Abstract

For years, Value-at-Risk and Expected Shortfall have been well established measures of market risk and the Basel Committee on Banking Supervision recommends their use when controlling risk. But their computations might be intractable if we do not rely on simplifying assumptions, in particular on distributions of returns. One of the difficulties is linked to the need for Integral Constrained Optimizations. In this article, two new stochastic optimization-based Simulated Annealing algorithms are proposed for addressing problems associated with the use of statistical methods that rely on extremizing a non-necessarily differentiable criterion function, therefore facing the problem of the computation of a non-analytically reducible integral constraint. We first provide an illustrative example when maximizing an integral constrained likelihood for the stress-strength reliability that confirms the effectiveness of the algorithms. Our results indicate no clear difference in convergence, but we favor the use of the problem approximation strategy styled algorithm as it is less expensive in terms of computing time. Second, we run a classical financial problem such as portfolio optimization, showing the potential of our proposed methods in financial applications.

Similar content being viewed by others

Notes

Without loss of generality, we only consider a minimization problem with equality constraints, since a maximization problem can be transformed into a minimization problem by negating the objective function while inequality constraints, say, \(g_{i}(x)\le 0\) can likewise be transformed into an equivalent equality constraint of the form \((g_{i}(x))^{+}=\max \{0,g_{i}(x)\}=0\).

We denote the EE distribution with \(EE(\alpha ,\beta )\) where \(\alpha \) and \(\beta \) are, respectively, the shape and scale parameters. The respective distribution function, \(F_{X}(\cdot )\), may be written following the definition by Gupta and Kundu (2001) as:

$$\begin{aligned} \begin{aligned} F_{X}(x;\alpha ,\beta )&= \left( 1-\exp (-\beta x) \right) ^{\alpha },~~\alpha>0, \beta>0, x>0. \end{aligned} \end{aligned}$$Smith et al. (2015) consider the change of variable \(z=\beta _{1}x\) to obtain:

$$\begin{aligned} \mathcal {R} = \alpha _{1}\int _{0}^{\infty } \exp (-\beta _{1}z) \left( 1- \exp {(-\beta _{1}z)} \right) ^{\alpha _{1}-1}\left( 1- \exp {(-(\beta _{2}/\beta _{1})z)} \right) ^{\alpha _{2}}dz, \end{aligned}$$while Nadarajah (2011) poses the transformation \(z=\exp (-\beta _{1} x)\) and obtains:

$$\begin{aligned} \mathcal {R} = \alpha _{1}\int _{0}^{1} \left( 1- z \right) ^{\alpha _{1}-1}\left( 1- z^{\beta _{2}/\beta _{1}} \right) ^{\alpha _{2}}dz. \end{aligned}$$All results are obtained using MatLab (version R2019a) on a laptop with a Intel(R) Core(TM) i7-5500U CPU @ 2.40GHz and 8GB RAM. The codes used in this article are available upon request from the corresponding author.

In our robustness checks we vary the value of main parameters of the algorithms, namely: a, N and \(T^{*}\), obtaining similar results in terms of efficiency and computational time (Cf. Appendix B).

We thank the first referee for noticing that the choice of the randomly chosen assets has no importance (since it can be generalized for all triplets of assets, and, more generally, to all sets of assets).

We follow Boucher et al. (2013) to build up our database: the “Equity” asset class is represented by a composite index of 95% of the MSCI Europe and 5% of the MSCI World; the “Bonds” asset class comes from the x-trackers II iBoxx Sovereigns Eurozone AAA UCITS 1C index (denoted as XBAT index); the “Money Market” is represented by the Euro Overnight Index Average (EONIA).

References

Andrieu, C., & Roberts, G. O. (2009). The pseudo-marginal approach for efficient Monte Carlo computations. The Annals of Statistics, 37(2), 697–725. https://doi.org/10.1214/07-aos574

Andrieu, C., & Thoms, J. (2008). A tutorial on adaptive MCMC. Statistics and Computing, 18(4), 343–373.

Anily, S., & Federgruen, A. (1987). Ergodicity in parametric nonstationary Markov chains: An application to simulated annealing methods. Operations Research, 35(6), 867–874. https://doi.org/10.1287/opre.35.6.867

Azzalini, A., & Valle, A.D. (1996). The multivariate skew-normal distribution. Biometrika 83(4):715–726, http://www.jstor.org/stable/2337278.

Beaumont, M. A. (2003). Estimation of population growth or decline in genetically monitored populations. Genetics, 164(3), 1139–1160. https://doi.org/10.1093/genetics/164.3.1139

Bergey, P. K., Ragsdale, C. T., & Hoskote, M. (2003). A simulated annealing genetic algorithm for the electrical power districting problem. Annals of Operations Research, 121(1), 33–55. https://doi.org/10.1023/A:1023347000978

Bertsekas, D. P. (2014). Constrained optimization and Lagrange multiplier methods. Cambridge: Academic press.

Bick, B., Kraft, H., & Munk, C. (2013). Solving constrained consumption-investment problems by simulation of artificial market strategies. Management Science, 59(2), 485–503. https://doi.org/10.1287/mnsc.1120.1623

Bohachevsky, I. O., Johnson, M. E., & Stein, M. L. (1986). Generalized simulated annealing for function optimization. Technometrics, 28(3), 209–217. https://doi.org/10.1080/00401706.1986.10488128

Boucher, C., Jannin, G., Kouontchou, P., & Maillet, B. (2013). An economic evaluation of model risk in long-term asset allocations. Review of International Economics, 21(3), 475–491. https://doi.org/10.1111/roie.12049

Calvo, C., Ivorra, C., & Liern, V. (2012). On the computation of the efficient frontier of the portfolio selection problem. Journal of Applied Mathematics, 2012, 1–25. https://doi.org/10.1155/2012/105616

Casarin, R., & Billio, M. (2007). Stochastic optimization for allocation problems with shortfall risk constraints. Applied Stochastic Models in Business and Industry, 23(3), 247–271. https://doi.org/10.1002/asmb.671

Castellano, R., Cerqueti, R., Clemente, G. P., & Grassi, R. (2021). An optimization model for minimizing systemic risk. Mathematics and Financial Economics, 15(1), 103–129. https://doi.org/10.1007/s11579-020-00279-6

Charalambous, C. (1978). A lower bound for the controlling parameters of the exact penalty functions. Mathematical programming, 15(1), 278–290. https://doi.org/10.1007/BF01609033

Costola, M., Maillet, B., & Yuan, Z. (2022). Mean–variance efficient large portfolios: A simple machine learning heuristic technique based on the two-fund separation theorem. Annals of Operations Research. https://doi.org/10.1007/s10479-022-04881-3

Crama, Y., & Schyns, M. (2003). Simulated annealing for complex portfolio selection problems. European Journal of Operational Research, 150(3), 546–571. https://doi.org/10.1016/S0377-2217(02)00784-1

Cramer, J.S. (1989). Econometric applications of maximum likelihood methods. CUP Archive.

D’Amico, S. J., Wang, S. J., Batta, R., & Rump, C. M. (2002). A simulated annealing approach to police district design. Computers and Operations Research, 29(6), 667–684. https://doi.org/10.1016/S0305-0548(01)00056-9

Dong, M. X., & Wets, R. J. B. (2000). Estimating density functions: A constrained maximum likelihood approach. Journal of Nonparametric Statistics, 12(4), 549–595. https://doi.org/10.1080/10485250008832822

Edrisi, A., Nadi, A., & Askari, M. (2020). Optimization-based planning to assess the level of disaster in the city. International Journal of Human Capital in Urban Management, 5(3), 199–206. https://doi.org/10.22034/IJHCUM.2020.03.02

Etgar, R., Shtub, A., & LeBlanc, L. J. (1997). Scheduling projects to maximize net present value - the case of time-dependent, contingent cash flows. European Journal of Operational Research, 96(1), 90–96. https://doi.org/10.1016/0377-2217(95)00382-7

Etgar, R., Gelbard, R., & Cohen, Y. (2017). Optimizing version release dates of research and development long-term processes. European Journal of Operational Research, 259(2), 642–653. https://doi.org/10.1016/j.ejor.2016.10.029

Feng, M. B., Maggiar, A., Staum, J., & Wachter, A. (2018). Uniform convergence of sample average approximation with adaptive importance sampling. In 2018 Winter Simulation Conference (WSC). IEEE. https://doi.org/10.1109/wsc.2018.8632370

Fisk, C. L., Harring, J. R., Shen, Z., Leite, W., Suen, K. Y., & Marcoulides, K. M. (2022). Using simulated annealing to investigate sensitivity of SEM to external model misspecification. Educational and Psychological Measurement. https://doi.org/10.1177/00131644211073121

Ftiti, Z., Tissaoui, K., & Boubaker, S. (2020). On the relationship between oil and gas markets: A new forecasting framework based on a machine learning approach. Annals of Operations Research, 313(2), 915–943. https://doi.org/10.1007/s10479-020-03652-2

Gilli, M., & Schumann, E. (2012). Heuristic optimisation in financial modelling. Annals of Operations Research, 193, 129–158. https://doi.org/10.1007/s10479-011-0862-y

Glizer, V.Y., & Turetsky, V. (2019). Robust optimization of statistical process control. In: 2019 27th Mediterranean Conference on Control and Automation (MED), IEEE, https://doi.org/10.1109/med.2019.8798539.

Gupta, R. D., & Kundu, D. (2001). Exponentiated exponential family: An alternative to gamma and Weibull distributions. Biometrical Journal: Journal of Mathematical Methods in Biosciences, 43(1), 117–130. https://doi.org/10.1002/1521-4036(200102)43:1<117::AID-BIMJ117>3.0.CO;2-R

He, Z., Wang, N., Jia, T., & Xu, Y. (2009). Simulated annealing and tabu search for multi-mode project payment scheduling. European Journal of Operational Research, 198(3), 688–696.

Homem-de-Mello, T. (2008). On rates of convergence for stochastic optimization problems under non-independent and identically distributed sampling. SIAM Journal on Optimization, 19(2), 524–551. https://doi.org/10.1137/060657418

Isaacson, D. L., & Madsen, R. W. (1976). Markov chains Theory and Applications. New York: Wiley.

Juditsky, A., & Nemirovski, A. (2020). Statistical Inference via Convex Optimization. Princeton University Press. https://doi.org/10.2307/j.ctvqsdxqd

Kirkpatrick, S., Gelatt, C. D., & Vecchi, M. P. (1983). Optimization by simulated annealing. Science, 220(4598), 671–680. https://doi.org/10.1126/science.220.4598.671

Kundu, D., & Gupta, R. D. (2005). Estimation of \(P[Y < X]\) for generalized exponential distribution. Metrika, 61(3), 291–308. https://doi.org/10.1007/s001840400345

van Laarhoven, P. J. M., Aarts, E. H. L., & Lenstra, J. K. (1992). Job shop scheduling by simulated annealing. Operations Research, 40(1), 113–125. https://doi.org/10.1287/opre.40.1.113

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91. https://doi.org/10.1111/j.1540-6261.1952.tb01525.x

de Mello, T. H., & Bayraksan, G. (2014). Monte Carlo sampling-based methods for stochastic optimization. Surveys in Operations Research and Management Science, 19(1), 56–85. https://doi.org/10.1016/j.sorms.2014.05.001

Meng, X., & Taylor, J. W. (2020). Estimating value-at-risk and expected shortfall using the intraday low and range data. European Journal of Operational Research, 280(1), 191–202. https://doi.org/10.1016/j.ejor.2019.07.011

Nadarajah, S. (2011). The exponentiated exponential distribution: A survey. AStA Advances in Statistical Analysis, 95(3), 219–251. https://doi.org/10.1007/s10182-011-0154-5

Porth, L., Boyd, M., & Pai, J. (2016). Reducing risk through pooling and selective reinsurance using simulated annealing: An example from crop insurance. The Geneva Risk and Insurance Review, 41(2), 163–191. https://doi.org/10.1057/s10713-016-0013-0

Rayward-Smith, V., Osman, I., Reeves, C., & Simth, G. (1996). Modern Heuristic Search Methods. New York: Wiley.

Ricca, F., & Simeone, B. (2008). Local search algorithms for political districting. European Journal of Operational Research, 189(3), 1409–1426. https://doi.org/10.1016/j.ejor.2006.08.065

Robert, C., & Casella, G. (2013). Monte Carlo statistical methods. Berlin: Springer.

Rutenbar, R. (1989). Simulated annealing algorithms: An overview. IEEE Circuits and Devices Magazine, 5(1), 19–26. https://doi.org/10.1109/101.17235

Ryu, D. W., Kim, J. I., Suh, S., & Suh, W. (2015). Evaluating risks using simulated annealing and building information modeling. Applied Mathematical Modelling, 39(19), 5925–5935. https://doi.org/10.1016/j.apm.2015.04.024

Seneta, E. (1981). Non-negative Matrices and Markov Chains. New York: Springer. https://doi.org/10.1007/0-387-32792-4

Shajin, D., Jacob, J., & Krishnamoorthy, A. (2021). On a queueing inventory problem with necessary and optional inventories. Annals of Operations Research. https://doi.org/10.1007/s10479-021-03975-8

Shapiro, A., Dentcheva, D., & Ruszczyński, A. (2014). Lectures on stochastic programming: Modeling and theory. US: SIAM.

Smith, B., & Wong, A. (2017). Simulated annealing of constrained statistical functions. In: Computational Optimization in Engineering - Paradigms and Applications, InTech, https://doi.org/10.5772/66069.

Smith, B., Wang, S., Wong, A., & Zhou, X. (2015). A penalized likelihood approach to parameter estimation with integral reliability constraints. Entropy, 17(6), 4040–4063. https://doi.org/10.3390/e17064040

Stander, J., & Silverman, B. W. (1994). Temperature schedules for simulated annealing. Statistics and Computing, 4(1), 21–32. https://doi.org/10.1007/bf00143921

Tayal, A., & Singh, S. (2018). Integrating big data analytic and hybrid firefly-chaotic simulated annealing approach for facility layout problem. Annals of Operations Research, 270(3), 489–514. https://doi.org/10.1007/s10479-016-2237-x

Wah, B. W., Chen, Y., & Wang, T. (2006). Simulated annealing with asymptotic convergence for nonlinear constrained optimization. Journal of Global Optimization, 39(1), 1–37. https://doi.org/10.1007/s10898-006-9107-z

Wang, H., Hu, Z., Sun, Y., Su, Q., & Xia, X. (2018). Modified backtracking search optimization algorithm inspired by simulated annealing for constrained engineering optimization problems. Computational Intelligence and Neuroscience, 2018, 1–27. https://doi.org/10.1155/2018/9167414

Woodside-Oriakhi, M., Lucas, C., & Beasley, J. (2011). Heuristic algorithms for the cardinality constrained efficient frontier. European Journal of Operational Research, 213(3), 538–550. https://doi.org/10.1016/j.ejor.2011.03.030

Zhang, C., Lin, Q., Gao, L., & Li, X. (2015). Backtracking search algorithm with three constraint handling methods for constrained optimization problems. Expert Systems with Applications, 42(21), 7831–7845. https://doi.org/10.1016/j.eswa.2015.05.050

Acknowledgements

We thank Jean-Luc Prigent for positive comments and encouragement on the preliminary draft of this article, as well as participants to the FEM2021 conference (Paris, on-line, June 2021), as well as the Editor in charge and two anonymous referees who significantly contributed to the improvement of the article. Roberto Casarin and Anthony Osuntuyi gratefully acknowledge the funding received from the EURO Horizon 2020 project on Energy Efficient Mortgages Action Plan (EeMAP), grant agreement No 746205 and the VERA project on economic and financial cycles under the grant number No. 479/2018 Prot. 33287 -VII / 16 of 08.06.2018. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A proof to theorem 1: ergodicity of MCWMSA

The proof for Theorem 1 follows standard arguments for the convergence of Inhomogeneous Markov Chains (e.g., Isaacson and Madsen (1976) and Seneta (1981) for related results). More precisely, we first form a lower bound on the probability of reaching any solution from any local minimum, and then show that this bound does not approach zero too quickly. Let G be the generation probability that satisfies 19.

-

a.

Let:

$$\begin{aligned} \displaystyle \varDelta _{G} = \min _{\begin{array}{c} (x',\lambda ')\in \mathcal {N}({x,\lambda }),\\ {x,\lambda }\in \mathcal {S} \end{array}} G(x,\lambda ;x',\lambda ') \end{aligned}$$and:

$$\begin{aligned} \displaystyle \varDelta _{L^{M}} = 2\max _{\begin{array}{c} (x',\lambda ')\in \mathcal {N}(x,\lambda ),\\ (x'\lambda ')\in \mathcal {S},y,y'\in \mathcal {Y}^M \end{array}}\{|L^{M}(x',\lambda ') -L^{M}(x,\lambda )|\}, \end{aligned}$$be, respectively, the value of the smallest one-step solution generation probabilities and the size of the largest potential jump in the value of the auxiliary penalty function between any pair of trial solutions. \(\mathcal {S}=\mathcal {X}\times \mathbb {R}_{+}^{r}\) denotes the search space while \(\mathcal {N}(x,\lambda )\) represents the neighborhood of \((x,\lambda )\). If \((x,\lambda )\ne (x',\lambda ')\), then for all \((x,\lambda )\in \mathcal {S}\) and \((x',\lambda ')\in \mathcal {N}(x,\lambda )\), we have:

$$\begin{aligned} \begin{aligned}&P_{MCWMSA}(x,\lambda ;x',\lambda ') = \int _{\mathcal {Y}^{M}}\int _{\mathcal {Y}^{M}} G(x,\lambda ;x',\lambda ')A^{M}_{T_{k}}(x,\lambda ;x',\lambda ')q^{M}_{x}(y)q^{M}_{x'}(y')dydy' \\&\quad = G(x,\lambda ;x',\lambda ')\int _{\mathcal {Y}^{M}}\int _{\mathcal {Y}^{M}} A^{M}_{T_{k}}(x,\lambda ;x',\lambda ')q^{M}_{x}(y)q^{M}_{x'}(y')dydy' \\&\quad = {\left\{ \begin{array}{ll} G(x,\lambda ;x',\lambda ')\int _{\mathcal {Y}^{M}}\int _{\mathcal {Y}^{M}} \min \left\{ \exp \left( -\frac{(L^{M}(x',\lambda ')-L^{M}(x,\lambda ))}{T}\right) ,1\right\} q^{M}_{x}(y)q^{M}_{x'}(y')dydy', &{} {\text {if }u=1 }\\ G(x,\lambda ;x',\lambda ')\int _{\mathcal {Y}^{M}}\int _{\mathcal {Y}^{M}} \min \left\{ \exp \left( -\frac{(L^{M}(x,\lambda )-L^{M}(x',\lambda '))}{T}\right) ,1\right\} q^{M}_{x}(y)q^{M}_{x'}(y')dydy' , &{} {\text {if }u=0 } \end{array}\right. }\\&\quad \ge G(x,\lambda ;x',\lambda ')\exp \left( -\frac{\varDelta _{L^{M}}}{T_{k}}\right) \int _{\mathcal {Y}^{M}}\int _{\mathcal {Y}^{M}} q^{M}_{x}(y)q^{M}_{x'}(y')dydy'\\ \\&\quad \ge \varDelta _{G}\exp \left( -\frac{\varDelta _{L^{M}}}{T_{k}}\right) . \end{aligned} \end{aligned}$$(A.1) -

b.

For any \(\lambda \), let:

$$\begin{aligned} \displaystyle \varDelta _{min}^{M} = \min _{\begin{array}{c} (x',\lambda ')\in \mathcal {N}(x,\lambda ),\\ A^{M}_{T_{k}}<1, y,y'\in \mathcal {Y}^{M} \end{array}} \left( L^{M}(x',\lambda ') - L^{M}(x,\lambda ) \right) \ge 0, \end{aligned}$$be the size of the smallest positive jump in the value of the objective function between any solution pair. If \((x',\lambda ')=(x,\lambda )\), we have:

$$\begin{aligned}&P_{MCWMSA}(x,\lambda ;x',\lambda ') \nonumber \\&\quad = 1-\int _{\mathcal {N}(x,\lambda )}\int _{\mathcal {Y}^{M}}\int _{\mathcal {Y}^{M}} A_{T_{k}}^{M}(x,\lambda ;x',\lambda ') q^{M}_{x}(y)q^{M}_{x'}(y')dydy'G(x,\lambda ;dx',d\lambda ') \nonumber \\&\quad = \int _{\begin{array}{c} \mathcal {N}(x,\lambda ),A^{M}_{T_{k}}<1 \end{array}}\int _{\mathcal {Y}^{M}}\int _{\mathcal {Y}^{M}} \left( 1- A_{T_{k}}^{M}(x,\lambda ;x',\lambda ')\right) q^{M}_{x}(y)q^{M}_{x'}(y')dydy'G(x,\lambda ;dx',d\lambda ') \nonumber \\&\quad \ge \int _{\begin{array}{c} \mathcal {N}(x,\lambda ),A^{M}_{T_{k}}<1 \end{array}}\int _{\mathcal {Y}^{M}}\int _{\mathcal {Y}^{M}} \varDelta _{G}(1 - \exp (-\varDelta _{min}^{M}/T_{k}))q^{M}_{x}(y)q^{M}_{x'}(y')dydy'dx'd\lambda '. \end{aligned}$$(A.2)Since, \(T_{k}\) is a decreasing sequence, it is always possible to find a \(k_{0}>0\) so that for all \(k\ge k_{0}\), \(\displaystyle (1-\exp (-\varDelta _{min}^{M}/T_{k}))\ge \exp (-\varDelta _{L^{M}}/T_{k})\).

Thus:

$$\begin{aligned} P_{MCWMSA}(x,\lambda ;x,\lambda )\ge \exp (-\varDelta _{L^{M}}/T_{k}). \end{aligned}$$ -

c.

Based on the result obtained above, for all \((x,\lambda ),(x',\lambda ')\in \mathcal {S}\) and \(k\ge k_{0}\), the N-step transition probability from \((x,\lambda )=(x_{0},\lambda _{0})\) to \((x',\lambda ')=(x_{N},\lambda _{N})\) satisfies the following:

$$\begin{aligned} P_{MCWMSA}^{N}(x,\lambda ;x',\lambda ')= \prod _{i=0}^{N-1}P_{MCWMSA}(x_{i},\lambda _{i};x_{i+1},\lambda _{i+1}) \ge \left( \varDelta _{G}\exp (-\varDelta _{L^{M}}/T_{k}) \right) ^{N}. \end{aligned}$$Let \(\displaystyle {\tau _{1}\left( P\right) }\) denote the coefficient of ergodicity for the transition probability matrix P, defined by:

$$\begin{aligned} \begin{aligned}&\tau _{1}\left( P_{MCWMSA}^{N}\right) = 1 - \min _{(x,\lambda ),(x',\lambda ')\in \mathcal {S}}\sum _{(x'',\lambda '')\in \mathcal {S}} d(x,\lambda ,x',\lambda ',x'',\lambda '') \end{aligned} \end{aligned}$$where \(d(x,\lambda ,x',\lambda ',x'',\lambda '')\!=\!\min \left\{ P_{MCWMSA}^{N}(x,\lambda ; x'',\lambda ''), P_{MCWMSA}^{N}(x',\lambda '; x'',\lambda '' ) \right\} \) An Inhomogeneous Markov Chain is weakly ergodic if and only if there is a strictly increasing sequence of positive numbers so that:

$$\begin{aligned} \sum _{k=0}\left( 1-\tau _{1}(P_{MCWMSA}^{N})\right) = \infty , \end{aligned}$$(A.3)using the bound on \(P_{MCWMSA}^{N}(x,\lambda ;x',\lambda ')\), we find that:

$$\begin{aligned}&1- \tau _{1}(P_{MCWMSA}^{N})=\min _{(x,\lambda ),(x',\lambda ')\in \mathcal {S}}\sum _{(x'',\lambda '')\in \mathcal {S}}d(x,\lambda ,x',\lambda ',x'',\lambda '') \nonumber \\&\quad \ge \min _{(x,\lambda ),(x',\lambda ')\in \mathcal {S}}\min _{(x'',\lambda '')\in \mathcal {S}}\left\{ P_{MCWMSA}^{N}(x,\lambda ; x'',\lambda ''), P_{MCWMSA}^{N}(x',\lambda '; x'',\lambda '' ) \right\} \nonumber \\&\quad \ge \left( \varDelta _{G}\exp (-\varDelta _{L^{M}}/T_{k}) \right) ^{N} = \varDelta _{G}^{N}\exp (-N\varDelta _{L^{M}}/T_{k}). \end{aligned}$$(A.4)Substituting \(\displaystyle {T_{k}\ge \frac{N\varDelta _{L^{M}}}{\log {(k+1)}}, ~~k\ge 0 }\) in Eq. A.3 gives:

$$\begin{aligned} \begin{aligned} \sum _{k=0}\left( 1-\tau _{1}(P_{MCWMSA}^{N})\right)&\ge \sum _{k=k_{0}}\varDelta _{G}^{N}\exp (-N\varDelta _{L^{M}}/T_{k})\\&\ge \varDelta _{G}^{N}\sum _{k=k_{0}}\dfrac{1}{k+1} = \infty . \end{aligned} \end{aligned}$$(A.5)This implies that the Markov Chain, \((x,\lambda ,x',\lambda ')\), is weakly ergodic.

-

d.

Furthermore, since the acceptance probability function \(A_{T_{K}}^{M}\) is an exponential rational function in \(1/T_{k}\) and belongs to the closed class of asymptotically monotone functions (Anily and Federgruen (1987), Proposition 1) then the sequence of \((x_{n},\lambda _{n})\) converges in distribution (Anily and Federgruen (1987), Corollary 1). This implies that the Markov Chain is strongly ergodic.\(\square \)

Appendix B robustness checks

This section provides the robustness checks of the results in Tables 2 and 3 with respect the main parameters of the algorithms, namely a, N and \(T^{*}\) (boldface values), showing similar results in terms of efficiency, computational time and GIMHSA dominance.

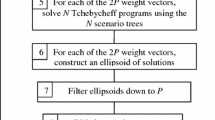

Appendix C Pseudo-codes

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Casarin, R., Maillet, B.B. & Osuntuyi, A. Monte carlo within simulated annealing for integral constrained optimizations. Ann Oper Res 334, 205–240 (2024). https://doi.org/10.1007/s10479-022-04994-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04994-9