Abstract

We implement a risky choice experiment based on one-dimensional choice variables and risk neutrality induced via binary lottery incentives. Each participant confronts many parameter constellations with varying optimal payoffs. We assess (sub)optimality, as well as (non)optimal satisficing by eliciting aspirations in addition to choices. Treatments differ in the probability that a binary random event, which are payoff—but not optimal choice—relevant is experimentally induced and whether participants choose portfolios directly or via satisficing, i.e., by forming aspirations and checking for satisficing before making their choice. By incentivizing aspiration formation, we can test satisficing, and in cases of satisficing, determine whether it is optimal.

Similar content being viewed by others

Notes

See Buchanan and Kock (2001) on information overload issues.

Marley (1997).

See, among others, Savikhin (2013) on financial analysis and risk management.

Consequentialist bounded rationality assumes that choosing among alternatives by anticipating their likely implications requires causal relationships linking the choice (means) and determinants beyond one’s control, such as chance events, to the relevant outcome variables (ends).

Note that this kind of experimental analysis can shed light on mental modeling and – more generally – on cognitive processes, in addition to eliciting the usual choice data.

From the seminal contribution of Simon (1955) to contributions in mathematics (see Krantz and Kunreuther 2007) and psychology (Kruglanski 1996 and Kruglanski et al. 2002), as well as to the literature on the role of mental models in decision making (Gary and Wood 2011), this approach has increasingly contaminated economics (Camerer 1991; Pearl 2003 and Gilboa and Schmeidler 2001), although not always beyond lip service.

One essentially employs a multiple selves approach that does not require intrapersonal payoff aggregation.

Of course, one may object that risk attitude can be interpreted much more broadly than captured by curvature of utility-of-money curves, e.g., via probability transformation. Again, we can say that most of other risk aspects seem to play no or, at best, a minor role in our setup.

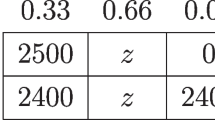

See Table 1 presenting the optimal predictions.

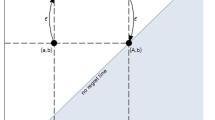

To justify Assumption 2 participants can consider 6 options i by moving a slider displaying

and \(\underline{P}(i)=(e-i)c\) before making their choice, as it will be explained in the Experimental Protocol section.

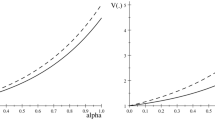

and \(\underline{P}(i)=(e-i)c\) before making their choice, as it will be explained in the Experimental Protocol section.In the spirit of Fechner’s (1876) law for visual distance perception, symmetry could be questioned by concavity in perceiving numerical success for all numerical goals, irrespective whether the goals are monetary or probabilities of earning €14 rather than €4. Rather than risk aversion postulating a concave utility of money, in our context, the concavely perceived numerical goal would be the probability of earning €14, which suggests more i choices below rather than above \(i^*\).

Nevertheless, concepts relying on “rational mistakes” are often used to account for empirical, mostly experimentally observed, behavior, e.g., Quantal Response (Equilibrium) estimates (McKelvey and Palfrey 1995), but also in game theory, e.g., in case of the “intuitive criterion” (Cho and Kreps 1987) and “properness” (Myerson 1978).

We will often employ both possibilities by reporting significance levels based on each choice and individual averages, with the latter in brackets.

Figure 11 in Appendix B shows the difference between the actual investment choice (i) and the unconstrained optimal investment (\(i^{\circ }\)).

In each round of T2, we allow participants to modify the stated probability once: this actually occurred 3% and 2% of the times in phase 1 and 2, respectively.

References

Buchanan, J., & Kock, N. (2001). Information overload: A decision making perspective. In Multiple Criteria Decision Making in the New Millennium, 49–58 (Springer Berlin Heidelberg).

Camerer, C. F. (1991). The process-performance paradox in expert judgment: How can experts know so much and predict so badly? In K. A. Ericsson & J. Smith (Eds.), Towards a general theory of expertise: Prospects and limits. New York: Cambridge University Press.

Cho, I. K., & Kreps, D. M. (1987). Signaling games and stable equilibria. The Quarterly Journal of Economics, 102, 179–221.

Fechner, G. T. (1876) Vorschule der aesthetik (Vol. 1). Germany: Breitkopf and Härtel.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10, 171–178.

Gary, M. S., & Wood, R. E. (2011). Mental models, decision rules, and performance heterogeneity. Strategic Management Journal, 32, 569–594.

Gilboa, I., & Schmeidler, D. (2001). A theory of case-based decisions. Cambridge: Cambridge University Press.

Güth, W., Levati, M. V., & Ploner, M. (2009). An experimental analysis of satisficing in saving decisions. Journal of Mathematical Psychology, 53, 265–272.

Güth, W., & Ploner, M. (2016). Mentally perceiving how means achieve ends. Rationality and Society. doi:10.1177/1043463116678114

Greiner, B. (2015). Subject pool recruitment procedures: Organizing experiments with ORSEE. Journal of the Economic Science Association, 1, 114–125.

Harless, D. W., & Camerer, C. F. (1994). The predictive utility of generalized expected utility theories. Econometrica, 62, 1251–1289.

Hey, J. D. (1995). Experimental investigations of errors in decision making under risk. European Economic Review, 39, 633–640.

Hey, J. D., & Orme, C. (1994). Investigating generalizations of expected utility theory using experimental data. Econometrica, 62, 1291–1326.

Krantz, D. H., & Kunreuther, H. C. (2007). Goals and plans in decision making. Judgment and Decision Making, 2, 137–168.

Kruglanski, A. W. (1996). Goals as knowledge structures. In P. M. Gollwitzer & J. A. Bargh (Eds.), The psychology of action: Linking cognition and motivation to behavior (pp. 599–619). New York: Guilford Press.

Kruglanski, A. W., Shah, J. Y., Fishbach, A., Friedman, R., & Chun, W. Y. (2002). A theory of goal systems. In M. P. Zanna (Ed.), Advances in experimental social psychology (pp. 331–378). San Diego: Academic Press.

Loomes, G., & Sugden, R. (1995). Incorporating a stochastic element into decision theories. European Economic Review, 39, 641–648.

McKelvey, R. D., & Palfrey, T. R. (1995). Quantal response equilibria in normal form games. Games and Economic Behaviour, 7, 6–38.

Marley, A. A. J. (1997). Probabilistic choice as a consequence of nonlinear (sub) optimization. Journal of Mathematical Psychology, 41, 382–391.

Myerson, R. (1978). Refinements of the Nash equilibrium concept. International Journal of Game Theory, 7, 73–80.

Pearl, J. (2003). Causality: models, reasoning and inference. Econometric Theory, 19, 675–685.

Sauermann, H., & Selten, R. (1962). Anspruchsanpassungstheorie der Unternehmung. Zeitschrift fü die Gesamte Staatswissenschaft, 118, 577–597.

Savikhin, A.C. (2013). The Application of Visual Analytics to Financial Decision-Making and Risk Management: Notes from Behavioural Economics. In Financial Analysis and Risk Management, 99-114 ( Springer Berlin Heidelberg).

Selten, R., Pittnauer, S., & Hohnisch, M. (2012). Dealing with dynamic decision problems when knowledge of the environment is limited: an approach based on goal systems. Journal of Behavioral Decision Making, 25, 443–457.

Selten, R., Sadrieh, A., & Abbink, K. (1999). Money does not induce risk neutral behavior, but binary lotteries do even worse. Theory and Decision, 46, 213–252.

Simon, H. A. (1955). A behavioral model of rational choice. The Quarterly Journal of Economics, 69, 99–118.

Author information

Authors and Affiliations

Corresponding author

Additional information

The research presented in this paper was financed by the Max Planck Institute of Bonn.

Appendices

Appendix A

In this appendix, we report the translated version of the instructions given to participants.

Welcome to our experiment!

Please, read the instructions carefully.

During this experiment you will be asked to make several decisions. These decisions as well as random events will determine your earning. We will now explain the experiment and the payment mechanism.

The experiment consists of two identical phases of 18 rounds each. At the beginning of each round you are endowed with an amount of money that can be allocated in two kinds of investment: investment A and investment B. Investment A is a risk-free bond with constant repayment factor, independent of the market condition; Investment B is a risky asset whose repayment factor changes with the market condition and the amount invested in it.

The market can be in good or bad conditions whose probabilities are communicated in each round.

At the end of the experiment, the computer will randomly select a round and you will be paid for that round.

Once the experiment has been completed, you will be asked to answer a questionnaire whose information will be strictly reserved and will be used only anonymously and for research purposes.

Please, work in silence and do not disturb other participants. If you have some doubts, please, raise your hand and wait: one experimenter will come and help you as soon as she can.

ENJOY!

INVESTMENT CHOICE

In each round you will be endowed with an amount of money (e), which varies from round to round, that can be allocated between investment A and investment B, by moving the cursor in the bar (see screenshot). Investment A has a constant repayment factor (c), independent of the market condition; Investment B is risky and its repayment factor changes with market condition (good or bad) and the amount invested: specifically, the investment in B is lost in bad market condition and repays only in good market condition.

Market is in good or bad condition with known probabilities, p respectively (1-p), which will be communicated in each round.

We will illustrate the choice task in the following example. This will help to familiarize with the screenshots for the investment decisions (see the figure below).

Assume that in a given round you are endowed with e = 3. You must choose how much to invest in the risky asset B (i) and how much to invest in the risk-free bond A (e-i).

The repayment factor for the risk-free bond A is 0.29 (c).

The repayment factor for the risky asset B depends on the amount you invest (i) and on the market condition, good or bad, whose probabilities, in the example, are 14% (p) and 86% (1-p) respectively. In particular, the repayment factor of the risky investment i is (e-i) in good market condition and 0 in bad market condition.

Given the endowment (in the example, e=3) and the repayment factor of the risk-free bond (in the example, c=0.29), your investment in the risky asset (in the example, i=1) and your investment in the risk-free bond (in the example, (e-i)=2) will determine your probability of earning €14 and the complementary probability of earning €4, which both depend on good or bad market condition, as will be shortly explained.

Please, note that your choice will affect only the probability of earning €14 or €4.

In the good market condition, the probability of earning €14 is given by the sum of repayment of the risk-free investment, c*(e-i), and the repayment of the risky investment, (e-i)*i. In the screenshot, the probability of earning €14, calculated by the computer, is represented by the height of the column corresponding to the good market condition. In the example, given the investment choice of i=1 in the risky asset and (e-i)=2 in the risk-free bond, the probability of earning €14 is approximately 80%.

In the bad market condition, the probability of earning €14 is given only by the repayment of the risk-free investment, c*(e-i). In the example, the probability of earning €14, calculated by the computer, is represented by the height of the column corresponding to the bad market condition. In the example, given the investment choice of i=1 in the risky asset and (e-i)=2 in the risk-free bond, the probability of earning €14 is approximately 50%.

Before making your final decision on how much to invest in the risky asset (i) you can try and visualize the effects of your choice on the probability of earning €14 in the two different market conditions by scrolling the cursor on the bar. You have several attempts before your final one. You can move the cursor at most 6 times. You can, of course, confirm also an earlier try. The count of your attempts is shown in the centre of the screen by the number between the two columns (in the example, 1 try). The number in the upper right corner up, instead, shows the time elapsed in the current round: for each round, you have at most 60 seconds to make your final choice (in the example, you still have 53 seconds left).

Warning: if you do not confirm your investment choice in time, your last choice before the time expiration will be considered.

YOUR EARNING IN THE EXPERIMENT

As already explained, in this experiment you can earn either €14 or €4. Your actual earning will depend on the randomly chosen payment round, on your investment decision and on the market condition in that round.

In particular, at the end of the experiment the earning of €14 or €4 will be selected by the computer with a probability that depends on:

-

1.

the round randomly chosen for the final payment;

-

2.

your investment choice in that round;

-

3.

the market condition in that round (either good or bad).

In addition, you will receive a show up fee of €4.

The total earning will be paid individually, privately and immediately after the experiment to each participant.

Welcome to our experiment!

Please, read the instructions carefully.

During this experiment you will be asked to make several decisions. These decisions as well as random events will determine your earning. We will now explain the experiment and the payment mechanism.

The experiment consists of two identical phases of 18 rounds each. At the beginning of each round you are endowed with an amount of money that can be allocated in two kinds of investment: investment A and investment B. Investment A is a risk-free bond with constant repayment factor, independent of the market condition; Investment B is a risky asset whose repayment factor changes with the market condition and the amount invested in it.

The market can be in good or bad conditions whose probabilities are unknown. Before the investment choice, you will be asked to state your expectations regarding the probabilities of market in good or bad conditions.

At the end of the experiment, the computer will randomly select a round and you will be paid for that round.

Once the experiment has been completed, you will be asked to answer a questionnaire whose information will be strictly reserved and will be used only anonymously and for research purposes.

Please, work in silence and do not disturb other participants. If you have some doubts, please, raise your hand and wait: one experimenter will come and help you as soon as she can.

ENJOY!

INVESTMENT CHOICE

In each round you will be endowed with an amount of money (e), which varies from round to round, that can be allocated between investment A and investment B, by moving the cursor in the bar (see screenshot). Investment A has a constant repayment factor (c), independent of the market condition; Investment B is risky and its repayment factor changes with market condition (good or bad) and the amount invested: specifically, the investment in B is lost in bad market condition and repays only in good market condition.

Market is in good or bad condition with unknown probabilities.

We will illustrate the choice task by the following example. This will help to familiarize with the screenshots for the investment decisions (see the figure below).

Assume that in a given round you are endowed with e = 3. You must choose how much to invest in the risky asset B (i) and how much to invest in the risk-free bond A (e-i).

The repayment factor for the risk-free bond A is 0.29 (c).

The repayment factor for the risky asset B depends on the amount you invest (i) and on the market condition, good or bad. In particular, the repayment factor of the risky investment i is e-i in good market condition and 0 in bad market condition.

Given the endowment (in the example, e=3) and the repayment factor of the risk-free bond (in the example, c=0.29), your investment in the risky asset (in the example, i=1) and your investment in the risk-free bond (in the example, (e-i)=2) will determine your probability of earning €14 and the complementary probability of earning €4, which both depend on good or bad market condition, as will be shortly explained.

Please, note that your choice will affect only the probability of earning €14 or €4.

In the good market condition, the probability of earning €14 is given by the sum of repayment of the risk-free investment, c*(e-i), and the repayment of the risky investment, (e-i)*i. In the screenshot, the probability of earning €14, calculated by the computer, is represented by the height of the column corresponding to the good market condition. In the example, given the investment choice of i=1 in the risky asset and (e-i)=2 in the risk-free bond, the probability of earning €14 is approximately 80%.

In the bad market condition, the probability of earning €14 is given only by the repayment of the risk-free investment, c*(e-i). In the screenshot, the probability of earning €14, calculated by the computer, is represented by the height of the column corresponding to the bad market condition. In the example, given the investment choice of i=1 in the risky asset and (e-i)=2 in the risk-free bond, the probability of earning €14 is approximately 50%.

Before making your final decision on how much to invest in the risky asset (i) you can try and visualize the effects of your choice on the probability of earning €14 in the two different market conditions by scrolling the cursor on the bar. You have several attempts before your final one. You can move the cursor at most 6 times. You can, of course, confirm also an earlier try. The count of your attempts is shown in the centre of the screen by the number between the two columns (in the example, 1 try). The number in the upper right corner up, instead, shows the time elapsed in the current round: for each round, you have at most 60 seconds to make your final choice (in the example, you still have 53 seconds left).

Warning: if you do not confirm your investment choice in time, your last choice before the time expiration will be considered.

Before the investment choice, in each round you will be asked to state your expectations about the market conditions. In particular, you will be asked to state your expectation regarding the market in good condition and the computer will automatically generate the complementary probability for the market in bad condition.

STATEMENT OF THE EXPECTATIONS ABOUT MARKET CONDITIONS

In each round, before your investment choice, you have to state your expectations regarding the probabilities of market in good or bad condition, as shown in the screenshot.

When inserting the probability for good market condition, clicking on “IMPOSTA” the computer automatically generates the complementary probability for bad market condition. By clicking on “Confirm”, in the lower right corner of the screen, you can then proceed with your investment choice.

YOUR EARNING IN THE EXPERIMENT

As already explained, in this experiment you can earn either €14 or €4. Your actual earning will depend on the randomly chosen payment round, on your investment decision and on the market condition in that round.

In particular, at the end of the experiment the earning of €14 or €4 will be selected by the computer with a probability that depends on:

-

1.

the round randomly chosen for the final payment;

-

2.

your investment choice in that round;

-

3.

the market condition in that round (either good or bad).

In addition, you will receive a show up fee of €4.

The total earning will be paid individually, privately and immediately after the experiment to each participant.

Welcome to our experiment!

Please, read the instructions carefully.

During this experiment you will be asked to make several decisions. These decisions as well as random events will determine your earning. We will now explain the experiment and the payment mechanism.

The experiment consists of two identical phases of 18 rounds each. At the beginning of each round you are endowed with an amount of money that can be allocated in two kinds of investment: investment A and investment B. Investment A is a risk-free bond with constant repayment factor, independent of the market condition; Investment B is a risky asset whose repayment factor changes with the market condition and the amount invested in it.

The market can be in good or bad conditions whose probabilities are communicated in each round.

At the end of the experiment, the computer will randomly select a round and you will be paid for that round.

Once the experiment has been completed, you will be asked to answer a questionnaire whose information will be strictly reserved and will be used only anonymously and for research purposes.

Please, work in silence and do not disturb other participants. If you have some doubts, please, raise your hand and wait: one experimenter will come and help you as soon as she can.

ENJOY!

INVESTMENT CHOICE

In each round you will be endowed with an amount of money (e), which varies from round to round, that can be allocated between investment A and investment B, by moving the cursor in the bar (see screenshot). Investment A has a constant repayment factor (c), independent of the market condition; Investment B is risky and its repayment factor changes with market condition (good or bad) and the amount invested: specifically, the investment in B is lost in bad market condition and repays only in good market condition.

Market is in good or bad condition with known probabilities, p respectively (1-p), which will be communicated in each round.

We will illustrate the choice task by the following example. This will help to familiarize with the screenshots for the investment decisions (see the figure below).

Assume that in a given round you are endowed with e = 3. You must choose how much to invest in the risky asset B (i) and how much to invest in the risk-free bond A (e-i).

The repayment factor for the risk-free bond A is 0.29 (c).

The repayment factor for the risky asset B depends on the amount you invest (i) and on the market condition, good or bad, whose probabilities, in the example, are 14% (p) and 86% (1-p) respectively. In particular, the repayment factor of the risky investment i is (e-i) in good market condition and 0 in bad market condition.

Given the endowment (in the example, e=3) and the repayment factor of the risk-free bond (in the example, c=0.29), your investment in the risky asset (in the example, i=1) and your investment in the risk-free bond (in the example, (e-i)=2) will determine your probability of earning €14 and the complementary probability of earning €4, which both depend on good or bad market condition, as will be shortly explained.

Please, note that your choice will affect only the probability of earning €14 or €4.

In the good market condition, the probability of earning €14 is given by the sum of repayment of the risk-free investment, c*(e-i), and the repayment of the risky investment, (e-i)*i. In the screenshot, the probability of earning €14, calculated by the computer, is represented by the height of the column corresponding to the good market condition. In the example, given the investment choice of i=1 in the risky asset and (e-i)=2 in the risk-free bond, the probability of earning €14 is approximately 80%.

In the bad market condition, the probability of earning €14 is given only by the repayment of the risk-free investment, c*(e-i). In the example, the probability of earning €14, calculated by the computer, is represented by the height of the column corresponding to the bad market condition. In the example, given the investment choice of i=1 in the risky asset and (e-i)=2 in the risk-free bond, the probability of earning €14 is approximately 50%.

Before making your final decision on how much to invest in the risky asset (i) you can try and visualize the effects of your choice on the probability of earning €14 in the two different market conditions by scrolling the cursor on the bar. You have several attempts before your final one. You can move the cursor at most 6 times. You can, of course, confirm also an earlier try. The count of your attempts is shown in the centre of the screen by the number between the two columns (in the example, 1 try). The number in the upper right corner up, instead, shows the time elapsed in the current round: for each round, you have at most 60 seconds to make your final choice (in the example, you still have 53 seconds left).

Warning: if you do not confirm your investment choice in time, your last choice before the time expiration will be considered.

Before the investment choice, in each round you will be asked to state the probability of earning €14 instead of €4 that would make you satisfied, both for market in good and bad condition separately. You will earn €14 with the probability that makes you satisfied if the probability implied by your investment choice i (the height of €14-column in the screenshot) is not smaller than the probability that makes you satisfied (in the screenshot your stated satisficing probability is shown by the horizontal line). On the contrary, if the probability implied by your investment choice i (the height of the €14-column in the screenshot) is smaller than the probability that makes you satisfied, you will earn €14 with 0% probability.

STATEMENT OF THE PROBABILITY OF EARNING €14 THAT MAKES YOU SATISFIED

In each round, before your investment choice, you will have to state the probability of earning €14 instead of €4 that would make you satisfied for both markets in good condition (\(\hbox {P}_{\mathrm{sb}})\) and in bad condition (\(\hbox {P}_{\mathrm{sc}})\), separately.

Warning: The probability that makes you satisfied for the market in good condition cannot be smaller than the probability for the market in bad condition.

In the example below \(\hbox {P}_{\mathrm{sb}}\) is set at 60% and \(\hbox {P}_{\mathrm{sc}}\) is set at 50%.

By clicking on “Confirm”, in the lower right corner of the screen, you can then proceed with your investment choice.

Warning: you can modify the probability that makes you satisfied only once, by clicking on the button “I want to modify \(\hbox {P}_{\mathrm{sb}}\) and \(\hbox {P}_{\mathrm{sc}}\)”.

YOUR EARNING IN THE EXPERIMENT

As already explained, in this experiment you can earn either €14 or €4. Your actual earning will depend on the randomly chosen payment round, on your investment decision and on the market condition in that round and on your stated aspiration levels.

In particular, at the end of the experiment the earning of €14 or €4 will be selected by the computer with a probability that depends on:

-

1.

the round randomly chosen for the final payment;

-

2.

your investment choice in that round;

-

3.

the market condition in that round (either good or bad);

-

4.

whether the probability of earning €14 that makes you satisfied is achieved in the following way:

-

a)

If the probability of earning €14 that makes you satisfied is achieved, the probability of earning €14 is equal to your satisficing probability for the market condition of the round randomly chosen.

In the example, the market in good condition and the investment choice i=1 determine a probability of 80% of earning €14. Since the stated satisficing probability for the market in good condition is 60%, the result is the following:

-

You achieved the stated satisficing probability of 60%;

-

You earn €14 with probability 60% and €4 with probability 40%.

-

-

b)

If the probability of earning €14 that makes you satisfied is not achieved, the probability of earning €14 is 0%.

In the example, in case of market in bad condition and the investment choice i=1, the result is the following:

-

You earn €14 with probability 0%, which means that you earn €4 with probability 100%.

-

-

a)

In addition, you will receive a show up fee of €4.

The total earning will be paid individually, privately and immediately after the experiment to each participant.

Welcome to our experiment!

Please, read the instructions carefully.

During this experiment you will be asked to make several decisions. These decisions as well as random events will determine your earning. We will now explain the experiment and the payment mechanism.

The experiment consists of two identical phases of 18 rounds each. At the beginning of each round you are endowed with an amount of money that can be allocated in two kinds of investment: investment A and investment B. Investment A is a risk-free bond with constant repayment factor, independent of the market condition; Investment B is a risky asset whose repayment factor changes with the market condition and the amount invested in it.

The market can be in good or bad conditions whose probabilities are unknown.

At the end of the experiment, the computer will randomly select a round and you will be paid for that round.

Once the experiment has been completed, you will be asked to answer a questionnaire whose information will be strictly reserved and will be used only anonymously and for research purposes.

Please, work in silence and do not disturb other participants. If you have some doubts, please, raise your hand and wait: one experimenter will come and help you as soon as she can.

ENJOY!

INVESTMENT CHOICE

In each round you will be endowed with an amount of money (e), which varies from round to round, that must be allocated between investment A and investment B, by moving the cursor in the bar (see screenshot). Investment A has a constant repayment factor (c), independent of the market condition; Investment B is risky and its repayment factor changes with market condition (good or bad) and the amount invested: specifically, the investment in B is lost in bad market condition and repays only in good market condition.

Market is in good or bad condition with unknown probabilities.

We will illustrate the choice task by an example. This will help to familiarize with the screenshots for the investment decisions (see the figure below).

Assume that in a given round you are endowed with e=3. You must choose how much to invest in the risky asset B (i) and how much to invest in the risk-free bond A (e-i).

The repayment factor for the risk-free bond A is 0.29 (c).

The repayment for the risky asset B depends on the amount you invest (i) and on the market condition, good or bad. In particular, the repayment factor of the risky investment i is e-i in good market condition and 0 in bad market condition.

Given the endowment (in the example, 3) and the repayment factor of the risk-free bond (in the example, 0.29), your investment in the risky asset (i) and your investment in the risk-free bond (\(e-i)\) will determine your probability of earning €14 and the complementary probability of earning €4, which both depend on good or bad market condition.

Please, note that your choice will affect only the probability of earning €14 or €4.

In the good market condition, the probability of earning €14 is given by the sum of repayment of the risk-free investment, c*(e-i), and the repayment of the risky investment, (e-i)*i. In the screenshot, the probability of earning €14, calculated by the computer, is represented by the height of the column corresponding to the good market condition. In the example, given the investment choice of i=1 in the risky asset and (e-i)=2 in the risk-free bond, the probability of earning €14 is approximately 80%.

In the bad market condition, the probability of earning €14 is given only by the repayment of the risk-free investment, c*(e-i). In the example, the probability of earning €14, calculated by the computer, is represented by the height of the column corresponding to the bad market condition. In the example, given the investment choice of i=1 in the risky asset and (e-i)=2 in the risk-free bond, the probability of earning €14 is approximately 50%.

Before making your final decision on how much to invest in the risky asset (i) you can try and visualize the effects of your choice on the probability of earning €14 in the two different market conditions by scrolling the cursor on the bar. You have several attempts before your final one. You can move the cursor at most 6 times. You can, of course, confirm also an earlier try. The count of your attempts is shown in the centre of the screen by the number between the two columns (in the example, 1 try). The number in the upper right corner up, instead, shows the time elapsed in the current round: for each round, you have at most 60 s to make your final choice (in the example, you still have 53 seconds left).

Warning: if you do not confirm your investment choice in time, your last choice before the time expiration will be considered.

Before the investment choice, in each round you will be asked to state the probability of earning €14 instead of €4 that would make you satisfied, both for market in good and bad condition separately. You will earn €14 with the probability that makes you satisfied if the probability implied by your investment choice i (the height of €14-column in the screenshot) is not smaller than the probability that makes you satisfied (in the screenshot your stated satisficing probability is shown by the horizontal line). On the contrary, if the probability implied by your investment choice i (the height of the €14-column in the screenshot) is smaller than the probability that makes you satisfied, you will earn €14 with 0% probability.

STATEMENT OF THE PROBABILITY OF EARNING €14 THAT MAKES YOU SATISFIED

In each round, before your investment choice, you will have to state the probability of earning €14 instead of €4 that would make you satisfied for both markets in good condition (\(\hbox {P}_{\mathrm{sb}})\) and in bad condition (\(\hbox {P}_{\mathrm{sc}})\), separately.

Warning: The probability that makes you satisfied for the market in good condition cannot be smaller than the probability for the market in bad condition.

In the example below \(\hbox {P}_{\mathrm{sb}}\) is set at 60% and \(\hbox {P}_{\mathrm{sc}}\) is set at 50%.

By clicking on “Confirm”, in the lower right corner of the screen, you can then proceed with your investment choice.

Warning: you can modify the probability that makes you satisfied only once, by clicking on the button “I want to modify \(\hbox {P}_{\mathrm{sb}}\) and \(\hbox {P}_{\mathrm{sc}}\)”.

YOUR EARNING IN THE EXPERIMENT

As already explained, in this experiment you can earn either €14 or €4. Your actual earning will depend on the randomly chosen payment round, on your investment decision and on the market condition in that round.

In particular, at the end of the experiment the earning of €14 or €4 will be selected by the computer with a probability that depends on:

-

1.

the round randomly chosen for the final payment;

-

2.

your investment choice in that round;

-

3.

the market condition in that round (either good or bad);

-

4.

whether the probability of earning €14 that makes you satisfied is achieved in the following way:

-

a)

If the probability of earning €14 that makes you satisfied is achieved, the probability of earning €14 is equal to your satisficing probability for the market condition of the round randomly chosen.

In the example, the market in good condition and the investment choice i=1 determine a probability of 80% of earning €14. Since the stated satisficing probability for the market in good condition is 60%, the result is the following:

-

You achieved the stated satisficing probability of 60%;

-

You earn €14 with probability 60% and €4 with probability 40%.

-

-

b)

If the probability of earning €14 that makes you satisfied is not achieved, the probability of earning €14 is 0%.

In the example, in case of market in bad condition and the investment choice i=1, the result is the following:

-

You earn €14 with probability 0%, which means that you earn €4 with probability 100%.

-

-

a)

In addition, you will receive a show up fee of €4.

The total earning will be paid individually, privately and immediately after the experiment to each participant.

Appendix B

See Tables 14, 15, 16 and 17 and Figs. 9, 10, 11, 12, 13 and 14

Rights and permissions

About this article

Cite this article

Di Cagno, D., Galliera, A., Güth, W. et al. (Sub) Optimality and (non) optimal satisficing in risky decision experiments. Theory Decis 83, 195–243 (2017). https://doi.org/10.1007/s11238-017-9591-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-017-9591-2

and

and