Abstract

We experimentally study the effects of allotment—the division of an item into homogeneous units—in independent private value auctions. We compare a bundling first-price auction with two equivalent treatments where allotment is implemented: a two-unit discriminatory auction and two simultaneous single-unit first-price auctions. We find that allotment in the form of a discriminatory auction generates a loss of efficiency with respect to bundling. In the allotment treatments, we observe large and persistent bid spread, and the discriminatory auction is less efficient than simultaneous auctions. We provide a unified interpretation of our results that is based on both a non-equilibrium response to the coordination problem characterizing the simultaneous auction format and a general class of behavioral preferences that includes risk aversion, joy of winning and loser’s regret as specific cases.

Similar content being viewed by others

Notes

For business-to-business (B2B) multi-unit auctions, see Katok and Roth (2004).

The experimental instructions, a formal analysis of the testable predictions and some additional empirical results are provided in the Supplementary Material.

Our rematching protocol implies that, given the size of the sub-groups (six subjects), on average subjects interacted with the same opponent every 5 periods. Clearly, this is not a perfect stranger design; nevertheless, the protocol leaves very little room for developing bidding strategies over multiple periods. The rematching protocol was intended to increase the number of independent observations and perform non parametric tests to check for robustness of the main parametric results.

Results of these robustness checks are available upon request.

In line with these findings, a (two-sided) Mann-Whitney rank-sum test rejects the null hypothesis that the relative efficiency in 1A1U is the same as that in the two allotment treatments (\(z=2.057\), \(p<0.05\)). Similarly, the test detects a significant difference in relative efficiency between 1A2U and 2A1U (\(z=-2.693\), \(p<0.01\)) as well as between 1A1U and 1A2U (\(z=2.517\), \(p<0.05\)). No significant differences are observed between 1A1U and 2A1U (\(z=1.015\), \( p=0.310\)).

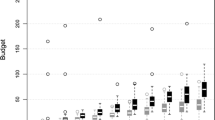

This result is confirmed by a (two-sided) Wilcoxon signed-rank test, which rejects the null hypothesis that bids are equal to the RN level in the three treatments (\(z=2.666\), \(p<0.01\)).

In line with the previous results, a (two-sided) Mann-Whitney rank-sum test strongly rejects the null hypothesis that the average bid in 1A1U is the same as in the allotment treatments (\(z=2.160\), \(p=0.031\)). Again, the negative effect of allotment on bids is stronger when 1A1U is compared to 1A2U (\(z=2.075\), \(p=0.038\)), rather than when it is compared to 2A1U (\(z=1.634\), \(p=0.102\) for the two-sided test). We do not find any significant difference between 1A2U and 2A1U (\( z=-0.574\), \(p=0.566\)).

In order to disentangle the intercepts from the effects of repetition, we imposed the linear trend to start from 0 in the first period.

This result is confirmed by non parametric tests: a (two-sided) Mann-Whitney rank-sum test does not reject the null hypothesis that bid spread in 1A2U is the same as in 2A1U (\(z=0.751\), \(p=453\)).

We run two additional panel regressions (with clustered standard errors). The dependent variable in the first (second) regression is equal to the unique bid in 1A1U and to the highest (lowest) bid in the two allotment treatments, 1A2U and 2A1U. As controls, both regressions include the allotment dummy, 1A2U and 2A1U, the value of one item and the time trend. The estimate of 1A2U and 2A1U is not significant in the first regression, while it is negative and significant at the \(1 \, \%\) level in the second regression.

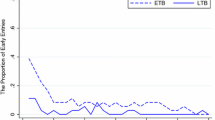

In an effort to reduce overbidding and bid spread, bidders could be given the option to reconsider their bids in a second stage (see, for instance, Güth et al. 2003; Porter et al. 2003, for experiments introducing the reconsider option in different contexts). We thank an anonymous referee for addressing this issue. From what we have seen in our analysis, it is not clear whether such an option would be effective. First, our results suggest that cognitive costs are not able to account for the observed treatment effects (see our analysis regarding response time in the Supplementary Material). Second, as mentioned in the paper, we find no indication of learning, as overbidding and bid spread are very similar in early and late periods of the experiment.

It is worth emphasizing that shaky bidding behavior in 2A1U explains the non-equivalence between 1A2U and 2A1U in terms of probability of bid spread, not the mere fact that we observe a fraction of zero-spread bids in 2A1U. In fact, a limited number of zero-spread bids in 2A1U (and in 1A2U) is still compatible with Nash Equilibrium. Notice that the claim that, under (A2), Nash Equilibrium bids in 1A2U and 2A1U are always characterized by bid spread, holds only when the strategy space is continuous. In a setting like ours, where the space of admissible bids is discrete, equilibrium bids can display zero-spread for low types. In fact, consider a bidder with a very low valuation: in a continuous domain, this bidder will find it optimal to make a positive but small bid spread; but in a discrete domain, this bidder is artificially forced either to make a large bid spread or to make no spread at all, and may opt for the latter. Table 5 confirms that the probability of making zero-spread bids is larger for low valuation bidders. In other words, bid spread signals equilibrium behavior; zero-spread, instead, is consistent both with equilibrium (but only for low valuation bidders) and with shaky bidding behavior.

The idea behind shaky bidding is thus close to the one behind the concepts of risk dominance. However, while risk dominance is an equilibrium selection criterion, i.e., a player adopts this criterion to choose among her equilibrium strategies, shaky bidding behavior applies to all the strategies of a player, including strategies that are not part of any Nash Equilibrium. Hence, shaky bidding is a non-equilibrium choice model, similar in spirit to a level-k thinking model (see, e.g., Nagel 1995): in fact, a shaky bidder can be thought of as a level-1 bidder who picks the strategy that is the best response to a (level-0) bidder who randomizes only over bids that are part of a Nash Equilibrium. In the Supplementary Material, we provide a simple \(3 \times 3\) example to illustrate the workings of the shaky bidding assumption as opposed to traditional equilibrium selection criteria.

An anonymous referee has proposed the Quantal Response Equilibrium (QRE) has an alternative behavioral assumption to account for the observed difference between 1A2U and 2A1U. In fact, despite the fact that 1A2U and 2A1U are equivalent in the Nash Equilibrium, out-of-equilibrium payoffs differ across these treatments and this may lead to different QRE. In particular, the coordination risk characterizing 2A1U would reflect large payoff losses associated with mis-coordinated outcomes, justifying the larger probability of playing the conservative zero-spread strategy. We recognize the sensibleness of this intuition; unfortunately, due to the large dimensionality of our experimental setting, fitting a QRE model to our data is technically unfeasible. We thus keep this idea as a potential subject for future research. It is worth noticing that the QRE concept is a completely different behavioral hypothesis with respect to our shaky bidding story (assumption A3). While QRE keeps the equilibrium condition but relaxes the rationality assumption by admitting that players may play also suboptimal strategies, assumption (A3) retains rationality (shaky bidders do best respond to their beliefs) but relaxes the equilibrium condition (shaky bidders’ beliefs, though sensible, are incorrect). Notice also that the evidence presented in Table 8, which, in our view, sheds light on the motives underlying shaky bidding behavior, would hardly be reconciled with a pure QRE hypothesis.

For a formal discussion, see the Supplementary Material, where we characterize equilibrium bids under risk aversion, joy of winning and loser’s regret. We also provide empirical insight on the relevance of the hypothesis of risk aversion and joy of winning/loser’s regret by combining subjects’ bids with the information collected through the post-experiment questionnaire. Results show that the proportions of subjects that either reported to be risk averse or gave importance to winning increase with overbidding, thus confirming that the behavioral hypothesis considered may indeed be relevant.

The vast experimental literature on auctions (for an overview, see Kagel 1995; Kagel and Levin 2011) shows that risk aversion is undoubtedly an important factor in explaining deviations from the theoretical RN equilibrium; at the same time, it is clear that other behavioral elements may play a role. Kirchkamp et al. (2010), using a novel experimental design that manipulates bidders’ risk preferences through the number of income-relevant auctions, show that risk preferences explain overbidding by about 50 %.

Cox et al. (1988), Goeree et al. (2002), Grimm and Engelmann (2005), Cooper and Fang (2008), among others, argue that joy of winning may explain deviations from the RN equilibrium in experimental auctions. Joy of winning has also found increasing support from recent studies in neuroscience and psychology, according to which placing subjects into competitive environments can trigger a desire to win (see Delgado et al. 2008; Malhotra 2010, both adopting an auction setup). In the literature, joy of winning has sometimes been modeled as a fixed extra-benefit that, upon winning the auction, adds to the difference between value and price (see, e.g., Cooper and Fang 2008; Roider and Schmitz 2012), sometimes as a bonus proportional to the value of the object won (see Grimm and Engelmann 2005). In the Supplementary Material, where we formally analyze a joy of winning model, we follow the former, more popular, modeling strategy.

Notice that, even though in our 2A1U, two auctions take place, they are run simultaneously: hence, a bidder views them as a single auction game where two units are sold. Notice also that assuming that, within an auction game where two units are sold, the joy of winning is decreasing in successive units, does not imply that it decreases from one auction game to the next. Rather, our idea is that, when a bidder enters a new auction game, the extra-value of winning jumps back to the initial value, even though that bidder won some units in the previous periods.

Engelbrecht-Wiggans and Katok (2008, 2009) and Filiz-Ozbay and Ozbay (2007) show that loser’s regret induce bidders to overbid to prevent regret in case they do not win the auction. Recently, Roider and Schmitz (2012) show that joy of winning and loser’s regret (which they call “disutility of losing”) together are able to rationalize much of the existing experimental evidence on single-unit auctions.

The literature has identified a second type of regret in auctions, called winner’s (or money-left-on-the-table) regret: this occurs when the winner in an auction realizes he could have won anyway with a lower bid. Notice that this second type of regret does not fit into the class of preferences identified by assumptions (A1) and (A2) as it surely violates the first.

We thank two anonymous referees for pointing out these two additional behavioral hypothesis. In the Supplementary Material, we formally show that simple models incorporating these hypothesis generate the same predictions as those obtained under joy of winning and loser’s regret. Notice, however, that, if the bidder’s reference point were the status quo, loss aversion would never bite and assumptions (A1) and (A2) would not be satisfied.

References

Asanuma, B., & Kikutani, T. (1992). Risk absorption in Japanese subcontracting: a microeconometric study of the automobile industry. Journal of the Japanese and International Economies, 6(1), 1–29.

Athey, S., & Levin, J. (2001). Information and competition in U.S. forest service timber auctions. Journal of Political Economy, 109(2), 375–417.

Betz, R., Seifert, S., Cramton, P., & Kerr, S. (2010). Auctioning greenhouse gas emissions permits in Australia. Australian Journal of Agricultural and Resource Economics, 54(1), 219–238.

Bolton, G. E., & Ockenfels, A. (2000). ERC: a theory of equity, reciprocity and competition. American Economic Review, 90(1), 166–193.

Chakraborty, I. (1999). Bundling decisions for selling multiple objects. Economic Theory, 13(3), 723–733.

Chernomaz, K., & Levin, D. (2012). Efficiency and synergy in a multi-unit auction with and without package bidding: an experimental study. Games and Economic Behavior, 76(2), 611–635.

Cooper, D. J., & Fang, H. (2008). Understanding overbidding in second price auctions: An experimental study. Economic Journal, 118(532), 1572–1595.

Cox, J. C., Smith, V. L., & Walker, J. M. (1988). Theory and individual behavior of first-price auctions. Journal of Risk and Uncertainty, 1(1), 61–99.

Cramton, P., Shoham, Y., & Steinberg, R. (2006). Combinatorial auctions. Cambridge: MIT Press.

Delgado, M. R., Schotter, A., Ozbay, E. Y., & Phelps, E. A. (2008). Understanding overbidding: Using the neural circuity of reward to design economic auctions. Science, 321(5397), 1849–1852.

EC, European Commission, 2013. European Commission guidance for the design of renewables support schemes. Staff working document 2013–439. Available from http://ec.europa.eu/energy/gas_electricity/doc/com_2013_public_intervention_swd04_en.pdf

Engelbrecht-Wiggans, R., & Kahn, C. M. (1998a). Multi-unit auctions with uniform prices. Economic Theory, 12(2), 227–258.

Engelbrecht-Wiggans, R., & Kahn, C. M. (1998b). Multi-unit pay-your-bid auctions with variable awards. Games and Economic Behavior, 23(1), 25–42.

Engelbrecht-Wiggans, R., & Katok, E. (2008). Regret and feedback information in first-price sealed-bid auctions. Management Science, 54(4), 808–819.

Engelbrecht-Wiggans, R., & Katok, E. (2009). A direct test of risk aversion and regret in first-price sealed-bid auctions. Decision Analysis, 6(2), 75–86.

Engelmann, D., & Grimm, V. (2009). Bidding behaviour in multi-unit auctions—An experimental investigation. Economic Journal, 119(537), 855–882.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. Quarterly Journal of Economics, 114(3), 817–868.

Filiz-Ozbay, E., & Ozbay, E. Y. (2007). Auctions with anticipated regret: Theory and experiment. American Economic Review, 97(4), 1407–1418.

Fischbacher, U. (2007). Z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Goeree, J. K., Holt, C. A., & Palfrey, T. R. (2002). Quantal response equilibrium and overbidding in private-value auctions. Journal of Economic Theory, 104(1), 247–272.

Goeree, J. K., Palmer, K., Holt, C. A., Shobe, W., & Burtraw, D. (2010). An experimental study of auctions versus grandfathering to assign pollution permits. Journal of the European Economic Association, 8(2–3), 514–525.

Goeree, J. K., Offerman, T., & Sloof, R. (2013). Demand reduction and preemptive bidding in multi-unit license cuctions. Experimental Economics, 16(1), 52–87.

Goswami, G., Noe, T. H., & Rebello, M. J. (1996). Collusion in uniform-price auctions: Experimental evidence and implication for treasury auctions. Review of Financial Studies, 9(3), 757–785.

Greiner, B. (2004). An online recruitment system for economic experiments. In K. Kremer & V. Macho (Eds.), Forschung und Wissenschaftliches Rechnen. GWDG Bericht 63 (pp. 79–93). Göttingen: Gesellschaft f ür Wissenschaftliche Datenverarbeitung.

Grimm, V., & Engelmann, D. (2005). Overbidding in first price private value auctions revisited: Implications of a multi-unit auctions experiment. In U. Schmidt & S. Traub (Eds.), Advances in public economics: Utility, choice, and welfare (pp. 235–254). Dordrecht: Springer.

Güth, W., Ivanova-Stenzel, R., Königstein, M., & Strobl, M. (2003). Learning to bid—An experimental study of bid function adjustments in auctions and fair division games. Economic Journal, 113(487), 477–494.

Harsanyi, J. C., & Selten, R. (1988). A general theory of equilibrium selection in games. Cambridge: MIT Press.

IRENA, International Renewable Energy Agency. (2013). Renewable energy auctions in developing countries. Available from http://www.irena.org/Publications.

Kagel, J. H. (1995). Auctions: A survey of experimental research. In J. H. Kagel & A. E. Roth (Eds.), The handbook of experimental economics (pp. 501–585). Princeton, NJ: Princeton University Press.

Kagel, J. H., & Levin, D. (2005). Multi-unit demand auctions with synergies: Behavior in sealed-bid versus ascending-bid uniform-price auctions. Games and Economic Behavior, 53(2), 170–207.

Kagel, J.H., Levin, D., 2011. Auctions: A survey of experimental research, 1995–2010. To appear in The handbook of experimental economics.

Katok, E., & Roth, A. E. (2004). Auctions of homogeneous goods with increasing returns: experimental comparison of alternative Dutch auctions. Management Science, 50(8), 1044–1063.

Kawasaki, S., & McMillan, J. (1987). The design of contracts: Evidence from Japanese subcontracting. Journal of the Japanese and International Economies, 1(3), 327–349.

Kirchkamp, O., Reiss, J.P., Sadrieh, A., 2010. A pure variation of risk in private-value auctions. Mimeo. http://www.kirchkamp.de/pdf/Risk2010_01-c.pdf

Köszegi, B., & Rabin, M. (2006). A model of reference-dependent preferences. Quarterly Journal of Economics, 121(4), 1133–1165.

Kwasnica, A. M., & Sherstyuk, K. (2013). Multiunit auctions. Journal of Economic Surveys, 27(3), 461–490.

List, J. A., & Mason, C. F. (2011). Are CEOs expected utility maximizers? Journal of Econometrics, 162(1), 114–123.

Lopomo, G., Marx, L. M., McAdams, D., & Murray, B. (2011). Carbon allowance auction design: An assessment of options for the United States. Review of Environmental Economics and Policy, 5(1), 25–43.

Malhotra, D. (2010). The desire to win: The effects of competitive arousal on motivation and behavior. Organizational Behavior and Human Decision Processes, 111(2), 139–146.

Nagel, R. (1995). Unraveling in guessing games: An experimental study. American Economic Review, 85(5), 1313–1326.

Palfrey, T. R. (1983). Bundling decisions by a multiproduct monopolist with incomplete information. Econometrica, 51(2), 463–483.

Piovesan, M., & Wengström, E. (2009). Fast or fair? A study of response times. Economics Letters, 105(2), 193–196.

Popkowski Leszczyc, P. T. L., & Häubl, G. (2010). To bundle or not to bundle: Determinants of the profitability of multi-item auctions. Journal of Marketing, 74(4), 110–124.

Porter, D., Rassenti, S., Roopnarine, A., & Smith, V. (2003). Combinatorial auction design. Proceedings of the National Academy of Science, 100(19), 11153–11157.

Roider, A., & Schmitz, P. W. (2012). Auctions with anticipated emotions: Overbidding, underbidding, and optimal reserve prices. The Scandinavian Journal of Economics, 114(3), 808–830.

Rubinstein, A. (2007). Instinctive and cognitive reasoning: A study of response times. Economic Journal, 117(523), 1243–1259.

Sade, O., Schnitzlein, C., & Zender, J. F. (2006). Competition and cooperation in divisible good auctions: An experimental examination. Review of Financial Studies, 19(1), 195–235.

Yun, M. (1999). Subcontracting relations in the Korean automotive industry: Risk sharing and technological capability. International Journal of Industrial Organization, 17(1), 81–108.

Acknowledgments

We are indebted to Giancarlo Spagnolo, Ted Turocy, two anonymous referees and the editor, David Cooper, for fruitful suggestions. We thank Thomas Bassetti, Paolo Bertoletti, Maria Bigoni, Ottorino Chillemi, Christopher Cotton, Dirk Engelmann, Jose-Antonio Espin-Sanchez, Carlos Alós-Ferrer, Oscar Mitnik, Luigi Moretti, Marco Pagnozzi, Alexander Rasch, Achim Wambach and participants at the PRIN Workshop in Capri, the XXVII Jornadas de Economia Industrial in Murcia, the Economics Department Seminar in Pavia, the 2012 ASSET Conference in Cyprus and the seminars at the Chaire EPPP-Paris 1, Pantheon Sorbonne, the “Design and Behavior” group of the University of Cologne, the PET 13 - International meeting of the Association for Public Economic Theory, for their comments. Financial support from the Centro Studi di Economia e Tecnica dell'Energia "Giorgio Levi Cases" - University of Padova, the Italian Ministry of Education (PRIN N.20089PYFHY_002) and the Austrian Science Fund (FWF-Project S 103070-G14) is gratefully acknowledged. All errors are ours.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Rights and permissions

About this article

Cite this article

Corazzini, L., Galavotti, S., Sausgruber, R. et al. Allotment in first-price auctions: an experimental investigation. Exp Econ 20, 70–99 (2017). https://doi.org/10.1007/s10683-016-9476-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-016-9476-1