Abstract

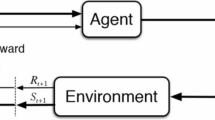

We compare price dynamics of different market protocols (batch auction, continuous double auction and dealership) in an agent-based artificial exchange. In order to distinguish the effects of market architectures alone, we use a controlled environment where allocative and informational issues are neglected and agents do not optimize or learn. Hence, we rule out the possibility that the behavior of traders drives the price dynamics. Aiming to compare price stability and execution quality in broad sense, we analyze standard deviation, excess kurtosis, tail exponent of returns, volume, perceived gain by traders and bid-ask spread. Overall, a dealership market appears to be the best candidate, generating low volume and volatility, virtually no excess kurtosis and high perceived gain.

Similar content being viewed by others

References

Amihud Y, Mendelson H (1987) Trading mechanisms and stock returns: an empirical investigation. J Finance 42(3):533–553

Amihud Y, Mendelson H (1991) Volatility, efficiency, and trading: evidence from the japanese stock market. J Finance 46(5):1765–1789

Audet N, Gravelle T, Yang J (2001) Optimal market structure: Does one shoe fit all?. Technical report, Bank of Canada

Bernanke B, Gertler M (1999) Monetary policy and asset price volatility. Econ Rev, Federal Reserve Bank of Kansas City 0:17–51

Bottazzi G, Dosi G, Rebesco I (2005) Institutional architectures and behavioral ecologies in the dynamics of financial markets. J Math Econ 41(1–2):197–228

Cliff D (2003) Explorations in evolutionary design of online auction market mechanisms. Electronic Commer Res Appl 2:162–175

Cox T, Cox M (2000) Multidimensional scaling. Chapman and Hall/CRC, London

Day R, Huang W (1990) Bulls, bears and market sheep. J Econ Behav Organ 14(3):299–329

Edwards J, Oman P (2003) Dimensional reduction for data mapping. R News 3(3)

LeBaron B (2001) A builder’s guide to agent based financial markets. Quant Finance 1(2):254–261

LiCalzi M, Pellizzari P (2003) Fundamentalists clashing over the book: a study of order driven stock markets. Quant Finance 3:470–480

LiCalzi M, Pellizzari P (2005) Simple market protocols for efficient risk sharing. Mimeo (submitted)

Lux T, Marchesi M (1999) Scaling and criticality in a stochastic multi-agent model of a financial market. Nature 397:498–500

Madhavan A (2000) Market microstructure: a survey. J Financ Mark 3:205–258

Maslov S (2000) A simple model of an order-driven market. Physica A 278:571–578

Smith V (1988) Bubbles, crashes, and endogenous expectations in experimental spot asset markets. Econometrica 56(5):1119–1151

Vila A (2000) Asset price crises and banking crises: some empirical evidence. Technical report, Bank of International Settlements

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pellizzari, P., Forno, A.D. A comparison of different trading protocols in an agent-based market. J Econ Interac Coord 2, 27–43 (2007). https://doi.org/10.1007/s11403-006-0016-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-006-0016-5