ring network corresponds to 32 primary defaults. In this experiment such a lower bound is never achieved and the median final contagion threshold of the ring corresponds to 58 primary defaults out of 64 banks. This finding reinforces the conclusion drawn on the basis of the analytic results shown in Sect. 3: the ring network is indeed highly resilient to large shocks.

Figure 1a shows that the first and final thresholds of contagion converge in a neatly progressive fashion as the density of the networks increases. The gap between these two thresholds (Fig. 1b), computed as in Eq. (11), diminishes rapidly in the low range of density, as the in-degree and out-degree of the nodes in the networks grow from 1 to 20 (out of a maximum of 63). Conversely, the gap declines at a slow pace in the medium and high range of density. This shows that the robust-yet-fragile response to shocks of a regular network becomes noticeable starting from medium levels of connectivity.

We now look at the distribution of all the contagion thresholds, from first to final, of the randomly generated networks. Figure 2 shows in three dimensions the distribution of the (average) increments in secondary defaults induced by an increment of the exogenous shock, for each network configuration. On the horizontal axes we have the magnitude of the shock (number of primary defaults) and the steps of the transformation of the ring network into the complete one, steps corresponding to 64 different degrees of connectivity. The vertical axe measures the growth of the scope of contagion (in terms of average number of secondary defaults), if any, generated in correspondence to a pair (shock, configuration). In other words, the vertical coordinate measures the marginal contribution to default contagion that a given shock yields in a given network configuration. Thus, the figure plots the distribution of the contagion thresholds for each network configuration, starting from the ring network (degree of connectivity 1) to the complete network (degree of connectivity 64).

The information contained in this plot is best explained taking the first network configuration, the ring, as an example. The plot of its contagion thresholds appears as a straight line, with a negative slope, that starts from a vertical coordinate equal to one. The rationale for this result is the following. In the ring network, with \(\phi =0.4\), all random shocks consisting of a single primary default induce one secondary default. Shocks composed of two random primary defaults not adjacent to one another generate two secondary defaults. Conversely, these shocks yield just one secondary default if the two primary defaults are adjacent.Footnote 23 Thus, the average growth of secondary defaults, obtained by enlarging the cardinality of the random sets of primary defaults from one to two, is smaller than unity. This average growth is the value of the vertical coordinate of the pair (shock 2, configuration 1). Similarly, shocks consisting of three primary defaults induce three secondary defaults only if the random primary defaults do not happen to be adjacent; otherwise, they induce just one secondary default. Hence, the average increment of secondary defaults obtained perturbing the ring network with shocks of size three is smaller than the one obtained with shocks of size two. By the same token, in the case at hand, progressive augments of the shock size deliver progressively smaller increments in the scope of contagion. This response to shocks, however, is a peculiarity of the unilateral ring networks. We shall see in Sects. 4.2.1 (Fig. 5) and 4.2.2 (Fig. 8) that bilateral circular networks behave like the second configuration in Fig. 2, i.e. they display the more general hill-shaped distribution of thresholds. Moreover, and most importantly, Fig. 2 displays a clear and progressive reduction of the dispersion of contagion thresholds associated with the growing degrees of density of the networks. Figure 3 shows the standard deviation of the contagion thresholds obtained with each configuration of the networks.

The growth of the density of the networks progressively reduces the dispersion of their contagion thresholds; the latter become closer to one another and finally all collapse on the value of the single contagion threshold of the complete network, \(N^{c}\). As for the gap between the first and final thresholds, the plot is convex and decreases markedly in correspondence of the initial, low levels of connectivity. Most of the reduction of the standard deviation of the contagion thresholds occurs as the degree of the banks in the networks grows from 1 to 30 (out of a maximum of 63).

4.2 The centralisation experiment

In this section, we present simulations of the response to solvency shocks of networks characterised by different degrees of centralisation. In this experiment, we start from a bilateral ring (also known as a bilateral circle) and progressively transform it into a star network, keeping connectivity minimal and constant. A bilateral ring network is composed of a circle of banks in which every bank lends to and borrows from each of its two neighbours. In other words, each pair of adjacent banks in this network is bilaterally linked by a cross-holding of deposits (as it is in the complete and star interbank networks defined in Sect. 3.2). The simulation engine transforms a bilateral ring network into a star network in 63 steps. At each step of this process, a bank in the ring is detached from its two neighbours and is linked to the (designated) centre bank, becoming a pendant node of the latter, whereas its two neighbours become linked directly to one another. This procedure delivers networks composed of a star-shaped part and a circular part, where the centre bank belongs to both parts. At each step of the re-wiring process, a bank exits the ring part and becomes a peripheral bank in the star part of the network. At the k-th step, we have a network made of a star part, composed of a centre node and k pendant nodes, and a circular part, composed of \(n-k\) nodes. In so doing, and up to the 62nd iteration, the number of links in the networks is kept equal to 2n and becomes equal to \(2(n-1)\) at the last step of this procedure, the step that generates a star network.

In the centralisation experiment, we run two sets of simulations. In the first we transform a ring network into a star network, in which the centre bank has the same amount of assets, equity and customer deposits as a peripheral bank, while holding an amount of interbank deposits equal to \(n-1\) times the ones held by a peripheral bank. We call this the homogeneous star network. In the second set of simulations, we transform a ring network into a star network in which the assets, equity and customer deposits of the designated centre bank grow progressively as the number of its pendant banks grows. We call this the concentrated star network, and in this test we study the joint effects of concentration and centralisation, Finally, in the following simulations, we focus on the second threshold of contagion rather than the first one. The behaviour of the first contagion threshold reveals little information about the robust-yet-fragile behaviour of the networks at hand. In both the star and the circular part of the generated networks, one primary default is sufficient, in many cases, to induce one secondary default. Hence, in these tests, the median of the first default contagion appears close to a straight line in all the network configurations. Conversely, the comparison of the trends of the second and final thresholds of contagion captures the rate of convergence of all contagion thresholds (but the first).

4.2.1 From ring networks to homogeneous star networks

Like in the connectivity experiment, we perturb the networks with a sequence of shocks consisting of the deletion of a progressively growing number of randomly external assets. Figure 4a depicts the distribution of the second and final contagion thresholds, corresponding to the 64 network configurations. The vertical axe measures the magnitude of the shock whereas the horizontal axe marks the 63 steps of the transformation from ring (first column) to star networks (last column).

This plot shows that the convergence between the second and final thresholds of contagion becomes noticeable in the last twenty steps of the re-wiring procedure, i.e. only for relatively high levels of centralisation. The graph in Fig. 4b, representing the gap between these two thresholds is indeed concave and drops sharply starting from networks in which the star part comprises 44 banks out of 64.

As in Fig. 2, the three-dimensional plot in Fig. 5 shows the distribution of all the contagion thresholds, from first to final, of the randomly generated networks. One of the horizontal axes marks the steps of the centralisation procedure, whereas the variables measured on the other two axes are the same as in Fig. 2, i.e. the number of primary defaults and the average increase of secondary defaults.

This plot shows that the concentration of the contagion thresholds grows with the degree of centralisation of the randomly generated networks. The first configurations, starting from the bilateral ring, show a highly dispersed distribution of contagion thresholds. In the final configuration, the star network, all the contagion thresholds fall within the range \([ \widetilde{\tau }^{s},\tau _{f}^{s}]\), i.e. between the final thresholds corresponding to the case in which the centre bank is in the set of primary defaults and to the opposite case.Footnote 24 Figure 6 shows the (weighted) standard deviation of the thresholds obtained for each network configuration.

Starting from the first network configuration, the bilateral ring, we see that the dispersion of the contagion thresholds is maximal and substantially stable in the first ten steps of the re-wiring procedure (apart from a small, negligible increase in the first five steps) and then progressively diminishes as the degree of centralisation increases. Starting from the tenth network configuration, the (weighted) standard deviation of the contagion thresholds decreases in a monotonic and slightly concave fashion.

4.2.2 From ring networks to concentrated star networks

In this set of simulations, we test the effects of centralisation on contagion along with the implications of having a large bank at the centre of the star parts of the generated networks. The setting of this experiment differs from the previous one in two aspects. First, at each step of the re-wiring procedure, half of the assets, equity and customer deposits of the bank that becomes a pendant node of the centre bank are transferred to the latter. In other words, as a bank is moved from the ring part to the star part of the network, its size is halved, and half of its external assets and liabilities are transferred to the designated centre bank. For modelling convenience, each bank in the starting configuration, the ring, is endowed with two assets (rather than one), for a total of 2n external assets.Footnote 25 This means that, at the k-th step of the transformation from ring to star networks, we have k pendant banks in the star part endowed with one asset, \(n-k\) banks in the ring part endowed with two assets, and the centre bank endowed with \(k+2\) assets. The final network configuration is a star network composed of \(n-1\) peripheral banks and a bank at the centre that is \(n-1\) times larger, in terms of the balance sheet items, than a peripheral bank. Second, in this test a shock consists in the erasure of the value of a randomly selected set of assets (instead of a selection of primary defaults).

With the progressive growth of the designated centre bank, we intend to mimic one facet of the known process of concentration that occurred in the banking industry since the mid-nineties. The available evidence indicates that this process generated two-tiered banking sectors connected through sparse core-periphery interbank networks. The cores appear composed of few large banks connected among themselves, whereas each of these large banks is at the centre of a star (money centre) network with a large number of much smaller peripheral banks.Footnote 26 The emergence of these large and highly connected banks poses questions about their impact on system stability. They are ‘too big and too connected’ to fail, creating moral hazard problems for regulators and authorities. However, our simulations show that having a large bank at the centre of a star network, instead of a small bank, does not noticeably change the response to shocks of this class of networks.

The boxplot of Fig. 7a displays the second and final contagion thresholds, showing that, like in the previous case, the convergence is progressive and it occurs mostly in the last steps of the transformation from ring to star networks.

In the final configuration, the second and final contagion thresholds coincide (as they should), and the distribution of this threshold is characterised by a large dispersion. The lower bound of this distribution is equal to \(\tau ^{s}\), i.e. the (smallest) final contagion threshold of a star network, that corresponds to the case in which the entire exogenous shock is allocated to the centre bank. The upper bound of the distribution is the final threshold \(\tau _{f}^{s}\) , that obtains in the opposite case, when the shock hits peripheral banks only. The final thresholds obtained in the 1000 seeds of simulation lie within this range and depend on the random allocation of the shock between centre and periphery of the star network. The pattern of the gap between the second and final thresholds, in Fig. 7b, is concave and sharply drops in the last ten iterations of the centralisation procedure.

The three-dimensional plot of the contagion thresholds, shown in Fig. 8, indicates that the convergence of all the contagion thresholds starts at medium values of the centralisation process and grows rapidly only in the last steps of the re-wiring procedure.

This pace of convergence is confirmed by looking at Fig. 9, displaying the plot of the standard deviations of the thresholds distributions for each network configuration.

The figure shows that the dispersion of the contagion thresholds is relatively stable in the first 30 steps of centralisation and that most of the reduction of the standard deviation occurs in the last twenty steps of the ring-to-star transformation.

4.3 The effects of the size of intra-network exposures

We run experiments with different values of the intra-network liabilities of banks, \(d_{i}\). We do so by setting the ratio between internal and external debts of banks, \(\phi =d_{i}/h_{i}\) equal to 0.2; 0.4; 0.6 and 0.8 in the numerical simulations presented in Sects. 4.1 and 4.2.Footnote 27 The relevance of this ratio is in the fact that it governs the allocation of losses among creditors of defaulting banks. The larger the \(\phi \), the larger the amount of losses that defaulting banks transmit to other banks in the network. Thus, the larger the \(\phi \), the larger the scope of the contagion process induced by a shock. Indeed, all the contagion thresholds defined in Sect. 3.2 are decreasing in \(\phi \). The boxplots in Fig. 10 depict the distributions of the medians of the contagion thresholds obtained in the three experiments with the four different settings of \(\phi \).

Increasing \(\phi \) from 0.2 to 0.4 and 0.6 worsens the exposure to a contagion of all networks, as shown by the lowering of the medians of the contagion thresholds in all three tests. Interestingly, augmenting from 0.6 to 0.8 we obtain almost no effect on the medians of the thresholds. Intra-network liabilities equal to 0.6 of extra-network liabilities are sufficient to carry most of the contagious losses that can cross an interbank network.

Besides these differences, the response to shocks obtained with these different settings of \(\phi \) delivered results that are similar to the ones obtained with \(\phi =0.4\). With all these values of parameter \(\phi \) we obtain increasing concentrations of the contagion thresholds of the generated networks, as connectivity or centralisation increase. Moreover, we obtain the same difference between the connectivity and the centralisation experiment described in Sects. 4.1 and 4.2: the robust-yet-fragile response of regular networks takes place starting from medium-low levels of density, whereas the analogous consequence of centralisation produces its effects only in highly centralised networks. The high resiliency of ring networks to large shocks is also confirmed with \(\phi \) equal to 0.2; 0.6 and 0.8. Even in the most contagious setting, i.e. \(\phi =0.8\), the exposure of ring networks to a systemic crisis remains limited.

5 Robustness-yet-fragility and the too-many-to-fail problem

The exposure of interbank networks to risk of balance-sheet default contagion has relevant implications for the so-called ‘too-many-to-fail’ problem. When an event of default contagion involves a substantial number of banks, the intervention of central banks and monetary authorities—that aim to keep the stability of the financial systems—becomes problematic. Isolated failures of banks occur through time without endangering the stability of banking systems, unless they regard ‘systemically important financial institutions’, i.e. banks that are “too-big-to-fail”.Footnote 28 The authorities usually deal with the idiosyncratic bankruptcy of a bank, or of a few small banks, arranging a private resolution of the crisis—such as an acquisition or a bail-in involving the claimants of the defaulting bank—or, more rarely, letting the bank in default to be liquidated.Footnote 29 Conversely, the contextual and simultaneous bankruptcy of a non-negligible number of banks poses a significant threat to the stability of banking systems and forces central banks and monetary authorities to resort to costly public bail-outs. In this type of scenarios, it is difficult to resort to the options of acquisition, bail-in or liquidation: the authorities face a “too-many-to-fail” problem.Footnote 30 First and most important, the contextual liquidation of several banks would inflict substantial negative externalities to the rest of the economy, welfare losses that can be larger than the cost of a public bail-out. At the same time, private bail-ins become difficult to implement because when the number of banks in default is large, the number of healthy banks in the sector diminishes and the overall liquid resources available for the acquisition of troubled banks within the banking sector can result insufficient.Footnote 31 Moreover, and perhaps most important, if the welfare losses in case of no intervention are larger than the cost of a bail-out, then the ‘no bail-out’ threat on the part of the authorities is not credible. In this case, the authorities are in a strategically weak position that hinders the arrangement of a bail-in (Bernard et al. 2022). In this type of scenarios, the authorities are forced to implement public bail-outs, as happened in 2008 during the subprime crisis, notwithstanding the fiscal costs and the moral hazard problems they entail. Thus, as Acharya and Yorulmazer (2007) point out, the “too-many-to-fail” issue creates a time inconsistency in the policy of regulators: while it is ex-ante optimal not to bail-out banks in default, the bail-out becomes ex-post optimal if there are many banks in default.

In sum, a ‘too-many-to-fail’ scenario arises if the overall losses due to contagion, in case of no intervention, are larger than the cost of bailing out the initially troubled banks, i.e. the primary defaults. The occurrence of such a scenario, in the case of an exogenous shock, depends on the scope of the consequent contagion compared to the size of the initial shock, i.e. the amplification of defaults due to contagion. We examine the ratio between secondary and primary defaults to measure such amplification. Charting such a ratio, we show that the more robust-yet-fragile a network is, then (i) the less it increases the number of defaults through contagion in case of small shocks, preventing a ‘too-many-to-fail’ scenario, and (ii) the more it amplifies the number of defaults in case of large shocks, generating in such cases the problem at hand. Interestingly, we show that the opposite does not generally hold for vulnerable-yet-resilient networks-to wit, sparse and decentralised networks. Apart from the unilateral ring’s limiting case, sparse and decentralised networks are not sufficiently vulnerable to small shocks to generate a ‘too-many-to-fail’ problem for such shocks, whilst they might do so for shocks of medium magnitude.

Figure 11 plots the values taken on by the ratio between secondary and primary defaults in our connectivity experiment, for networks with different degrees of connectivity and for all shocks.

The unilateral ring, i.e. a regular network of degree 1, nearly doubles the number of defaults for small and medium shocks. In this network, even in case of small shocks that cause a small number of defaults, contagion can render the cost of no intervention larger than the cost of bail-out and generate a ‘too-many-to-fail’ problem. This feature, however, belongs only to the limiting case of the unilateral ring, it cannot be taken as representative of a larger class of sparse and decentralised networks. Indeed, the plot of the default amplification ratio for regular networks of degree 2 (density 0.03) already shows a different response to shocks: the ratio at hand reaches values larger than 0.7 only for shocks larger than one third of total assets. This robustness to small shocks grows rapidly in the degree of connectivity, as shown by the plot concerning the regular networks of degree 5 (density 0.08). As density reaches 0.5 (degree 32), the network becomes rather robust to small/medium shocks, with no secondary defaults for shocks smaller than 35% of total assets, and highly fragile to shocks larger than 45% of total assets. A response to shocks quite close to the tipping point displayed by the complete networks. Thus, as far as connectivity is concerned, we have that medium levels of connectivity are sufficient to hinder the emergence of a ‘too-many-to-fail’ scenario in case of small/medium shocks, while the opposite holds for sufficiently large shocks.

Bernard et al. (2022) run a similar numerical experiment on default amplification in complete and ring networks.Footnote 32 In their simulations, these authors calibrate the networks on the balance-sheet data of the banks regarded in the 2018 EBA stress test. Although these authors control for a limited range of possible shocks, their results strongly resonate with the results we obtain for the unilateral ring and the complete networks. Nonetheless, their interpretation differs from ours. Bernard et al. (2022) consider the behaviour of the ring network as representative of the class of sparse and decentralised networks. Moreover, they take the linear combination of the response of ring and complete networks to shocks as a proxy for the response of regular networks with varying degrees of density. Our results do not support this view.

Focusing now on the effects of centralisation, we obtain the patterns of default amplification presented in Fig. 12.

The results obtained in the ‘ring to homogeneous star’ experiment, depicted in Fig. 12a, show that: (1) the bilateral ring (first configuration, null centralisation) has a response to shocks very close to the one of the regular networks of degree 2; (2) the resiliency to small/medium shocks (\(<0.4\)), along with the marked default amplification for medium/large shocks(\(\ge 0.45\)), becomes visible starting from medium/high degrees of of centralisation (i.e., from the fortieth out of sixty-three steps of rewiring). The ‘ring to concentrated star’ experiment, in Fig. 12b shows similar patterns of default amplification for low levels of centralisation, as expectable. Conversely, in this experiment, we have that the containment of the scope of contagion for small/medium shocks occurs only for high levels of centralisation (starting from the fiftieth step of rewiring) and for small shocks (\(<0.3\)). This difference between the two experiments reflects the ‘too-big-to-fail’ problem in having a large bank at the centre of a star network. Both experiments show that centralisation can prevent the occurrence of a ‘too-many-to-fail’ problem for small/medium shocks only if the periphery is sufficiently numerous to absorb the losses coming from and through the centre bank.

6 Policy implications

In the last three decades, national banking systems in all advanced countries have undergone a remarkable concentration and consolidation process. As a result, two-tiered banking systems have emerged, composed of a limited number of large banks and a large number of small banks. There is a large consensus and evidence that these two-tiered banking systems generated networks of interbank claims that appear similar to the stylised core-periphery network (hereafter CP) defined by Craig and von Peter (2014). Such a ‘perfect’ CP network consists of a fully connected core of banks, where each of the latter is connected to a set of periphery banks that are not connected among them but to a single core bank. To wit, a complete network of banks (the core), in which each core bank is the centre of a star network.Footnote 33

Numerous authorsFootnote 34—such as, inter alia, in ’t Veld et al. (2014), Craig and von Peter (2014), Bech and Atalay (2010), Langfield et al. (2014), who investigate the interbank networks of the Netherlands, Germany, USA and UK, respectively, while Gurgone et al. (2018) and Fricke and Lux (2015) study the italian E-mid liquidity market—show that the observed national interbank networks display a good fit to the stylised CP network. In the empirical CP networks, the cores appear composed of a limited number of large banks—usually classified as SIFI’s—densely connected among them, whilst the peripheries consist of small banks connected with one or few core banks and sparsely connected (if at all) among them.Footnote 35 More precisely, the cores of these national networks display a density roughly comprised in the range [0.55, 0.65]. Craig and von Peter (2014) find that the density of the core of the German system is 0.66. According to Fricke and Lux (2015), the density of the core in the Italian interbank liquidity market oscillates through time between 0.55 and 0.65. These findings align with the measures of fitness of the observed systems to the stylised CP put forward by several authors, e.g. Langfield et al. (2014), who find a fitness equal to 0.672. In other words, the cores of the observed national CP networks are similar to regular networks with medium/high density. Our results indicate that the density of such cores is sufficient to generate a high degree of robustness-yet-fragility. This implies that the observed CP networks are robust-yet-fragile to insolvency shocks. In these networks, systemic contagion can only occur across the core, given the scarcity of links among peripheral banks.Footnote 36 The observed core-periphery pairs, on their part, appear close to a perfect star with a large bank at the centre. A network configuration that implies resilience to small (peripheral) shocks and fragility to large (central) shocks.

Given this scenario, we make the following remarks concerning macroprudential policies pursued by regulators.

1. Both the Dodd-Frank act and the Basel III agreements prescribe policies to contain the number and size of interbank connections of SIFI’s banks.Footnote 37 These policies aim at taming the threat to stability posed by the existence of banks that are too big and too connected to fail. The cores of the observed CP networks are mostly composed of SIFI’s banks. Limiting the numerosity and magnitude of the interbank claims of SIFI’s banks amounts to limiting the number and size of intra-core connections. Our simulations shed some light on the systemic consequences of such policies, separating the effects that the density of a network has on contagion from the effects due to the magnitude of interbank obligations. The results we obtain show that a reduction in the density of the cores per se does not alter the scenario significantly. As shown in Fig. 13a, halving the number of links (from 40, density 0.63, to 20, density 0.317), the default amplification for large shocks diminishes of one-tenth, circa, at the price of a higher fragility to medium shocks. The picture does not change much even bringing density down to 0.16, that is one-quarter of the observed density:

Conversely, an upper bound to the size of interbank exposures seems to deliver a more substantial reduction of systemic risk. Figure 13b displays the default amplification ratio that we obtain from regular networks with density 0.6 for ratios \(\phi \) of intra/extra network obligations equal to 0.2, 0.4 and 0.6. Reducing the \(\phi \) ratio from 0.6 to 0.4 improves the response to shocks markedly, whilst a further reduction to 0.2 renders the network entirely robust to medium/large shocks, leaving little scope to default contagion even in case of large shocks.

These results suggest that it is preferable to pursue the containment of systemic risk, in national CP networks, by limiting the magnitude of intra-core interbank claims rather than their numerosity. This type of policies, however, comes at a cost. There is a trade-off between the resilience of interbank networks to insolvency shocks and their efficiency in covering liquidity risk (Gofman 2017; Castiglionesi and Eboli 2018). In the case at hand, the fewer and the smaller the intra-core interbank claims, the less effective the CP networks in re-allocating liquidity among banks, the higher the risk of fire sales and price-mediated contagion due to idiosyncratic liquidity shortages.Footnote 38 Our knowledge of the terms of this trade-off between efficiency and stability is still limited. Further research is required to assess the costs and benefits of this type of policies.

2. The occurrence of common exogenous shocks due to the overlapping and correlation of banks’ portfolios is a major source of systemic risk in interbank networks—along with counterparty default contagion and price-mediated contagion due to fire sales.Footnote 39 Common shocks can create “too-many-to-fail” problems to the robust-yet-fragile national CP banking networks. On the one hand, the robustness to small shocks makes the CP national banking systems resilient to the default of a single core bank, creating the grounds for implementing private bail-ins in such cases. On the other hand, the fragility to large and common exogenous shocks, and the ensuing default amplification, generates a too-many-to-fail problem that renders the public bail-out unavoidable in case of such shocks. Thus, the density of the cores of national CP interbank networks increases (decreases) the likelihood of public bail-outs in case of joint (single) failures. Moreover, it appears that banks with more similar real exposures tend to lend more to each other.Footnote 40 For these reasons, regulators should contain the risk of common shocks among densely connected core banks, discouraging the cross-holding of claims among core banks with similar portfolios. Regulators can pursue these goals by introducing capital and liquidity requirements on SIFI’s banks based not only on their individual risk profile, as it is now, but also on measures of the correlation of a bank’s portfolio with the portfolios held by the other banks in the core. The risk-weighted leverage requirement prescribed by Basel II, in which different risk weights apply to different assets, could be amended in this sense.Footnote 41 In this leverage ratio, interbank claims are in the lowest risk class, along with mortgages and government bonds. This classification should be corrected. The risk associated with an interbank claim should be based on the correlation of the portfolios of the pair of banks involved. The so modified risk-weights for interbank loans would reflect, at least partially, the aggregate systemic risk generated by these assets.

7 Conclusions

Using computational methods, we investigate the relation between the degrees of density or centralisation of interbank networks and their robustness-yet-fragility to insolvency shocks. The results show that the robustness-yet-fragility of interbank networks grows in a neatly progressive fashion both with density and with centralisation, but at different paces. In (decentralised) regular networks, most of the risk-sharing effects of interbank cross-holding of financial claims arise from low to medium levels of connectivity. Starting from the medium level of density, 0.5, we have a robust-yet-fragile reaction to shocks that appears close to the neat phase transition—from no contagion to systemic crisis—displayed by complete networks. Conversely, a minimally connected and progressively centralised interbank network becomes robust-yet-fragile with high centralisation levels only, i.e. when it is close to a perfect star. Interestingly, we find that the vulnerable-yet-resilient feature of unilateral ring networks indeed belongs to such a stylised network, whilst it does not apply to other sparse and decentralised networks. These results indicate that, as far as counterparty default contagion is concerned, no interbank network can create a too-many-to-fail problem in case of small shocks but the unilateral ring. Sparse and decentralised interbank networks appear sufficiently fragile to generate such a problem in case of shocks of intermediate magnitude. Finally, medium levels of density and high levels of centralisation prevent the emergence of a too-many-to-fail issue for small and medium shocks, whilst creating the problem in a drastic fashion in case of large shocks.

Our results shed some light on the response to insolvency shocks that one can expect from the observed national banking systems. There is empirical evidence that the cores of the observed core-periphery national interbank networks resemble regular networks endowed with densities that range from 0.55 to 0.65. Consequently, and concerning counterparty default contagion, the observed cores appear highly resilient to small (idiosyncratic) shocks while being exposed to systemic crises in the case of large shocks involving a plurality of core banks. As pointed out by several scholars, the cores at hand are mainly composed of SIFI’s banks that tend to have overlapping and correlated portfolios. A level of risk-sharing that creates the grounds for the occurrence of common insolvency shocks. The connectedness of the observed cores drastically magnifies the scope of contagion in the case of such a shock. Our results indicate that, in this scenario, a reduction of the magnitude (rather than their numerosity) of the interbank claims held by core banks would effectively contain the risk of systemic crises.

Notes

The density of a network is the ratio between the number of links existing in the network and the maximum possible number of links that the network can have (i.e., \(n(n-1)\) in a network with n nodes). The centralisation of a network is usually measured by the Freeman graph centralization index, that expresses the degree of inequality or variance in the centrality of nodes in a network as a percentage of that of a perfect star network of the same size.

Direct balance-sheet contagion, also known as counterparty contagion, results from the transmission of losses from defaulting banks to creditor banks. It is considered one of the primary sources of systemic risk, along with asset commonality and price-mediated contagion due to fire sales.

In a ring interbank network (also known as ‘circle’) each bank is unilaterally connected to just two neighbours, forming a circular network.

In a complete interbank network, each bank is directly connected to every other bank. A star network consists of a centre bank and a set of peripheral banks, where the bank at the centre is connected with all peripheral banks while the latter are not connected among themselves. See Sect. 3 for the formal definitions of complete, ring and star interbank networks.

As opposed to the intra-networks assets and liabilities, cross-held by the banks in a network.

As discussed in the next section, the existing computational simulations that study contagion in sparse regular networks—e.g., Nier et al. (2007) and Lorenz et al. (2009)—do not control for shocks of different size, hence they miss their vulnerable-yet-resilient nature. The analytic studies of contagion that highligth this feature of ring networks—e.g., Acemoglu et al. (2015a, 2015b) and Eboli (2019)—focus only on the unilateral ring, because of the untractability of the bilateral ring and of other sparse regular networks.

A direct comparison is hindered by the fact that the two papers adopt different methodologies. For his simulations, Ladley uses a partial equilibrium model with heterogeneous banks, borrowers and depositors in which banks interact through an inter-bank market.

Gofman (2017) intends to evaluate the effects of policies that aim to improve financial stability by imposing limits in terms of the number of connections in the interbank market.

In a star network where the centre bank is as large as a peripheral bank, we have \(m=1\). More generally, m is the smallest integer such that: \(m\ge \frac{\varepsilon +\varepsilon \phi (n-1))}{1-\varepsilon }\frac{1+\phi }{ \phi }=n\left[ \frac{\varepsilon (1+\phi )}{1-\varepsilon } \right] +\frac{\varepsilon (1-\phi ^{2})}{\phi (1-\varepsilon )}\), where \( \varepsilon \) is the equity/total assets ratio, \(\varepsilon =e_{i}/(a_{i}+c_{i})\).

k is the largest integer such that

$$\begin{aligned} k+2(k-1)\left[ \left( 1+\frac{h_{i}}{d_{i}}\right) ^{k-1}-1\right] \le \frac{a_{i}}{e_{i}}=\frac{1-\varepsilon }{\varepsilon \left( 1+\phi \right) } +1. \end{aligned}$$The scope of contagion of a single ‘seed’ in the ring network is rather limited. In a highly contagious scenario with large interbank exposures, \( \phi =1\), and a low equity/asset ratio, \(\varepsilon =0.05\), we have \(k=2.\) We have \(k=3\) for \(\phi =1\) only with an equity/asset ratio as small as \( \varepsilon =0.03\).

\(\widehat{k}\) is the largest integer such that

$$\begin{aligned} \widehat{k}+2(\widehat{k}-1)\left[ \left( 1+\frac{h_{i}}{d_{i}}\right) ^{ \widehat{k}-1}-1\right] \le \frac{a_{i}+d_{i}}{e_{i}}=\frac{1}{\varepsilon } . \end{aligned}$$In a scenario with large interbank exposures, \(\phi =1\), and a low equity/asset ratio, \(\varepsilon =0.05\), we have \(\widehat{k}=3\), whereas \( k=2\). It can be computationally checked that \(\widehat{k}>k\) for all pairs \( (\varepsilon ,\phi ).\) It follows that \(\widehat{\tau }_{2}^{o}>\tau _{2}^{o} \) for \(n>4\).

The ring network is the initial network configuration in the connectivity experiment presented in Sect. 4.1.

The code of the simulation engine is available on request at https://github.com/bulentozel/SimFinNet. See Ozel et al. (2018) for a detailed description of this device.

Empirical evidence shows that the capital ratio of banks, in different countries and across different types of banks, is highly concentrated around a mean equal to 0.1. The Basel II accords recommend that banks hold capital at least as large as 8% of its risk-weighted assets. Caccioli et al. (2014) collect data on a large sample of U.S. commercial banks and find that “On average, the variable Capital is 10%, and its standard deviation is 5.2%”. This finding is supported by the data collected by the World Bank, https://data.worldbank.org/indicator/FB.BNK.CAPA.ZS?view=chart, that reports the average equity/asset ratios of banks in all ‘Countries and Economies’.

Conversely, the empirical evidence on the magnitude of interbank exposures, hence on the values of the ratio \(\phi ,\) is not as neat and abundant. Perillo and Battiston (2020), who use data from the European Central Bank Statistical Warehouse, find that euro area financial institutions’ assets comprise a 33% of reported intra-network assets. This value, coupled with an equity/asset ratio of 0.1, indicates a \(\phi \) ratio roughly equal to 0.4. We also control for \(\phi \) equal to 0.2; 0.6 and 0.8 because the accuracy of this datum, based on reported claims only, is only a proxy for the partly unobservable interbank financial obligations.

A directed graph is regular if all nodes have the same degree and the indegree and outdegree of each node are equal to each other.

We did so by generating networks that are distance regular. In the class of distance-regular graphs, all nodes have the same degree of centrality, by any measure of centrality.